KILL YOUR RETIREMENT

Ultra Violence...

You spend your first twenty five years unconsciously learning why you are in a helpless need of your friendly state overlords and its never ending fiat investing labyrinth.

You then spend, like a good obedient tax cow, the next forty years of your life working a job you would otherwise choose not to work if you had the option.

And now what, peasant?!

Twenty more years. If you’re lucky. Living off the pittance you’re friendly state overlords print from nothing and drop into your trough, your state sanctioned bank account, every month or so. Your “social security” for being a compliant tax cow.

And along the way, maybe you created some state sanctioned tax cattle of your own.

Shoved them into the public school soul grinder and away they went too.

Hey, it’s not half bad right, you’ve got some state sanctioned medical cannabis to numb the pain of your futile existence. At least you’re retired now, am I right!

Or even better, the FIRE movement, boomers 2.0. At least these morons have half a brain to be conscience of the fact that they hate their jobs and understand their state overlords pension plan is a giant ponzi. So they’re cutting expenses and dumping everything into the S&P 500 index, hoping and praying the bankers don’t pull the plug on the markets until after they’ve saved enough, retired, and died.

Their kids? If they even have any. Good luck!

Lol.

Nice try, but the S&P is not gonna get you out of from fiatnam investment hell, amigo.

The fiatcong bankers and fiatcong politicians got that exit covered too!

You wanna know why people aren’t having kids these days. It’s because they don’t want to plunge their children into the same hopeless tax farm that they were born into, in the land of the “free,” born into the fiatnam jungles of lifelong investing to survive.

They might not understand it consciously, but that’s the horrific nihilistic reality.

Home of the brave?

More like home of the walking dead.

WELCOME TO FIATNAM

In fiatnam we spend all day everyday dodging the fiatcongs bullets and landmines of inflation and taxation.

And because we are spending all day everyday making investment decisions to dodge inflation and taxation, it leaves us approximately zero time each day to invest in our loved ones, in our relationships with our spouses, and our parents, and our children, and in our communities, and in our own hopes and dreams.

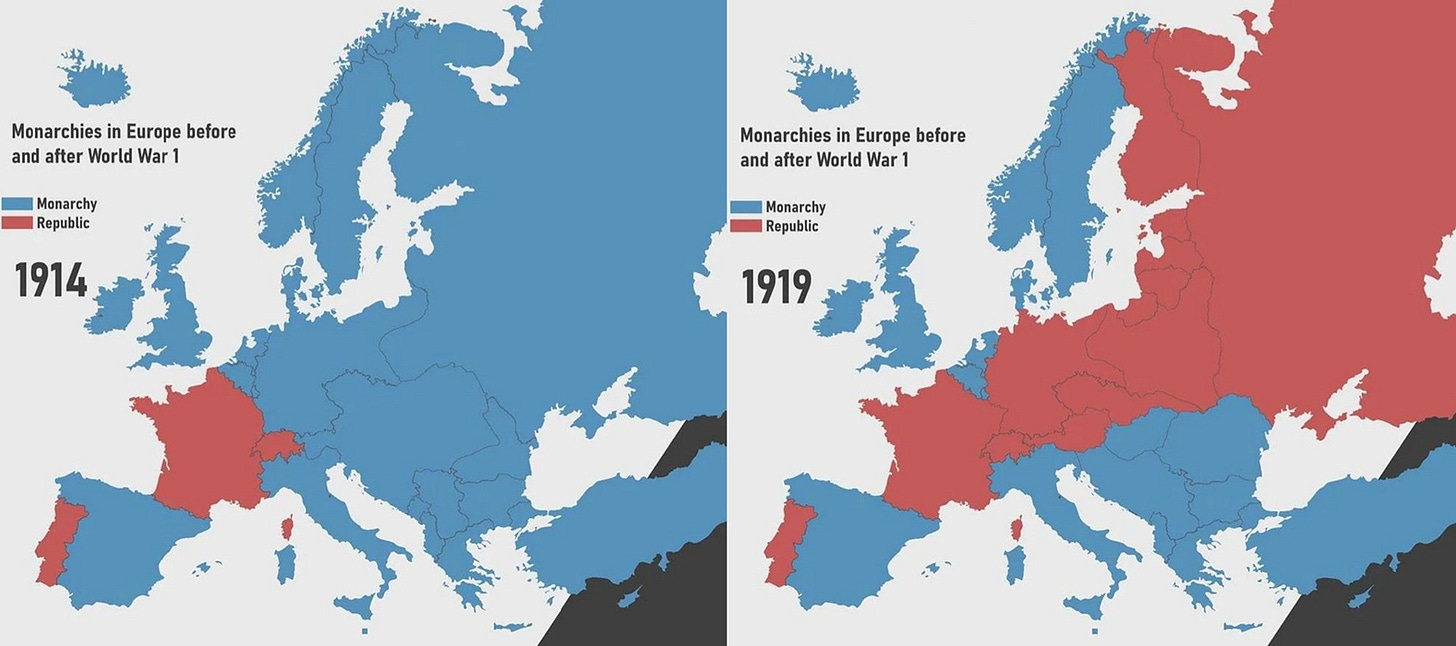

The scourge of fiatnam did not start with the twenty year Vietnam war from 1955 to 1975, which by the way was mostly a proxy war between the United States and Russia, sound familiar today with Ukraine, but instead fiatnam started in earnest in 1914 with World War I, which was really a war on private property rights, beginning with the destruction of your great grandfathers monetary property rights in their gold and ending with the usurping of thousands of years of familial heritage.

Good times.

And the fiatnam war has been raging on since.

“For your safety.”

How to end it?

Sorry, that’s impossible.

How to opt out?

Yeah, we got that one covered. It’s called bitcoin.

It start’s with a sound savings, and differentiating savings from investing.

Let’s dive in. That is of course, if you got half a mind for change, peasant.

INVESTING OR SAVING

It’s all very simple.

A simple framework to differentiate investment from savings.

They’ll stupefy you of course with phrases like “speculative investing” or “value investing” but it’s all a load of horseshit. Just the same as their attempts to confuse you with phrases like intrinsic value. It’s all fiatcong nonsense. Don’t get stupefied.

Follow this simple framework and you’ll have mad bread to break up:

investing is that which you do something with, and

savings is that which you do nothing with.

I know, that sounds pedantic, and midwit bell curve retarded.

But hear me out. It will make more sense.

Let’s consider some illustrative examples —

Holding $1,000 in the S&P 500 index… probably investing

Holding $1,000 in bitcoin... could be savings or investing

Holding $1,000 in fiat… probably savings

Do you see it?

Why is fiat considered savings by most everyone, and why is owning the S&P index considered an investment by most? They both hold monetary purchasing power so why the different classification?

The answer is that it is wholly dependent on the holders actions. One persons savings might be another persons investment simply because of how each person interacts with the same asset.

Suppose for example that you own the S&P index.

If you’re looking at it, maybe once a week, or maybe every night if the markets are getting really volatile, and wondering if you should sell or buy more, well then, because of the time you are investing in it thinking about trading, it then becomes an investment.

If however, you hold the S&P index without thinking of trading it, treating it as if it were your savings, because you simply dollar cost average into it with every paycheck, don’t care what the price of it is, don’t ever look at a chart wondering if it is time to sell, well then now you’re treating your S&P index holdings as savings, because in this scenario, you aren’t spending anytime thinking about it. If you’re not investing your time thinking about it then it’s simply savings, not investing.

See the difference!

Pretty simple. Keep it that way. Don’t over complicate it like the fiatcong want to make it.

That said, let’s add some nuance.

THREE TYPES OF INVESTING

We can characterize all of our actions that we conduct each day into three simple investment categories. Keep in mind that you should think of each of these three types of investing on a gradient. Probably you are somewhere between 0% and 100% on each of these for each type of investing you are doing throughout your day:

economical (e.g. profit driven) investing

ethical (e.g. belief based) investing

engineering (e.g. technological based) investing

ECONOMICAL INVESTING

In addition to stock trading, for profit, another very common type of economical investment is the time we invest in our jobs everyday.

Most all of us spend our days working, either as an employee or as an employer, with an aim at earning a profit. This is an economical type of investment. We invest our time at our professions, or our jobs, or at our trades or businesses, to earn profits. We identify supply and demand needs and invest ourselves, our time, with an intended monetary return on our invested time.

If you are doing anything at all today, with an eye towards a profit, that is an economical investment you are making. And most everyone spends their time on this type of investment, including actively trading the S&P 500 index. If your spending time on it, looking to earn a profit, not only is it investing, but specifically, it is economical investing.

ETHICAL INVESTING

We don’t choose any type of job for our economical investing. For example, most of us choose not to steal from others as a way to earn a profit. We find that choice to be something unethical, even though it might be more profitable. So although our job might be primarily driven by economical calculation, we also layer into that decision process our own beliefs and make an ethical investment into the job we choose.

But again, primarily for most of us, if the pay is good enough, regardless of our ethical beliefs, we’ll take the job. Most of us are not primarily driven by ethics, instead economics, our anticipated future profits, is our primary driver.

That said, there are many people that work in religious orders, for example, who might earn a smaller profit for their time than they otherwise could earn with their time doing something else, but they find themselves driven primarily by ethical or moral beliefs as to how they prefer to invest their time.

And outside of economical investments, most all non-monetary investing is done based on our ethical or moral beliefs. We invest our time with loved ones not for monetary gain, but for our beliefs and values that we hold more dearly, and all of these types of belief based actions are also ethical investments of our time.

Even if the best investment of our time is to do nothing at all, to enjoy a leisurely sunny day on the front porch for example, that’s an “ethical” investment. Whether we feel obligated to do so for ourselves, or perhaps we feel we owe ourselves a day of leisure, or we might find it healthy for our mind and body to relax on occasion when we can, whatever the reason, or lack of reason, we can broadly characterize this type of action as an ethical investment, based on our subjective hierarchy of values.

ENGINEERING INVESTING

There is one other type of investment we can broadly consider.

Where we might have the burning desire to produce something new, to build something unique, to design the first airplane, or divine the nature of electricity, for example, not necessarily with an eye towards tomorrow’s profits nor with some ethical pursuit, but with an eye towards achieving some technological engineering breakthrough. Some of us are simply driven or compelled to do so, without a well understood reason other than we have a deep desire to do it, to build it, or to create it.

This category of investment can be applicable for painters and musicians, for all of the arts, for all the maths, and the sciences, whom achieve breakthroughs not necessarily for profit or on the basis of ethical beliefs, but simply because something in their soul drives them to invest their time in a technological engineering investment activity.

POOR SAVINGS BEGETS FIATNAM INVESTING

Now then, because our savings vehicles are poorly designed, we are forced to spend most of our time on economical investments.

After we earn our money from our first economic investment of the day, our job, we are forced to spend the reminder of our day on our second economical investment, trading our earnings in the stock market.

Why do we need to earn our money twice each day, first with our job and second by trading it in and out of other investments?

Because all of those investments are poor savings vehicles, and therefore they require our time, turning what aught to be a savings vehicle, into an economical investment.

Ideally, we want a savings vehicle first and foremost to store our earned purchase power for all of time. If our savings vehicle leaks the purchasing power we’ve stored in it, then we have a poorly designed savings vehicle.

Until bitcoin was created there was no savings vehicle designed to store purchasing power for long periods of time without any loss of purchase power.

Before bitcoin we were forced to spend most of our time trying to offset the purchase power loss that our savings vehicles leaked out, whether it was the S&P 500 index, our bank account, or gold, or real estate, or bonds or any other sub optimum vehicle.

Which means rather than having a savings vehicle, we had an investment vehicle.

Which means, rather than spending more of our time on ethical and engineering investments, we end up stuck in fiatnam, spending all of our time on economic investing, attempting to dodge the inflation and taxation bullets the fiatcong relentlessly blast at our earned purchasing power, day in and day out.

But now with bitcoin, we finally have a savings vehicle the fiatcong can’t steal from.

FINDING BITCOIN SAVINGS ZEN

For most all of us bitcoin starts out as an investment.

We spend our time on it, thinking about it, worrying about it, trying to understand it.

Eventually though, after much work is put in, an understanding of what bitcoin is can finally be achieved. Each of us through our own efforts finally achieve the realization that bitcoin is simply the best form of money ever built, and once this realization sinks in, then it becomes nothing more than money, it becomes nothing more than the best, and frankly, the only viable savings vehicle available.

And once that realization is unlocked, you can spend your time making only one economic decision everyday, at your job.

You no longer need to spend the remainder of your day doing more economic investment calculations. You simply save your earnings into your bitcoin savings.

Deposit it into your own cold storage self custody setup, and forget it.

Stack sats, and chill.

And then something miraculous happens.

Your mind is no longer spending all of its time trying to make money.

And you realize that your health isn’t the greatest, and you start spending time making ethical investments in your health.

And then you realize your relationships aren’t the best they could be, so you spend time ethically investing in the relationships you care about.

And then something even more incredible happens.

Your savings actually starts working for you.

After a few years, you have more savings than you’ve ever had in your life. You realize that you wont be forced to spend all of your adult life on economical investing at a job you don’t like. You realize that you actually have a path forward to work on the hopes and dreams you had as a child. Suddenly your day job isn’t so bad, because you have a light at the end of the tunnel, a light and a path to guide you out of the fiatnam investment hell.

And when that day comes for you dear reader, you will come to understand why bitcoin is not going anywhere. You will find yourself where we all reside.

You will then have achieved the same experience that so many of us have already experienced for ourselves, those that came before you, and you realize that you would rather fight to the death to defend this precious savings vehicle we call bitcoin for yourself and your children and their children. You realize that you would rather die than go back into the fiatnam investment jungle of hell.

And you come to the same glorious conclusion. That we’re never going back.

Which means bitcoin is never going away.

Time to stop investing in bitcoin, amigo. Time to start saving in bitcoin.

All roads lead to bitcoin, transcending fiatnam hell.

Cheers.

🎯 GREAT (and Fun) read!!!! Fantastically written!

Nailed it again.