"THE CASE FOR THE DEPARTMENT OF GOVERNMENT EFFICIENCY (D.O.G.E.)"

The Urgent Crisis of Unsustainable Debt Growth

The Trump administration recently launched the Department of Government Efficiency (D.O.G.E.) to directly address the escalating fiscal irresponsibility within the federal government. Its ambitious mission is clear: drastically cut wasteful spending, enhance transparency, and eliminate the harmful reliance on deficit financing and QE-driven money printing.

The U.S. is caught in an Out-of-Control Debt Spiral

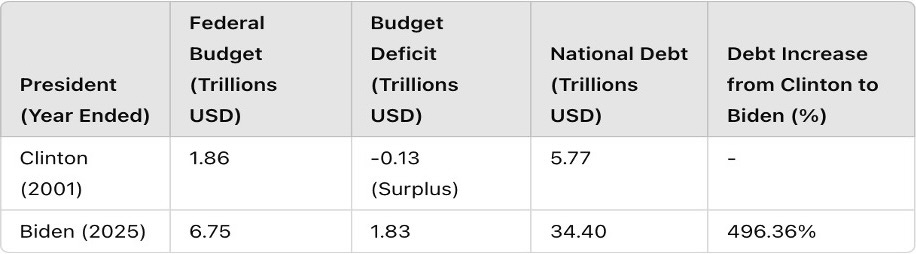

Over the past quarter-century—from President Clinton's term ending in 2001 to President Biden's concluding in 2025—The U.S. national debt surged dramatically from $5.77 trillion to $34.40 trillion, representing a 496% increase in just 24 years. This unsustainable growth, illustrated in the accompanying chart, presents a severe risk to both U.S. and global financial stability.

Galloping Budgets

Given the scale of the fiscal problem, the reforms that D.O.G.E. aims to implement must be of enormous magnitude. Small, incremental cuts are insufficient; only deep, transformative measures can halt and reverse the current fiscal trajectory, reestablish genuine financial stability, and restore global trust in America’s monetary stewardship.

Congress Continues to Approve Reckless Budgets Funded by Debt

In fiscal year 2024 alone, the federal government spent $6.75 trillion while collecting only $4.92 trillion in revenue, generating a deficit of approximately $1.83 trillion covered entirely through debt issuance.

A breakdown of government spending shows 75% is allocated to Social Security, Medicare, Medicaid, Military, Veterans, and Interest on Debt—categories untouched so far by proposed D.O.G.E. savings. Incremental cuts are insufficient; only deep, transformative reforms can alter the trajectory and restore fiscal stability.

To date, Mr. Musk’s team has focused exclusively on identifying cuts and savings within the remaining 25% of the budget, amounting to approximately $1.68 trillion. Achieving his targeted $1 trillion in annual savings is clearly impossible without addressing the larger, untouched portion of the budget.

The Treasury, The Fed, and the Debt Cycle

1. The Treasury as the Government’s “Checkbook”

• Acts as the federal government’s chronically overdrawn checking account due to political priorities:

• Social welfare and entitlement programs (e.g., Medicare, Medicaid, Social Security)

• Military and defense spending (military contractors, national security)

• Emergency relief and stimulus packages (e.g., COVID relief checks)

2. The Federal Reserve as the “Bank of All Banks”

• Serves as the lender of last resort, employing Quantitative Easing (QE)—money printing—to purchase Treasury bonds, temporarily masking fiscal irresponsibility.

• QE artificially lowers interest rates but creates inflationary pressures, asset bubbles, and currency debasement.

3. The Self-Reinforcing Cycle

• Treasury overspending → Issuance of Treasury bonds → Fed prints money (QE) to buy these bonds → encourages more overspending.

• This cycle creates structural dependency and inherent vulnerability, continuously weakening the financial credibility of the U.S. dollar.

4. Powerful Interests Entrenched in the System

• Large financial institutions: Profiting from QE liquidity.

• Defense contractors: Dependent on government contracts.

• Social welfare advocates and NGOs: Reliant on deficit-funded entitlements.

• Political establishment: Benefiting electorally from spending.

• State economies: Highly dependent on federal funding.

5. The Necessity of D.O.G.E.

D.O.G.E. is explicitly confronting these entrenched interests:

• Drastically reducing wasteful spending.

• Introducing rigorous fiscal transparency, and accountability.

• Establishing credible, long-term discipline.

Without directly addressing these vested interests, structural reforms will remain superficial, perpetuating fiscal instability.

6. Why Is Fiscal Reform Historically So Difficult?

Historical attempts at meaningful reform consistently failed due to resistance from powerful interests:

History demonstrates that without radical, structural reforms like D.O.G.E., significant change remains elusive.

7. Why D.O.G.E. is Essential

Without initiatives like D.O.G.E., fiscal reform is merely symbolic, risking economic instability and global financial crises. D.O.G.E. explicitly signals credible reform domestically and internationally, reinforcing confidence in the U.S. dollar and financial system.

8. The critical Link: D.O.G.E., Re-Monetization, and Stewardship

D.O.G.E. isn't an isolated effort—it's foundational to Re-Monetization, the strategic restoration of monetary trust and fiscal credibility. Fiat money relies on trust; when trust is compromised, restoring it requires clear and credible reforms.

9. D.O.G.E.’s Pivotal Role in Re-Monetization:

By tackling wasteful spending and structural inefficiencies directly, D.O.G.E. reshapes public and investor perception, laying the groundwork for genuine monetary stabilization. Without D.O.G.E., complementary measures like the U.S. Bitcoin Strategic Reserve, the Sovereign Wealth Fund (SWF), and the CFTC Asset Tokenization initiative risk remaining symbolic rather than transformative.

Thus, D.O.G.E. serves as a linchpin explicitly connecting fiscal discipline, renewed trust, and monetary stabilization, transitioning symbolic measures into concrete structural change.

10. Elon Musk’s Urgent Warning

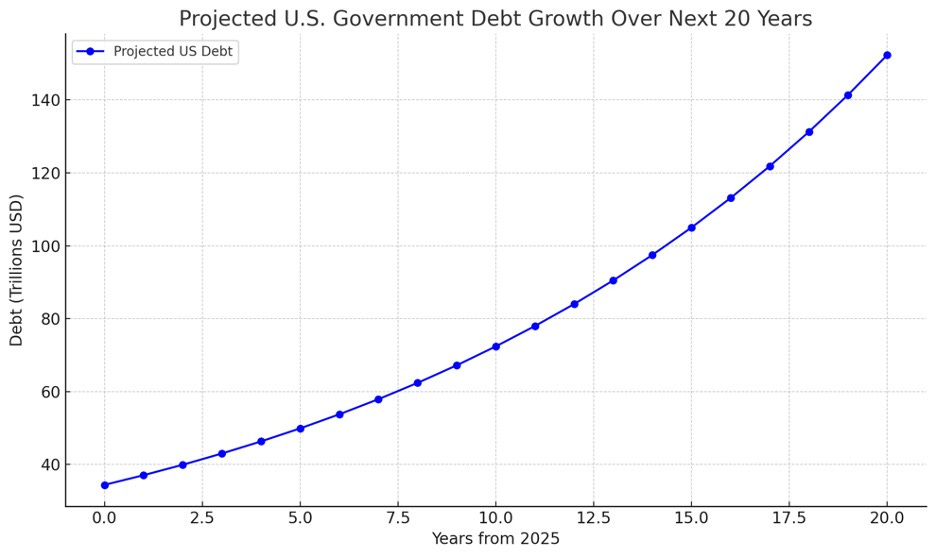

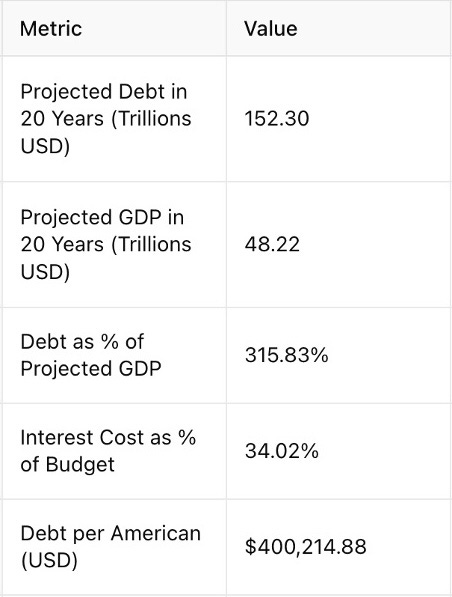

Elon Musk recently warned that without immediate fiscal reform, U.S. debt could exceed $152 trillion within 20 years—over 315% of GDP—with interest payments consuming 34% of the federal budget and burdening each American with over $400,000 in debt. Musk’s emphasis on radical reform, not incremental adjustments, is essential to avert economic catastrophe.

Elon Musk is right—the numbers speak for themselves!

11. The Strategic Importance of the Bitcoin Reserve

The success of D.O.G.E.’s fiscal reforms depends significantly on complementary initiatives like the U.S. Bitcoin Strategic Reserve. Bitcoin’s scarcity, decentralization, and transparency establish a credible monetary anchor independent from fiat vulnerabilities, reinforcing government commitment to structural fiscal reform. This credible backing transforms D.O.G.E. from ambitious rhetoric into sustainable economic stewardship.

Without a credible anchor like Bitcoin, D.O.G.E.’s reforms risk appearing temporary or reversible. A Bitcoin reserve thus ensures lasting confidence, providing market discipline and stability crucial for genuine, sustained fiscal reform.

Consider this: 1 million BTC purchased at an average cost of $200,000 each, appreciating at Bitcoin’s historical annual growth rate of 30%, would result in a strategic reserve valued at approximately $38.01 trillion within two decades—enough to pay off the entire U.S. government debt.

Conclusion:

D.O.G.E. is essential for dismantling fiscal irresponsibility, enhancing transparency, and restoring U.S. fiscal and monetary credibility. Its implementation, complemented by the Bitcoin Strategic Reserve, offers a credible and sustainable path toward genuine economic stewardship and financial stability.

Erasmus Cromwell-Smith.

March 13th. 2025.

https://medium.com/@e-cromwellsmith