THE MARKETING GENIUS OF HARARI

As an optimist, I wonder if Yuval is actually a full on toxic mountain man bitcoin maxi because his arguments against Bitcoin are so dogshit awful the only possible logical explanation is that he must be playing some sort of 4D chess game to accelerate Bitcoin adoption.

Unfortunately, as a realist, he’s just not that intelligent, or at least, he presumes his audience isn’t. Sadly, he’s nothing more than one of the many dime a dozen useful midwit tools helping to brainwash the masses.

Thus, as pragmatists’ we need to debunk this sort of nonsense, whenever it happens to make headlines, as was such an incident about a week ago, with the Bank of International Settlement (“BIS”) hosting their annual Midwit Influencer Summit.

We could be mistaken on the exact name of the summit, it is something like that, no doubt.

At any rate, the Bitcoin marketing genius Yuval was there and he surely didn’t disappoint.

What a legend.

By the way, what kind of a name is Yuval?

Well, in the Hebrew Bible Yuval was the son of Lamech and Adah, a brother of Jabal, a descendant of Cain. Yeah, that Cain, the one that killed his younger brother, Abel. Now, does that automatically mark Yuval as the bad guy, that his parents gave him the name of a murderous bloodline? We’re certainly not suggesting that it does, but we’re also not suggesting that it does not.

We’ll leave that for you to decide.

At any rate, here is a brief video clip from last weeks BIS Summit, with Yuval in true form, with his trademark doublespeak we’ve all grown fond of over the years. You know, the kind of doublespeak where one holds up a lie as the truth, and the truth as a lie.

Fascinating.

Enjoy!

And since none of you peasants click on our embedded videos, we went ahead and transcribed his talking points for you.

You’re welcome.

When I look at Bitcoin, as an historian, I don’t like it, because this is a money built on “distrust” — the central idea of Bitcoin is basically electronic gold, that we don’t trust the banks, the governments, so we don’t want to give them the ability to create as much money as they like, so we create this Bitcoin — it is a currency of distrust.

I do think the future belongs to electronic money, but what we’ve seen over the last centuries is that it’s actually a good idea to give banks and governments the ability to create more and more money in order to build more trust within society.

So, I’m not sure what money would look like in twenty years, or thirty years, but I hope it will be a currency of greater trust, and not a currency of distrust.

— Cain’s grandson, Yuval Harari, BIS Midwit Influencer Summit, May 2024

CONFLATE CONFOUND AND CONFUSE

Apparently, unbeknownst to everyone on the planet until Yuval “Don Quixote” Harari enlightened us all, money printing builds trust in a society.

Lol.

We should not be soon surprised to hear of Yuval “Don Quixote” Harari’s battles with windmill giants in the near future. Until then, let’s dissect this magical idea of building trust by printing money!

What we’ve seen over the last centuries is that it’s actually a good idea to give banks and governments the ability to create more and more money in order to build more trust within society.

— Yuval “Economist-Errant” Harari

Has Harari not been informed that the downfall of every single central bank, for all of recorded history, is one of simple monetary debasement, of the printing of money, that money printing is in fact the acid that dissolves the trust of a bank within society.

Is this guy just trying to be another John Law?

You know, the Scottish John Law who was laughed out of Scotland for his money printing central bank idea.

You know, the same John Law that then shilled his money printing idea in France, where he swindled his way into the wealthy and political class to create a money printing central bank in 1716.

Yeah, the one which ended in absolute devastation four short horrific years later in 1720. You know, the one that built all the trust!1

Folks like Harari, John Law, that FTX criminal Scam Bankman-Fried, as well as folks like Paul Krugman applauding the twin tower destruction back in the day, and so many other state funded imbeciles, they’re all cut from the same cloth, sucking off the knob of the guys pulling the strings for the silent banker/government partnership. They are the “economist-errant” class whose only mission is to conflate, confound and confuse, in order to milk the money printing cows, you witless masses dumbfounded in stupor, by the rhetoric of the economist-errant, begrudgingly allowing your purchasing power to be stolen in broad daylight.

LMFAO.

And what happened after the dumbass John Law had fun dying poor from printing up all that trust, the Dutch central bankers had their fun staying poor only a hundred short years later printing up their own pile of trust.

THE BANK OF AMSTERDAM COLLAPSE: 1780-1819

As explained by The Federal Reserve Bank of Atlanta:

The decline of the Bank of Amsterdam accelerated with the Fourth Anglo-Dutch War (1780-1784). The British blockade of Holland and the capture of many Asian colonies put tremendous pressure on the Dutch East India Company. The City of Amsterdam responded by shifting [Central] Bank policy towards substantial lending to the distressed company. Loans [read: “money printing”] were also extended to the city, to provincial governments, and to private parties through a new lending facility. The cost was a deterioration of the Bank’s balance sheet that contributed to a rapid decline in demand for bank guilders. [but what about muh trust?! lol]

The metallic stock of the bank dropped from 20 million in 1780 to 6 million in 1784. Balances remained stable only because the Bank was lending [“printing”] vast amounts [of money] to the [Dutch East India] Company.The French Revolution [they always need a war to get back on track] at first caused a revival of the Bank as money sought a safe haven, but Amsterdam proved no lasting refuge. The agio ran negative starting in August 1794, and money that could escape did before the French army arrived in the winter of 1794-5. The Bank of Amsterdam was finally closed in 1819, having been superseded by the Bank of the Netherlands in 1814.2

So why do these dimwits confuse printing money with trust, when the history of the world is nothing more than a series of high trust money printing disasters. One after another, again and again and again.

What is it that the banking and political class love about trusted money, and what is it that the bitcoin advocates love about trustless money?

A MONETARY VENN DIAGRAM

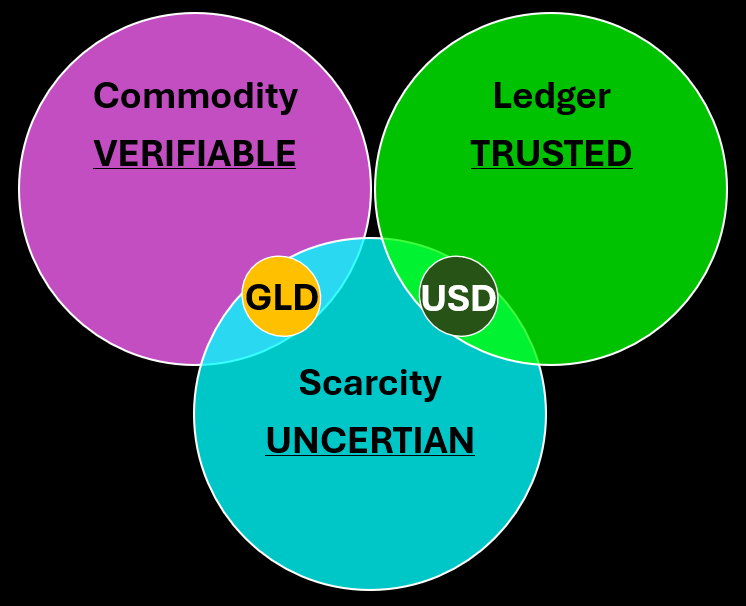

Three circles: a Verifiable Commodity, a Trusted Ledger, and Uncertain Scarcity.

And what appears?

Gold, and Fiat money.

COMMODITY MONEY

When scarcity meets commodities, commodity money emerges. Things like gold, salt, and real estate are various types of emergent commodity money since time immemorial.

Commodity money creation requires work spent up front. And this up front work removes the need for trust in the money, the money can simply be verified. It isn’t a trust based system. It is a verification based system.

These are not monies that people distrust, as our dear friend Yuval would attempt to doublespeak to you about, instead these are monies that are trustless, where there is no need to involve trust, they work without the need to include trust because of the work performed up front in the creation of the commodity, which enables the ability to verify the money.

In other words, commodity money is owned money, and a trusted counterparty is not required for this type of money.

LEDGER MONEY

When scarcity meets ledgers, ledger money emerges. Things like personal favors, bar tabs, fiat dollars, securities, and bonds, are all various types of ledger money since time immemorial.

Ledger money requires little upfront work to create. All that is needed is a little trust, and reputation, and once that is secured, the production of this type of money is as trivial as saying, I’ll get you next time to the bar keeper, or as simple as a key stroke for the bank branch. It requires essentially no work to produce this type of money, which means that it is a trust based system, trust in a counterparty to make good on your ledger balance at some point in the future. This system does not allow for verification because there is no way to verify an unknown future outcome of a counterparty, in the present.

This is why our midwit Yuval is so wrapped around the axel about trust, because his fiat world is a trust based world, so he can’t see bitcoin for what it is, a trustless ledger.

In other words, ledger money is owed money, and a trusted counterparty is required for this type of money to function, at least until Bitcoin arrived on the scene.

BITCOIN: VERIFIED LEDGER MONEY

What happens if we can create a commodity and weave it into a ledger, such that the ledger entries are the commodity.

Is such a thing even possible?

Oh yes, dear friends, indeed it is, and it is amazing.

Behold, when worlds collide!

When we build the commodity into the fabric of the ledger, when the two become inseparable, not only do we go from verifiable to verified certainty, we no longer need to trust the ledger, because the verification is all that is required, and so our ledger becomes a trustless record. Not a record without trust, the trust is certain, because the verification is certain, mathematically certain, objectively certain.

And what’s more, this certainty in the validity of the ledger and the commodity allows us to build in one more Earth shattering characteristic. Through certainty of the record, we can divine absolute scarcity into the money, something never possible in the history of mankind. A thing which no matter how many centuries of work performed, we cannot make more of, a perfected monetary attribute.

FARE THEE WELL

Dear Mr. Harari, I pity your short-sightedness. Your eyes deceive you.

Bitcoin is not a distrustful money. Bitcoin is the supreme being of money, an absolute mountain of trust exists here, greater than all the armies of the world could muster, greater than all past civilizations combined could muster.

You’re eyes only see the grain of sand at the foot hills of what you are missing, the entire mountain that is it’s existence, which will stand long after your glib trusted systems existence has been utterly exhausted.

It’s not that we don’t trust Bitcoin. To suggest Bitcoin is a distrustful system suggests that we do not trust the system or that we don’t trust other systems.

Bitcoin is a trustless system, meaning that we don’t need to trust it because we can verify it ourselves, and it is a trustless system because we don’t need to trust other systems either, because we don’t need to use them.

And not needing those other systems, like the high trust banking ledgers, is a major problem for bankers and their benefactors, like the government politicians and the multinational “elite” that feed off the system at everyone else’s expense. Thus the retarded gargling’s of the economist-errant like yourself, Yuval.

It might not seem so now, but in time the world will come to accept the colossus that is Bitcoin.

It is a juggernaut of proportions so massive we haven’t begun to comprehend them.

Our consciousness requires further expansion to grasp the enormity of the trustless verified and absolute system that is Bitcoin. It is something new to this Earth. A true zero to one. Something far beyond the consciousness of you midwits.

And not because you haven’t the capability to understand it, but because you haven’t yet humbled yourselves before it, in order to understand it. Should you choose to do so, you can still choose to not forsake your descendants.

The glory of Bitcoin will become known to all in due time, not because some choose to finally bend the knee, but because their consciousness must expand if one is to exist amongst the greatness that is Bitcoin.

Fare thee well, our smug little midwit friends.

Fare thee well.

Cheers!

There's no way his name is a random coincidence.

"drop the mic"