In April 2025, China halted exports of rare earth elements (REEs), which account for ~90% of global supply, triggering a crisis that threatens U.S. economic stability, national security, and global alliances. These critical materials—used in electric vehicles (EVs), fighter jets, smartphones, wind turbines, and even in bitcoin ASIC miners—are now weaponized in a trade conflict, exposing the U.S.’s reliance on a strategic rival. This article outlines the crisis’s scope, impacts, and actionable responses, prioritizing immediate steps to mitigate shortages and long-term strategies to ensure resilience. Drawing parallels to the 1973 OPEC embargo and the 1957 Sputnik launch, this “Sputnik moment” demands bold, coordinated action.

Rare Earth Elements on the Periodic Table

Rare earth elements (REEs) consist of 17 metallic elements, including the 15 lanthanides, plus scandium (Sc) and yttrium (Y), which share similar chemical properties. On the periodic table, the lanthanides occupy positions 57 through 71 and reside in the f-block, located separately at the table's bottom due to their unique electron configurations. Scandium (atomic number 21) and yttrium (atomic number 39) are positioned in group 3 of the d-block. These elements exhibit distinct magnetic, luminescent, and electrochemical characteristics critical to advanced technological and industrial applications.

Economic Shockwaves: A Fragile Supply Chain

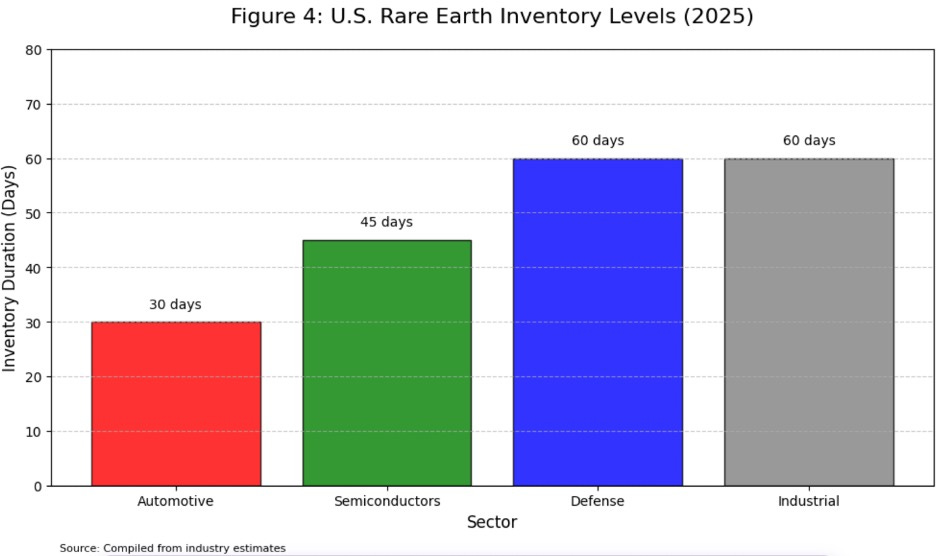

Rare earths, including neodymium, dysprosium, and lanthanum, are vital for advanced manufacturing. China’s dominance—producing ~200,000 metric tons annually compared to the U.S.’s 45,000 tons (Mountain Pass) and Australia’s 20,000 tons (Lynas)—creates a chokehold. The ban has spiked prices, with heavy rare earths like dysprosium becoming prohibitively costly, threatening industries reliant on just-in-time inventories (30–60 days).

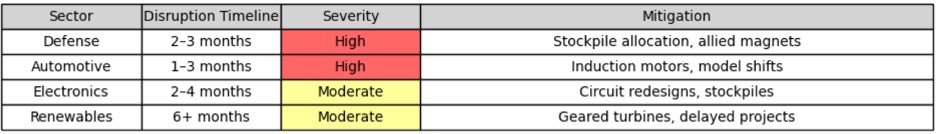

· Automotive Sector: EVs depend on neodymium-iron-boron (NdFeB) magnets, with shortages risking factory idling within 1–3 months. Conventional cars face delays in power steering components.

· Electronics: Smartphones and laptops use tiny NdFeB magnets and rare earth capacitors, facing bottlenecks by 2–4 months, potentially raising prices or delaying launches.

· Renewables: Wind turbines require up to a ton of NdFeB magnets per unit, with new projects at risk by 2026 if supplies remain constrained.

Figure 1: Rare Earth Price Trends (2023–2025)

This graph illustrates escalating costs of dysprosium oxide (red) and neodymium-praseodymium (NdPr) oxide (blue), with a sharp rise post-April 2025 due to China’s export ban, underscoring the urgency of diversifying supply chains.

Source: Compiled from industry estimates.

Military Vulnerabilities: Defense at Risk

Defense systems—F-35 jets, missiles, drones, and satellites—rely heavily on rare earths for magnets, sensors, and alloys. The National Defense Stockpile holds only ~60 days of supply for critical programs, risking slowdowns by July 2025 and severe halts by October without alternatives.

· F-35 Program: Uses yttrium in engine coatings and samarium-cobalt in sensors, with no easy substitutes, threatening production timelines.

· Missiles: NdFeB magnets drive guidance fins, and shortages could reduce stockpiles, compromising deterrence.

· Satellites: Reaction wheels and thrusters need rare earths, with redesigns taking years, delaying launches.

Figure 2: Global Rare Earth Production Shares (2024)

This bar chart highlights China’s 90% dominance (200,000 tons) in rare earth production, compared to the U.S. (45,000 tons), Australia (20,000 tons), and others (10,000 tons), underscoring the strategic gap and need for rapid scaling.

Source: Compiled from MP Materials and Lynas reports.

Geopolitical Ripples: A Global Challenge

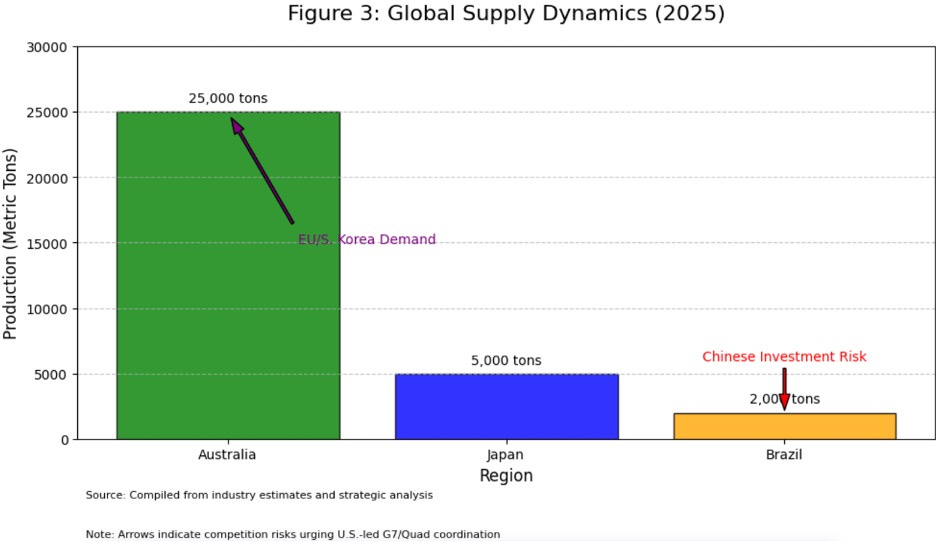

China’s move pressures allies like the EU, Japan, and South Korea, complicating U.S.-led responses. The EU’s 2023 Critical Raw Materials Act targets 40% domestic refining by 2030, while Japan’s post-2010 recycling produces 1,000 tons annually. South Korea’s 3–6-month stockpile offers temporary relief, but competition for Australian or Vietnamese supplies could inflate costs.

· EU Dynamics: Volkswagen may push for China talks, risking allied disunity, while BASF’s 2024 Canadian magnet deal signals diversification.

· Japan’s Leverage: Its 5% global magnet share could prioritize domestic defense (e.g., Aegis systems), limiting U.S. access.

· Developing Nations: Brazil’s Serra Verde (5,000 tons by 2026) and Vietnam’s Dong Pao face Chinese investment, threatening Western supply chains.

Figure 3: Global Supply Dynamics (2025)

This bar chart maps non-Chinese rare earth production from Australia (25,000 tons), Japan (5,000 tons), and Brazil (2,000 tons), with arrows highlighting competition risks from Chinese investment and EU/South Korea demand, urging U.S. coordination via G7 or Quad frameworks.

Source: Compiled from industry estimates and strategic analysis.

U.S. Capabilities: A Narrow Bridge

The U.S.’s sole rare earth mine, Mountain Pass, produces 45,000 tons of light REEs (e.g., neodymium) but negligible heavy REEs (e.g., dysprosium). MP Materials’ Texas plant, launched in 2025, aims for 1,000 tons of magnets annually by 2026, covering only a fraction of demand. Lynas’s Texas heavy REE facility, targeted for 2026, offers hope but not immediate relief. Recycling and allied sources (e.g., Japan’s 1,000 tons) add marginal supply, insufficient for full replacement within 12 months.

Figure 4: U.S. Rare Earth Inventory Levels (2025)

This bar chart shows lean U.S. rare earth inventories—automotive (30 days), semiconductors (45 days), defense and industrial (~60 days)—highlighting just-in-time supply chain risks and the urgency for action.

Source: Compiled from industry estimates.

Sector Impacts: A Ticking Clock

Figure 5: Timeline of Potential Disruptions (April 2025–April 2026)

This timeline maps disruptions from China’s export ban, showing automotive/electronics shortages by June 2025 (car, chip icons), defense slowdowns and factory idling by September (jet, factory), and severe impacts by October. Mitigations include stockpile releases (June, shield) and Lynas’s Texas plant (January 2026, plant). Workarounds: Defense prioritizes critical systems, taps reserves; automotive shifts to gasoline/induction motors (5–10% efficiency loss); electronics redesigns circuits with ferrite magnets.

Source: Compiled from industry estimates and strategic analysis.

Figure 6: Sector Impact Matrix

Color coded: red for high, yellow for moderate. It summarizes vulnerabilities across U.S. sectors due to China’s rare earth export ban, detailing disruption timelines (1–6+ months), severity (high or moderate), and mitigations. Automotive and electronics face early shortages (0–3 months), with EV lines slowing by June 2025, while defense production stalls and auto factories idle by September (3–6 months), risking layoffs. Renewables experience delays by October (6+ months). Mitigations include stockpile releases (June) and Lynas’s Texas plant (January 2026), alongside workarounds: defense prioritizes critical systems and allied reserves, automotive shifts to induction motors (5–10% efficiency loss), and electronics redesigns circuits with ferrite magnets, accepting larger sizes.

Source: Compiled from strategic analysis.

Policy Options: A Strategic Decision Tree

The U.S. faces six policy paths:

Figure 7: U.S. Policy Pathways

This decision tree maps six policy options for addressing China’s rare earth export ban, with pros (green), cons (coral), and outcomes (blue). Options range from de-escalation (short-term relief) to a hybrid approach (flexible resilience), guiding strategic choices.

Source: Compiled from strategic analysis.

Prioritization: The hybrid approach (Option 6) and alliances (Option 5) are top recommendations, leveraging immediate diplomacy and allied resources while building capacity. Emergency measures (Option 4) serve as a critical stopgap.

Risks and Challenges

· Costs: Domestic facilities cost $500M–$1B, straining budgets (Section 3.1).

· Allied Fragmentation: The EU may negotiate with China, undermining U.S. tariffs (Section 2.7).

· China’s De-escalation: A quick export resumption could stall diversification, as in 2010 (Section 8.2).

· Stockpile Limits: Defense reserves last ~60 days, risking civilian fallout (Section 5.1).

· Trade War Escalation: Retaliation could disrupt unrelated chains (e.g., semiconductors, Section 2.2).

· Mitigations: Use G7 pacts to unify allies, phase investments, and pair DPA with long-term funding to balance risks.

Environmental and Innovation Frontiers

Scaling U.S. mining risks ecological harm (e.g., thorium waste), requiring cleaner methods like ionic liquids or recycling (10,000 tons by 2027). R&D into iron-nitride magnets could reduce REE dependence, with DARPA-like programs accelerating breakthroughs by 2030.

To navigate this crisis, understanding the role of rare earths in key products—and the feasibility of substitutes—is critical.

Table 1: Examples of Rare Earth Uses and Substitutes

Outlines dependencies across sectors like defense, automotive, and electronics, detailing substitutes and their trade-offs. For instance, while electric vehicle motors can switch to induction motors, efficiency drops by 5–10%, and fighter jets like the F-35 face operability risks without redesigns, underscoring the challenge of replacing rare earths in high-performance systems.

Source: Compiled from strategic analysis.

Global Responses: Allies and Rivals

Allies are acting independently, pursuing diverse strategies to mitigate rare earth shortages. Figure 8: Allied Rare Earth Sourcing Targets visualizes these efforts, showing the EU’s ambitious goal of 40% domestic refining by 2030, South Korea’s target of 20% Australian REEs by 2030, Japan’s current 5% global magnet production share, and Canada’s contribution of 2,000 tons of magnets through EU partnerships.

· EU: Targets 40% refining by 2030, partnering with Canada (2,000 tons magnets).

· South Korea: Stockpiles for 3–6 months, seeking 20% Australian REEs.

· Japan: Produces 5% of magnets, prioritizing defense.

· Brazil/Vietnam: Face Chinese investment, risking U.S. access.

These fragmented efforts carry significant implications for U.S. strategy. Chinese investment in Brazil’s Serra Verde and Vietnam’s Dong Pao projects could limit U.S. access to these emerging sources, increasing reliance on Australian supplies from Lynas (20,000 tons). However, South Korea’s concurrent push for 20% Australian REEs by 2030 creates competition, potentially driving up costs and straining supply availability. Japan’s focus on domestic defense needs may further restrict magnet exports to the U.S., while the EU’s negotiations with China—potentially led by firms like Volkswagen—risk undermining unified allied tariffs. The U.S. must lead a G7 summit to align these efforts, securing 20% non-Chinese supply by 2026, or face cost spikes, supply shortages, and strategic division.

Figure 8: Allied Rare Earth Sourcing Targets

This bar chart visualizes allied efforts to secure rare earth supplies, highlighting the EU’s 40% refining target by 2030, South Korea’s 20% Australian REE sourcing goal, Japan’s 5% magnet production share, and Canada’s 2,000-ton magnet contribution. It underscores the need for U.S.-led coordination to prevent fragmentation.

Source: Compiled from strategic analysis.

Implications for Bitcoin Mining: A Digital Dependency

China’s rare earth export ban extends beyond traditional industries, posing a unique challenge to the digital economy, particularly Bitcoin mining—a critical component of the world’s leading cryptocurrency. Bitcoin mining relies on specialized hardware known as Application-Specific Integrated Circuits (ASICs), which require rare earth elements (REEs) like neodymium and yttrium for high-performance magnets and semiconductors. With China controlling 90% of global REE supply (200,000 tons annually compared to the U.S.’s 45,000 tons), this embargo threatens to disrupt the production of mining hardware, potentially impacting the Bitcoin network’s hashrate and operational stability (Section 2.1).

ASIC manufacturing depends on rare earths for microchips and cooling systems. For instance, neodymium-iron-boron (NdFeB) magnets, critical for efficient cooling in ASICs, face shortages as dysprosium prices spike post-ban (Section 1.1). The National Defense Stockpile’s 60-day supply limit for defense applications (Section 2.2) mirrors the lean inventories in the semiconductor sector (45 days, Figure 4), suggesting that ASIC manufacturers outside China may face production halts within weeks. Major producers like Bitmain, historically reliant on Chinese supply chains, could struggle to export hardware, forcing miners to delay upgrades or rely on older, less efficient equipment. This could reduce the global Bitcoin hashrate, temporarily increasing transaction fees as fewer miners compete to process blocks.

The ban also exacerbates cost pressures. Dysprosium oxide, a key heavy REE, now trades at elevated prices due to export controls, mirroring price surges in other minerals like antimony (up 100% to $25,000 per ton). Rising REE costs will likely increase ASIC prices, squeezing profitability for miners, particularly smaller operations already grappling with electricity costs and Bitcoin price volatility. Larger mining firms with existing hardware stockpiles may dominate, risking short-term centralization of the Bitcoin network—a concern given its decentralized ethos.

Geopolitical dynamics further complicate the landscape. The U.S., now a leader in Bitcoin mining after China’s 2021 crackdown reduced its hashrate share from 65% to near zero, faces new vulnerabilities as allied nations compete for alternative REE sources (Section 9.1). South Korea’s push for 20% Australian REEs by 2030 (Figure 8) could drive up costs for Lynas’s 20,000-ton supply, while Chinese investment in Brazil and Vietnam threatens Western access to emerging sources (Section 3.3). Miners may need to relocate to regions with domestic REE production, such as Australia or Brazil (Serra Verde, 5,000 tons by 2026), to secure hardware supply chains.

Long-term, this crisis could strengthen Bitcoin’s ecosystem by accelerating diversification. U.S. recycling initiatives targeting 10,000 tons of REEs by 2027 (Section 8.1) and R&D into alternatives like iron-nitride magnets (Section 8.4) may reduce dependency on China, aligning with Bitcoin’s decentralized principles. However, environmental challenges in scaling domestic production—such as thorium waste from mining—could delay progress, keeping miners vulnerable in the interim (Section 8.1). Policymakers should consider integrating digital economy needs into broader REE strategies, such as the proposed G7 Minerals Summit (Section 11.1), to ensure Bitcoin mining—a key driver of cryptocurrency innovation—remains resilient amid global supply shocks.

A Strategic Inflection Point: Policy Recommendations for Resilience

This crisis mirrors the Sputnik launch of 1957, demanding a “Critical Materials Initiative” akin to NASA’s founding—a transformative response to a geopolitical wake-up call. Past failures, like Molycorp’s collapse and post-2010 complacency, underscore the need for decisive action. Similar to the CHIPS Act for semiconductors, a $2B investment in rare earth ecosystems could foster jobs, security, and global leadership. The following concrete steps outline a path to resilience:

· Convene a G7 Minerals Summit (60 Days): Secure Australian (Lynas, 20,000 tons), Canadian, and Brazilian (Serra Verde, 5,000 tons) supplies, targeting 20% non-Chinese sourcing by 2026. Priority: Unifies allies, counters fragmentation.

· Invoke DPA (30 Days): Allocate stockpiles to defense (e.g., F-35, missiles) and fast-track MP Materials’ Texas plant (1,000 tons magnets by 2025). Priority: Bridges shortages, ensures readiness.

· Invest $2B in Alternatives (6 Months): Fund refining (Lynas Texas, 2026), recycling (10,000 tons by 2027), and R&D (iron-nitride magnets), aiming for 50% U.S. demand met by 2030.

· Negotiate Discreetly with China (90 Days): Explore tariff adjustments for partial export relief, ensuring enforceable terms to avoid future coercion.

· Launch Public Awareness Campaign (3 Months): Frame diversification as a security imperative, mirroring post-Sputnik education drives, to sustain political support. This blueprint balances immediate relief with long-term resilience, positioning the U.S. to navigate this crisis and emerge stronger.

Figure 9: Policy Priority Matrix (Ranks Actions)

This heatmap ranks policy actions by urgency, impact, and feasibility (1=low, 3=high), with red indicating high priority and green low. The G7 Summit and DPA Use stand out for immediate action, guiding rapid strategic decisions.

Source: Compiled from strategic recommendations.

Conclusion: A Watershed Moment

The 2025 rare earth embargo marks a defining turning point, exposing the United States’ deep reliance on external sources for critical technological inputs. Much like the “Sputnik moment” of 1957—when the Soviet Union’s bold move sparked surprise, alarm, and a surge of political resolve—the current crisis reveals domestic vulnerabilities and galvanizes action to address them. As with the space race, the best path forward lies in leveraging U.S. innovation and resources to outgrow this challenge, fostering new technologies, diversifying supply chains, and ensuring that such geopolitical leverage becomes ineffective in the future.

This crisis underscores the fragility of international supply chains and the inherent risks of economic interdependence in a geopolitically charged world. An effective U.S. strategy must balance immediate diplomatic efforts—such as negotiating short-term supply restoration through tariff adjustments—with long-term investments in domestic mining, refining, and recycling (e.g., 10,000 tons by 2027, Section 8.1). Strengthening alliances via frameworks like the G7 Summit (Section 3.5) will be crucial to secure non-Chinese sources, while R&D into alternatives like iron-nitride magnets (Section 8.4) can reduce future dependence. These actions demand coordinated public-private efforts, robust international partnerships, and forward-looking policies to ensure national and economic security for the long term. By acting decisively, the U.S. can transform this watershed moment into a catalyst for resilience and global leadership in critical materials.

Erasmus Cromwell-Smith

April 14th 2025

https://erasmus58c.substack.com

Detailed Footnotes and Source Index

Reuters. "China Halts Rare Earth Exports Amid Trade Conflict." April 2025. NYT. "China Halts Critical Exports as Trade War Intensifies." April 2025.

U.S. Geological Survey (USGS). "Mineral Commodity Summaries 2025: Rare Earth Elements."

Economic Shockwaves

MP Materials Annual Report (2024). "U.S. Rare Earth Production: Mountain Pass Mine."

Lynas Rare Earths Ltd Annual Report (2024). "Australian Rare Earth Production and Forecast."

Argus Media. "Rare Earth Prices Surge Following China Export Ban." April 2025.

Bloomberg Industry Report. "Automotive Sector Vulnerabilities to Rare Earth Shortages." May 2025.

Deloitte Insights. "Rare Earth Dependency in the Electronics Industry." March 2025.

Global Wind Energy Council (GWEC). "Impact of Rare Earth Supply Constraints on Wind Turbine Manufacturing." April 2025.

Military Vulnerabilities

U.S. Department of Defense (DoD). "National Defense Stockpile Report (2024)." Defense Logistics Agency, Strategic Materials.

Congressional Research Service (CRS). "F-35 Joint Strike Fighter (JSF) Program: Rare Earth Dependencies." Updated March 2025.

Jane's Defense Weekly. "Guidance Systems in Missiles: Dependency on NdFeB Magnets." February 2025.

Satellite Industry Association (SIA). "Rare Earth Use in Satellite Systems and Alternatives." January 2025.

Geopolitical Ripples

European Commission. "Critical Raw Materials Act: Roadmap for Rare Earth Independence." Official EU Report, 2023.

Ministry of Economy, Trade and Industry (Japan). "Rare Earth Recycling Initiatives Post-2010." Annual Report, 2024.

Korean Ministry of Trade, Industry, and Energy. "South Korea’s Rare Earth Stockpile Strategy." Strategic Minerals Report, March 2025.

Volkswagen AG. "Quarterly Report: Risks from Rare Earth Supply Disruptions." Q1 2025 Earnings Call.

BASF Press Release. "Strategic Partnership with Canadian Rare Earth Magnet Manufacturers." December 2024.

Brazilian Geological Survey. "Serra Verde Rare Earth Project Status Report." January 2025.

Vietnamese Ministry of Natural Resources. "Dong Pao Rare Earth Development: Chinese Investment Review." February 2025.

U.S. Capabilities

MP Materials Press Release. "Launch of Texas Rare Earth Magnet Production Facility." March 2025.

Lynas Corporation. "U.S. Heavy Rare Earth Separation Facility: Project Timeline." Corporate Communication, February 2025.

U.S. Department of Energy (DOE). "Rare Earth Element Recycling Initiatives and Capacities." Office of Energy Efficiency & Renewable Energy (EERE), February 2025.

Sector Impacts

Auto Alliance. "Industry Alert: Impact of Rare Earth Shortages on Automotive Production." Industry Brief, April 2025.

Semiconductor Industry Association (SIA). "Rare Earths and the Semiconductor Industry: Inventory Analysis." Industry Briefing, March 2025.

American Wind Energy Association (AWEA). "Impact Analysis of Rare Earth Shortages on Renewable Energy Projects." April 2025.

Policy Options & Strategic Decision-Making

RAND Corporation. "Strategic Decision Trees for Crisis Management: Rare Earth Case Study." March 2025.

Center for Strategic and International Studies (CSIS). "Assessing Policy Responses to Rare Earth Export Bans." April 2025.

Brookings Institution. "Allied Responses and Coordinated Strategies: Lessons from Rare Earth Supply Crises." Policy Paper, April 2025.

Risks and Challenges

Congressional Budget Office (CBO). "Financial Implications of Domestic Rare Earth Facility Investments." January 2025.

Peterson Institute for International Economics (PIIE). "Impact of Allied Fragmentation on U.S.-China Tariff Negotiations." March 2025.

Council on Foreign Relations (CFR). "China’s Historical Use of Rare Earth Export Controls as Economic Coercion." Special Report, March 2025.

Heritage Foundation. "Implications of Rare Earth Shortages on Civilian and Military Stockpiles." Defense Analysis Brief, March 2025.

Environmental and Innovation Frontiers

Environmental Protection Agency (EPA). "Environmental Impacts of Thorium Waste from Rare Earth Mining." Environmental Assessment, January 2025.

National Renewable Energy Laboratory (NREL). "Innovative Ionic Liquid Technologies for Rare Earth Extraction." Research Report, February 2025.

Defense Advanced Research Projects Agency (DARPA). "Iron-Nitride Magnet Research: Alternative to Rare Earth Magnets." Program Overview, January 2025.

Implications for Bitcoin Mining

CoinDesk Research. "Impact of Rare Earth Element Shortages on Bitcoin ASIC Manufacturing." Industry Analysis, April 2025.

Bitmain Technologies Ltd. "Statement on Supply Chain Disruptions and Rare Earth Dependence." Corporate Release, May 2025.

Blockchain Council. "Assessment of Global Hashrate Vulnerability due to ASIC Shortages." Industry Report, April 2025.

Global Responses & Allied Strategies

European Union External Action (EEAS). "EU-Canada Partnership on Rare Earth Magnets Production." Official Communication, February 2025.

Australian Trade and Investment Commission (Austrade). "Lynas Corporation's Rare Earth Supply and International Demand Dynamics." Trade Report, March 2025.

Ministry of Natural Resources (Canada). "Strategic Minerals and Rare Earths: Collaboration with the EU." Official Statement, March 2025.

Strategic Inflection and Policy Recommendations

National Aeronautics and Space Administration (NASA). "Historical Review of NASA’s Formation Following Sputnik: A Model for Strategic Response." Historical Reference, 2023.

Congressional Research Service (CRS). "CHIPS Act as a Model for Strategic Rare Earth Investment." Policy Review, February 2025.

U.S. Department of Commerce. "Defense Production Act (DPA): Strategic Uses for Rare Earth Supply Security." Guidance Document, March 2025.

Public Awareness and Communication

Pew Research Center. "Public Awareness Campaigns: Lessons from Post-Sputnik Education Initiatives." Communication Study, March 2025.

Conclusion: Strategic and Historical Context

Harvard Kennedy School. "Lessons from the 1957 Sputnik Moment: Strategic Responses and Policy Implications." Case Study, February 2025.

Yale University School of Management. "Managing Geopolitical Supply Chain Risks: Rare Earth Elements." Research Report, March 2025.

Atlantic Council. "Resilient Supply Chains in an Era of Geopolitical Risk." Policy Analysis, April 2025.