SUPERIOR TECH WINS

There has been more chatter recently in the “news” about how the United States might ban bitcoin with the recently proposed “Know Your Customer” (KYC) rules and regulations which would effectively make running a node, mining bitcoin, and self custody illegal for the vast majority of freedom loving bitcoiners not interested in such KYC absurdities.

For those of you just getting into bitcoin, I am here to share with you a nugget of wisdom. We do not give a fuck what a politician, or a judge, or a policeman, or any other state hired goombah has to say about the bitcoin we control, nor the miners and nodes that we run. We operate wholly outside of their jurisdictions. We operate in the jurisdiction known colloquially as GO FUCK YOURSELF, or GFY, if you are into the whole brevity thing.

Sure, some state actors might like to think that bitcoin falls within their jurisdictions, and sure there are some morons that believe governments like the US are somehow superordinate to bitcoin, but that is a fairy tale, friends. Math and human will do not naturally fall within the confines of imaginary jurisdictional borders. Math and human will created the borders in the first place, and math and human will, in the name of bitcoin, are dissolving those borders into irrelevance and oblivion, and there isn’t much of anything in the long term that those mid-wit state actors can do about it.

Sorry, not sorry.

Sure, in the short term they can snatch a few of us up and put us in cages, or murder some of us. But in the end we all die anyway, so it’s really not that big of a deal. Besides, I would rather die fighting against the morons than complicity live in their idiocracy, knowing the steak I am eating is not real. And there are boat loads of folks just like me all around the globe that live and die bitcoin, and if you are reading this, you’ll either join our ranks soon enough, or you’ll get run over by us. Choice is yours to make, amigo.

In the end, the efficiencies of bitcoin will overcome the deficiencies of fiat. Superior technology always prevails in the end.

Gun powder bested swords, electric lamps beat gas lamps, and a decentralized monetary ledger is eating the lunch of the centralized monetary ledgers. It’s simply a matter of energy usage.

Is it more or less energy intensive to force people to do what they don’t want to do?

Over the long arc of time, the energy spent keeping people in line is a losing strategy. People don’t want to be experts in swordsmanship, they just want a weapon that can end someone’s life if a legitimate threat arises. The gun solved this.

People don’t want to manage house fires or heat with their lights, they just want to see in the dark. Electric lighting solved this.

And people don’t want to get an anal probe every time they go grocery shopping, they just want to spend and receive money for services and goods they prefer, and bitcoin has solved this too.

But bitcoin has also, inadvertently came about its solution for peer to peer money in a way that pushes up against the statists territory. In addition to being the perfect peer to peer electronic cash, that is, a medium of exchange, bitcoin has also solved the problem of saving money, the store of value problem that has plagued the world since the demonetization of gold by the fiat statists in the early 1900’s.

The value store solution arises from bitcoin because of the limited supply of monetary units, because of the bitcoin scarcity, making it a great value storage medium, in addition to being a great value transfer medium. And as a value storage device, a savings account far superior to anything in the fiat world, including government bonds, this creates a big problem for the fiat statists.

Bitcoin has basically begun the process of stripping away the governments ability to print money, ad infinitum. This is a big problem for the statists. Allow me to explain.

THE REAL PONZI SCHEME

In modern history, prior to 1913, governments that ran the world whom wanted more funding for their raping, pillaging, plundering and murder, or as they might call it, for their spreading of democracy (lol), they would need to go to the public to raise funds, in the form of “war bonds” to finance their military actions. However ever since the first world war beginning in 1914, governments have relied on their friendly central banks to create money out of thin air to provide the financing the governments needed to support their war efforts.

In fact, the English involvement in WWI would have been cut dramatically short had it not used the printing press of the Bank of England to counterfeit money to fund its war efforts. And since then, governments around the world have been using their local central banks to print the money that the public would not otherwise be interested in financing. Effectively, the governments found a sly round about way to circumvent their citizenries interest in raising funds for activities they otherwise would not be interested in paying for. And by circumventing the public through their central banks, the increased money base pulled the purchasing power from the citizens that did not want to lend the money in the first place. In other words, central bank monetary inflation is a tax imposed upon the citizenry whom save and earn the currency units created by their friendly central bank overlords. It’s quite a nasty little game, and before bitcoin there was no sure way to avoid the purchasing power theft that the government and central banks of the world have been imposing on their citizenry.

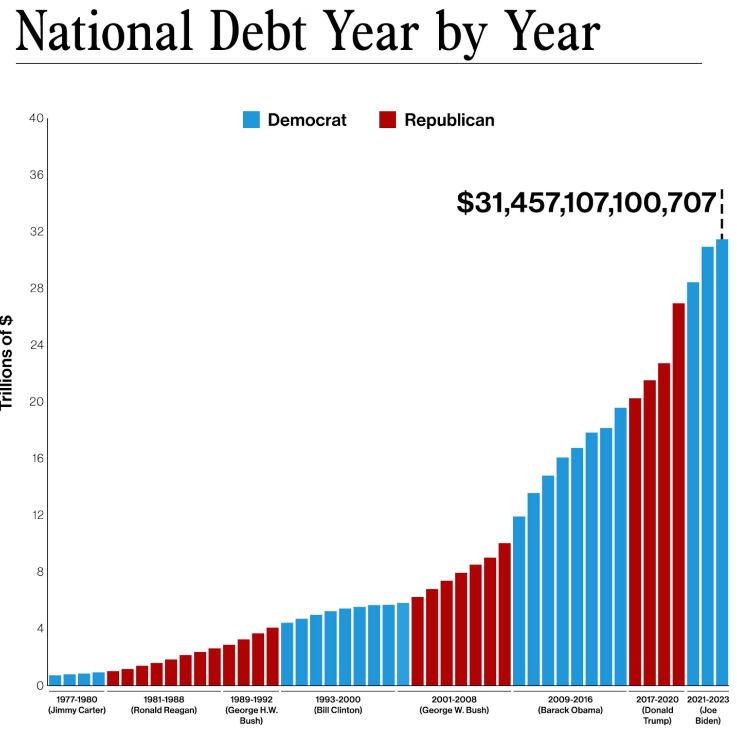

The obvious reason why housing and stock markets have sky rocketed in valuations over the past one hundred years is directly correlated with the sky rocketing government debts, which is just the other side of the dollar printing coin. Our houses don’t get better over time, and our businesses don’t get that much better over time, instead there is simply more monetary units from government debt expansion, chasing the same number of goods, and the end result is price appreciation, making our dollars worth less as more are printed to fund an ever growing national debt, both in the United States, and in every other “developed” government around the world, from China, to Russia, to Brazil, to Italy, and everywhere else in between. All 180 countries across the planet print money, through government debt, and thereby destroying the local currencies that their citizenry use to save and earn a living.

The only escape from this forced shake down by our local governments has been to take up a second job as a stock trader, foreign currency trader, government debt speculator, or rental property flipper. And when you think about it, most of us barely have time with one job, earning a living. So here we all are, with one job to earn a living, another job to find a place to hide our earnings and savings from monetary debasement, and no time left to raise our families or enjoy any amount of leisure time. We are all forced onto a sisyphean hamster whee, that we can’t even get off in our old age anymore because our part time trading gigs haven’t worked out, our stock portfolios are down, and more and more of us are ending up working until we’re in the grave.

When considered against the bitcoin alternative, the debt based model, one that the citizenry cannot opt out of, is a horrifically broken system, and it’s entirely predicated on our well intended governments never ending growing mountain of debt.

We can’t vote our wait out of this, amigos.

It’s not red versus blue, folks. It’s green versus orange. Are you getting the picture?

BITCOIN OR SLAVERY

It is not hyperbolic to view the current fiat system as a slave system because it forces everyone that participates to work far more than they otherwise would. With a constantly debasing currency, your labor is always worth less tomorrow for the same amount of work, and your savings are always worth less, and your pension is always worth less. There is no simple way to get ahead in such a system where a small privileged group of people can unilaterally vote to debase your wages, savings and pensions, simply by borrowing more money from their buyer of last resort, their central banks. It might have been a good solution in its infancy in the early 1900’s of the United States, but the central bank scheme has grown unchecked, and for those paying attention, it’s well intended governors have wreaked havoc on the populations of the world, with their best intentioned policies from climate change, to dietary needs, and emergency pandemic powers. Things are only getting worse from here as the debt mountain continues its exponential growth, requiring ever more ludicrous reasons to make the money printer go brrr.

The only solution for you and your family is a un-confiscatable, scarce asset. And there is only one asset on the planet that fits the bill, the one and the only, bitcoin.

With bitcoin you have not just a technological peer to peer monetary innovation, you have an army of individuals that cannot unsee what digital scarcity means to the world and to themselves and their families.

Bitcoin is the citizenries long lost check against central banking balance sheets. It is the return of an implicit “NO” to more government debt. In the beginning of the 1900’s the governments of the world took away their citizens vote against unchecked government spending. And now in the beginning of the 2000’s the citizenry of the world have taken back their vote of no confidence on government spending, and there is nothing in this universe that can put that bitcoin vote idea back in the bottle. It has been unleashed upon the world, with the utmost of humility and decency, through a fair and open launch, and the men and women that see bitcoin for what it is, stand united with open arms to all that seek refuge in it’s voluntary and righteous glory.

Let those that need to hear this heed these words, bitcoin is not going anywhere. Those of us that understand the importance of bitcoin will never comply with draconian measures to slow or stifle the justice it is imposing on every new unit of currency that the governments and central bankers of the world fraudulently print from nothing, albeit with their best of intentions. We are the bulwark. We are the undying. We are the remnant, and there is nothing in this universe that is going to stop this brush fire started in cyberspace in 2009. Our hearts and our minds, and our spirits are ablaze with the bright orange future we are bringing to this beautiful slice of heaven we call planet Earth.

Long live freedom, and long live bitcoin.

Cheers!