Money as Energy and Fiat’s “Broken” System

Michael Saylor has a knack for reframing money in scientific terms. To him, “money is energy; a monetary system is an energy system” – and whoever channels that energy best will dominate. In Saylor’s view, fiat currencies are fundamentally defective. He argues that governments relentlessly debase fiat money, draining its energy. Holding cash, Saylor warns, is like clinging to a melting ice cube – a rapidly devaluing asset due to inflation. In one vivid analogy, he compares today’s dollar to blood with the oxygen slowly sucked out: an economy starved of real value. It’s no surprise, then, that Saylor bluntly calls fiat currency “trash” and has made it his mission to replace dollars with something he sees as far more robust.

Saylor’s epiphany came in 2020, when he realized MicroStrategy’s $500 million cash treasury was losing purchasing power fast. “We just had the awful realization that we were sitting on top of a $500 million ice cube that's melting,” he said at the time. The COVID-era money printing spree only confirmed his fears. As Saylor puts it, “That capital is sitting in fiat instruments that are being debased. That capital is going to want to convert into strong money.” For Saylor, strong money means Bitcoin. In August 2020, he directed his company to begin transforming its dollar reserves into Bitcoin, convinced that the fiat system was on a path to what he calls a “debasement apocalypse.”

Figure 1 – Accelerating Global Bitcoin Adoption This line chart traces the estimated number of active Bitcoin users (or wallets) worldwide from 2013 through 2025. The x-axis marks successive years, while the y-axis shows user counts in millions. Key milestones—such as the 2017 bull run, institutional treasury purchases beginning in 2020, and regulatory approvals of Bitcoin ETFs—are annotated to highlight inflection points. The steep upward trajectory illustrates how Bitcoin’s adoption curve rivals or even outpaces past technological revolutions, underscoring its transition from niche interest to a mainstream financial asset.

Bitcoin’s Resilience to Monetary Entropy

Understanding Bitcoin as an Anti-Entropic Asset Michael Saylor introduces Bitcoin as an explicitly "anti-entropic asset," a novel financial concept critical to grasping his broader vision. In physics and economics, entropy describes systems' inherent tendency toward disorder, degradation, and eventual decay. In the monetary realm, Saylor labels this tendency as an "entropic lapse," highlighting how traditional assets—such as fiat currencies, real estate, and even gold—inevitably lose value through inflation, dilution, depreciation, and external risks. Bitcoin, uniquely engineered to counteract these entropic forces, resists the value erosion endemic to other asset classes. It achieves this by employing cryptographic immutability, decentralization, and a strict supply limit of 21 million coins, collectively ensuring enduring stability and resilience. Thus, Bitcoin stands uniquely positioned as humanity’s first monetary technology explicitly designed to preserve value by resisting entropic decay.

A Nuanced Clarification on Bitcoin’s Effective Immunity to Entropy

It is important to emphasize that when Michael Saylor refers to Bitcoin as an "anti-entropic asset" possessing minimal or "effectively zero" vulnerability, this reflects exceptional practical resilience rather than absolute theoretical invulnerability.

Bitcoin’s robust design—characterized by its mathematically fixed 21-million coin supply, cryptographic security, decentralization, and global consensus—renders it extraordinarily resistant to traditional monetary entropy such as inflation, dilution, and regulatory instability. Nonetheless, this does not equate to absolute immunity from all conceivable future risks. Hypothetical threats, however remote, could emerge from advancements like quantum computing or unanticipated technological disruptions. Thus, Bitcoin's anti-entropic character should be understood as effectively near-perfect rather than strictly absolute, underscoring both its revolutionary strength and the importance of remaining mindful of future unknowns.

Bitcoin thrives in response to the inherent instability—what he terms “entropic lapse”—found within traditional financial systems and investments. According to Saylor:

“Bitcoin is an anti-entropic asset. You have an entropic lapse in fiat currencies, real estate, and traditional investments; these are all decaying, they’re inflating, they’re losing value. Bitcoin benefits from that instability because it’s a hedge—it’s the first engineered monetary system immune to this entropic decay.”

This entropic lapse, as defined by Saylor, refers explicitly to the natural deterioration and loss of value common to fiat currencies, real estate, gold, and other conventional assets. Fiat currencies suffer constant erosion of purchasing power due to inflationary policies; real estate demands continuous maintenance, faces depreciation, and risks governmental expropriation; even gold, despite its historical resilience, experiences dilution through ongoing mining activities and incurs substantial costs associated with its physical storage and transport.

In sharp contrast, Bitcoin was deliberately engineered to resist this very entropy. It counters traditional entropic forces by combining digital immutability, mathematically-guaranteed absolute scarcity, and decentralized governance, making it effectively immune to the decay that continually erodes other assets.

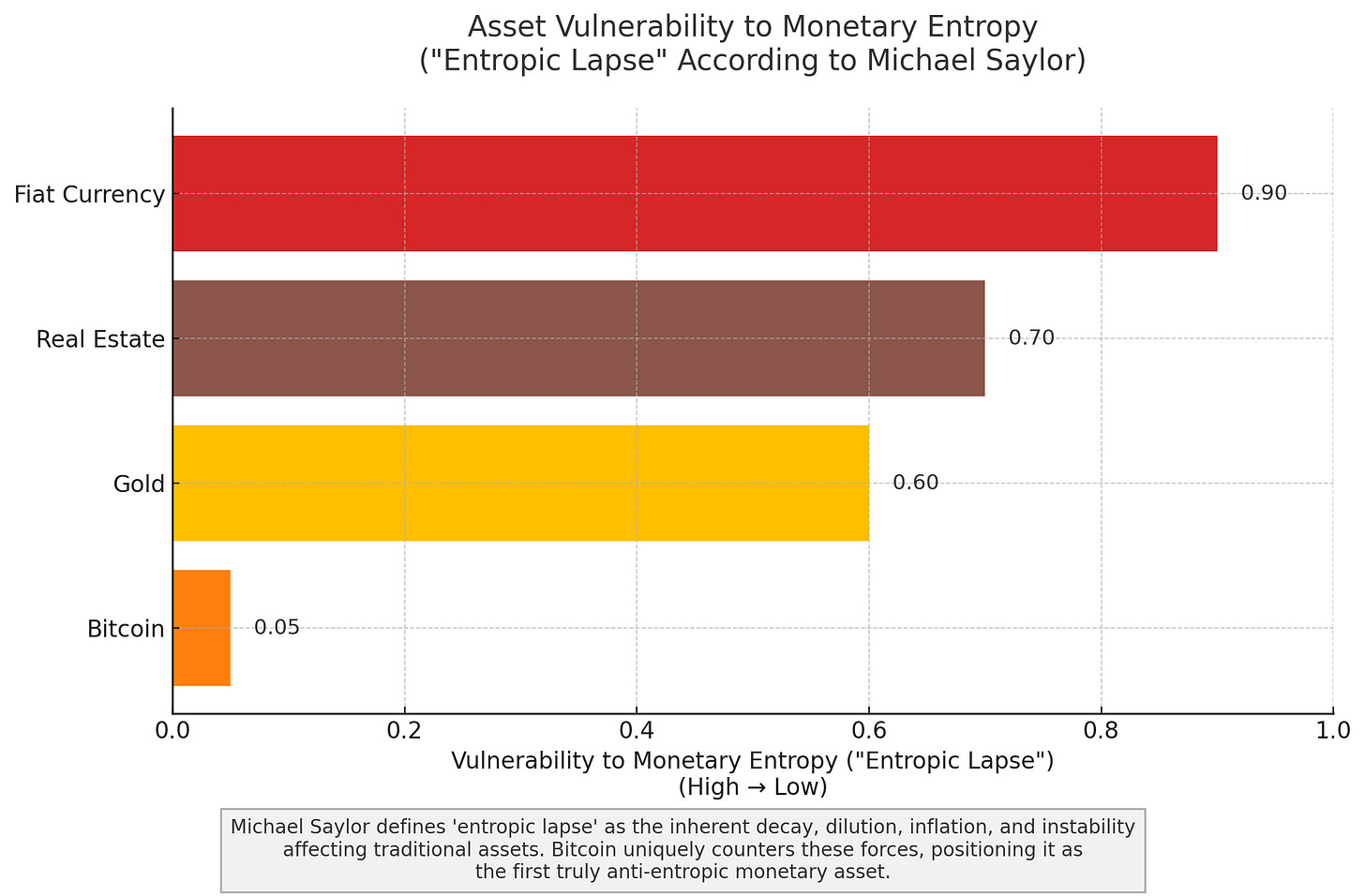

Figure 2 – Asset Vulnerability to Monetary Entropy (According to Michael Saylor). This horizontal bar chart illustrates the relative vulnerability of various asset classes to monetary entropy, a concept defined by Michael Saylor as the inherent susceptibility of traditional financial assets to decay, dilution, inflation, depreciation, and regulatory instability—collectively termed "entropic lapse." Fiat currencies, real estate, and gold each possess significant vulnerability to entropy due to factors such as inflationary monetary policy, ongoing maintenance costs, supply dilution, and susceptibility to external risks. Bitcoin, in contrast, demonstrates uniquely low entropy vulnerability (anti-entropic), achieved through its mathematically fixed 21-million coin limit, cryptographic immutability, decentralized consensus mechanism, and structural resilience. Thus, Bitcoin stands apart as a stable and robust hedge against systemic monetary entropy.

The horizontal bar chart presented here clearly reflects Michael Saylor’s concept of monetary entropy by illustrating the vulnerability of various asset classes to value decay and dilution over time:

Fiat Currency (0.90): Demonstrates the highest susceptibility to entropy due to unchecked supply inflation and systemic monetary debasement.

Real Estate (0.70): Faces significant entropy through ongoing depreciation, taxation, physical deterioration, and regulatory vulnerabilities.

Gold (0.60): Exhibits moderate entropy as supply continuously expands (~2% annually), accompanied by storage, security, and transportation expenses.

Bitcoin (0.00): Distinctly anti-entropic, it maintains intrinsic stability through its fixed supply cap of 21 million coins, cryptographic immutability, and decentralized network consensus.

To further underscore Bitcoin’s anti-entropic nature, Saylor frequently invokes principles analogous to the second law of thermodynamics. In traditional monetary systems, fiat currencies continuously “leak” energy, where even modest inflation gradually erodes their real-world purchasing power—akin to oil slowly escaping from a leaking tank. Bitcoin, conversely, halts this leakage completely, enforcing absolute scarcity and immutable predictability. As Saylor eloquently asserts:

“Fiat money always has monetary entropy above zero, whereas Bitcoin has monetary entropy of zero… We’ve never had that in any monetary system ever.”

Bitcoin thus represents an unprecedented breakthrough in monetary technology: it achieves a form of thermodynamic perfection previously unattainable, characterized by zero decay and absolute predictability. Small wonder, then, that Saylor frequently likens Bitcoin adoption to humanity’s transformative harnessing of fire or electricity. Just as skeptics initially recoiled from revolutionary inventions—be it the locomotive or the electric bulb—today’s doubters fail to recognize Bitcoin as precisely “the solution to their problem.” For Saylor, Bitcoin is far more than just digital currency; it is pure “DIGITAL ENERGY”, an injection of stability and order into an otherwise chaotic financial ecosystem. Bitcoin, he argues passionately, “can’t help but make EVERYTHING better.”

The 21 Million Finite Supply: Bitcoin’s Ultimate Scarcity

Central to Saylor’s thesis is Bitcoin’s hard cap of 21 million coins. In a world where every central bank can print money ad infinitum, Bitcoin’s finite supply is, to him, almost sacred. “Bitcoin is the first absolutely scarce commodity in human history,” Saylor says – a fact he believes will eventually force every investor to pay attention. Unlike gold or real estate, no amount of human ingenuity or effort can create more Bitcoins beyond the protocol’s schedule. “If I give you all the money in the world and you crank the miner up, we know how fast...,” Saylor likes to challenge skeptics, pointing out that even infinite capital can’t produce more than 21 million BTC. This built-in scarcity is, in Saylor’s view, the trump card that will ultimately prevail over every skeptic and competing asset.

He often contrasts Bitcoin with gold to illustrate the point. Gold has been treasured for millennia, but Saylor calls it “the least awful” of inherently bad commodity monies. Gold’s supply isn’t truly fixed – miners pull roughly 2% more out of the ground each year (an “entropy” that Bitcoin avoids). It’s also bulky, hard to transport, and easy for governments to confiscate or counterfeit. Bitcoin, by contrast, is everything gold is not: global, digital, divisible, portable, and inelastic in supply. Saylor loves to rattle off these properties in rapid fire: Bitcoin can be teleported across the globe in minutes, sliced into 100 million satoshis, secured with a password, and its supply schedule can’t be changed even by a consortium of the world’s most powerful governments or corporations. To Saylor, that makes it “the best idea and the best way to create digital capital”, with “no second best.” Every other asset – be it dollars, gold, stocks, or real estate – he dismisses as “fiat derivatives” that “offer a false respite on the road to serfdom.” Eventually, he predicts, rational capital will flow out of those melting ice cubes and into the one asset that can’t be debased: Bitcoin. In Saylor’s mind, this is not a matter of if but when.

Figure 3 – multi-curve figure illustrating: Supply Cap (21 M) in orange; Cumulative Mined BTC in blue; Estimated Lost BTC in red; Satoshi’s Stash (~1.125 M) in black; Institutional Holdings (>3 M) in green. Data points span from 2009 through May 2025, showing how each component contributes to the total potential supply of 21 million bitcoins.

Saylor emphasizes that Bitcoin’s hard cap of 21 million coins creates an unprecedented scarcity dynamic. As the cumulative mined curve (blue) asymptotically approaches the 21 million ceiling (orange), fewer new coins enter circulation each halving cycle—driving a classic supply shock. Meanwhile, the estimated lost curve (red) further shrinks the effective pool of spendable BTC, as coins irretrievably vanish from wallets or cold storage. Add to this the roughly 1.125 million BTC in Satoshi’s stash (black), which have remained idle since the genesis block, and the accelerating institutional holdings curve (green), now surpassing 3 million BTC as of May 2025, and you see a tightening squeeze on available supply. According to Saylor, demand from corporates and asset managers—who view Bitcoin as a superior “digital gold”—will continue to climb, while the combined effect of the supply cap, lost coins, and long-term hodlers ensures that scarcity intensifies over time. That interplay of fixed supply and growing demand, he argues, makes Bitcoin’s price appreciation not just plausible but highly likely—a winning scenario built into its very protocol.

The Smartest Guy in the Room?

Saylor carries himself with the conviction of someone who believes he’s the smartest guy in the room – and often, he just might be. An MIT-trained aeronautics engineer, Saylor made a fortune in the 1990s dot-com boom with MicroStrategy’s software, and earned a reputation for audacity early on. (“Either MicroStrategy’s Michael Saylor is a visionary, or he’s a delusional egomaniac,” Forbes quipped as far back as 1998.) That same larger-than-life persona is on full display in his Bitcoin evangelism. He speaks in grandiose statements peppered with historical and scientific references, comparing himself to figures who brought radical change. In one interview, Saylor likened advocating Bitcoin to “carrying a torch of digital fire” into a wary society, recalling how people “recoiled in horror” the first time they saw fire or electricity. This theatrical style – equal parts preacher and tech CEO – has made Saylor both a hero to Bitcoin believers and a curiosity to the broader public.

In corporate America, Saylor’s bold pivot has turned heads. MicroStrategy was the first U.S. corporation to adopt Bitcoin as a primary treasury reserve back in 2020, shocking many Wall Street observers. Saylor didn’t stop there. He became an evangelist to his peers, hosting a “Bitcoin for Corporations” summit to share his playbook with hundreds of CEOs and CFOs. “Every company has to make one of two choices… self-destruct by decapitalizing, or recapitalize with an asset that appreciates faster than money printing. This is where Bitcoin comes in,” he preached to fellow executives in early 2021. He even personally urged Elon Musk to consider moving Tesla’s cash into Bitcoin – a suggestion that preceded Tesla’s own $1.5B Bitcoin buy. Saylor frames it in almost moral terms: adopt Bitcoin or consign your company to “financial serfdom” under the yoke of inflation. Such rhetoric was unprecedented in buttoned-down CFO circles.

Yet, Saylor’s influence has undeniably grown. As Bitcoin’s price surged in 2020–2021, his strategy gained vindication and attracted imitators. “Michael Saylor is playing chess while everyone else is playing checkers,” one observer noted, after MicroStrategy’s stock rocketed and other firms like Square and Tesla followed his lead. Institutional investors that once scoffed now take his calls; Saylor has spoken at mainstream investment conferences, essentially telling asset managers that their “bond portfolios are doomed” and to buy Bitcoin instead. And with the advent of Bitcoin ETFs and BlackRock’s endorsement of crypto by 2024, the narrative Saylor championed — that Bitcoin would become an accepted institutional asset — is starting to materialize. He is often on television or podcasts, calmly explaining Bitcoin’s intricacies while dropping one-liners like, “Bitcoin is hope for a world running on empty”. Love him or hate him, Saylor has forced corporate treasurers to at least entertain the question: should we own a slice of this digital gold? In that sense, he’s expanding the Overton window of what’s “acceptable” in corporate finance.

The $1,000,000 Bitcoin Bet – By the Numbers

No one has bet more on Bitcoin’s long-term ascent than Michael Saylor – both at a corporate level and personally. MicroStrategy has continued to gobble up bitcoins relentlessly, even issuing debt and equity to fund purchases. As of early 2025, MicroStrategy owns roughly 447,000 BTC in its treasury – by far the largest holding of any public company. Saylor himself disclosed that he personally holds 17,732 BTC (worth over $1.5 billion at recent prices). These staggering stockpiles raise an intriguing hypothetical: What if Bitcoin reaches $1,000,000 per coin? Saylor has never been shy about Bitcoin’s moonshot potential, and a seven-figure price is no longer a fringe scenario in his mind. Below is a glimpse of how such a milestone would translate into wealth:

At a million dollars per BTC, MicroStrategy’s hoard alone would be worth nearly half a trillion dollars – vaulting the company into the upper echelons of corporate wealth (for context, that’s more than the market cap of Amazon as of 2025). Saylor’s personal BTC would swell to around $18 billion, likely placing him among the world’s richest individuals. His roughly 10% stake in MicroStrategy would compound that fortune even further. In other words, if Saylor’s most optimistic visions come true, he could go from merely a tech millionaire to potentially one of history’s first trillionaires.

Figure 4 – MicroStrategy Share Price vs. Bitcoin Holdings Over Time

This dual-axis time series juxtaposes MicroStrategy’s stock price (blue line, left y-axis) with its growing Bitcoin treasury (red line, right y-axis) from August 2020 through May 2025. The x-axis shows major purchase dates, each corresponding to announcements of new BTC acquisitions. The parallel upward trends highlight how the company’s balance-sheet strategy—buying and holding Bitcoin—has influenced its market valuation. Notable inflection points occur when large BTC purchases coincide with share-price rallies, illustrating the strong correlation between MicroStrategy’s crypto position and investor sentiment.

Of course, these are paper projections – the kind that make even Bitcoin bulls raise an eyebrow. But Saylor genuinely operates with this long horizon in mind. He frequently models Bitcoin’s total addressable market in the tens or hundreds of trillions (absorbing value from gold, real estate, bonds, etc.), implying prices well into the millions per coin. It’s the sort of talk that sounds fanciful – until you recall that Bitcoin has already risen from under $10,000 to nearly $100,000 in just a few years. Saylor would argue that exponential math is on his side, and that given enough time (a decade or two), a $1 million Bitcoin is a rational endpoint as global adoption grows. By positioning MicroStrategy and himself now, he’s effectively front-running what he sees as the inevitable revaluation of all money. It’s a high-stakes gamble, but one Saylor has backed with every asset at his disposal.

Bridging the Gap – Winning Minds and Market Share

Despite Saylor’s conviction, not everyone is ready to drink the “Bitcoin Kool-Aid” just yet. Winning greater mindshare among corporate executives, institutional investors, and the general public remains an uphill battle. Saylor’s strategy so far has been relentless evangelism. He has become a one-man Bitcoin PR machine, giving countless interviews where he patiently (or sometimes impatiently) educates skeptics on inflation and crypto economics. He launched the Bitcoin Mining Council in 2021 alongside Elon Musk to address Environmental, Social, and Governance (ESG) concerns by promoting energy transparency and sustainability in mining. The Council publishes data showing the majority of Bitcoin mining is done with renewable or wasted energy, directly tackling the critique that Bitcoin is an environmental disaster. Saylor knows that to get Fortune 500 CEOs and pension fund managers on board, he must defang the ESG issue and portray Bitcoin mining as a driver of innovation in clean energy.

Another angle Saylor has pursued is providing clear accounting and legal frameworks for Bitcoin adoption. At his seminars, MicroStrategy shared detailed guidance on handling Bitcoin custody, accounting for it under GAAP rules, and navigating regulatory uncertainties. This nuts-and-bolts approach is meant to make conservative CFOs comfortable that adding Bitcoin to their balance sheet is not only safe but perhaps even their fiduciary duty in an inflationary environment. In Saylor’s words, “you either have to decapitalize… or recapitalize with an asset that’s going to appreciate faster than the rate of monetary expansion”. He’s effectively daring fellow executives to be as bold as he has – or risk being left behind. The narrative he is pushing to the mainstream is that Bitcoin is no longer a speculative gamble; it’s a strategic imperative for any institution that wants to preserve value over the long term.

To win over the general public, Saylor has been less focused on marketing glitz (he’s hardly a meme-lord or influencer type) and more on being a steadfast, rational spokesman for Bitcoin. He often underscores that he’s never sold a single satoshi, positioning himself as the ultimate long-term HODLer, in contrast to fickle traders. This consistency bolsters his credibility. He’s also started to weave cultural references into his talks – quoting from economics, history, and even sci-fi – to connect with a wider audience. For instance, he’ll reference the Roman Empire’s debasement of the denariusor use analogies from the movie The Matrix (implying Bitcoin is the “red pill” to see reality). Such framing helps non-technical people grasp the stakes: it’s not just about tech, it’s about civilization-level choices between prosperity and decline. Saylor’s challenge, however, is tone. To truly win hearts, he may need to soften the “you’re gonna kill us all”-style urgency and address people’s genuine fears about volatility and change. In short, Saylor might temper his image from Bitcoin’s fire-and-brimstone prophet to more of a patient teacher and visionary leader that everyday folks and cautious CEOs alike can trust.

Volatility, Risk and the Critics

No profile of Michael Saylor would be complete without acknowledging the counterarguments and critiques of his approach. The most obvious is Bitcoin’s notorious volatility. While Saylor touts Bitcoin as a stable long-term store of value, in the short term it behaves more like a rollercoaster. MicroStrategy’s stock has effectively become a wild Bitcoin proxy – soaring when BTC rallies and plunging when crypto markets swoon. In 2022, for example, Bitcoin lost over 50% of its value from peak to trough, which translated into multi-hundred-million-dollar paper losses for MicroStrategy. The company even took a hefty impairment charge and faced questions about potential margin calls on its Bitcoin-backed loans. Skeptics argue that tying a software firm’s fate to such a volatile asset is irresponsible and borders on reckless gambling with shareholder value. If Bitcoin were to crash 80%+ (as it has in past cycles), MicroStrategy could be left technically insolvent, or at best, severely financially crippled. Saylor’s rebuttal is that volatility is the price of outsized returns – “Bitcoin’s volatility is a function of its growth”, he might say. He frames downturns as mere noise over a long enough time horizon (he even bought more during dips). Still, not every board or shareholder base would be as tolerant of gut-wrenching swings, and this limits how many corporates will follow his lead until Bitcoin matures.

Concentration risk is another concern. Saylor has effectively put all his eggs in one basket. Both his personal wealth and his company’s balance sheet are now overwhelmingly exposed to a single asset class. Classic financial theory would deem this extremely unwise – the first rule of treasury management is diversification. Saylor flatly rejects this logic, famously quipping that diversifying into inferior assets is like mixing wood chips into iron to build a weaker bridge. That absolutism raises eyebrows. There’s also a philosophical discomfort in allowing one corporation (or one person) to amass such a large stash of the world’s first open-source money. MicroStrategy holding 2%+ of all bitcoins cuts both ways: it’s a bold show of conviction, but also a potential centralization red flag in a protocol designed to have no kings. If Saylor alone controlled that much oil or gold, regulators might fret; with Bitcoin, there’s not much they can do, yet it still makes some in the community uneasy that a publicly traded company could wield outsized influence (for instance, what if one day MicroStrategy voted its coins in protocol governance, or suddenly sold en masse?). Saylor insists their holdings are for the long term, but the what-ifs persist.

Then there’s the perennial ESG (environmental, social, governance) critique. Bitcoin mining’s energy consumption has attracted heavy criticism, and by extension, so has Saylor’s evangelism of it. Environmentalists question how an executive can justify pouring billions into an asset that uses as much electricity as a medium-sized country. Saylor’s response has been proactive: he co-founded the Bitcoin Mining Council to “promote energy usage transparency and accelerate sustainability initiatives worldwide”. He frequently highlights that Bitcoin mining is rapidly adopting renewable energy and “stranded” energy that would otherwise be wasted. He even argues Bitcoin is a net positive for the environment in the long run, by incentivizing investment in green energy infrastructure and stabilizing fragile power grids. Nonetheless, the ESG issue is far from settled in the public mind. Many institutional investors still have mandates that prevent them from embracing something perceived as environmentally harmful, and this represents a headwind to the kind of widespread adoption Saylor envisions.

Finally, critics point out that Saylor’s track record isn’t spotless. Lest we forget, during the dot-com bust in 2000, MicroStrategy’s stock collapsed and Saylor himself faced an accounting controversy that led to restating financials. His personal net worth imploded by hundreds of millions in a matter of weeks. That history leads some to view him as a risk-taker who’s gotten ahead of himself before. Could Bitcoin be another example of overreach? they ask. Saylor’s reply is that the two situations are entirely different – back then he was an aggressive young CEO in an overhyped market, whereas now he sees a once-in-a-millennium opportunity to fix the monetary foundation of the world. But the critique stands: overexposure to any one bet can ruin even the brightest minds. If Bitcoin were somehow usurped by a superior technology (or crushed by unforeseen regulation, quantum hacking, etc.), Saylor would go down in history as a cautionary tale – the Icarus who flew too close to the sun of digital gold. He acknowledges this only to the extent of joking that in his next life, there’s no going back to mere bits and bytes: “In my next job, I intend to focus more on Bitcoin,” he tweeted wryly when he gave up MicroStrategy’s CEO role to focus solely on BTC strategy. In other words, he’s all-in – critics be damned.

Visionary Ahead of His Time?

Is Michael Saylor a visionary genius? The verdict is still out – and it likely hinges on Bitcoin’s fate in the coming decade. What’s clear is that Saylor has planted himself far ahead of the current paradigm. In an era when most CFOs still allocate maybe 1-5% to Bitcoin (if any at all), Saylor bet hundreds of percent (leveraging MicroStrategy’s entire company value to buy even more BTC). This puts him outside the Overton window of acceptable corporate behavior, at least for now. But many great visionaries were initially outside the mainstream consensus. It’s not hard to draw parallels between Saylor and other historical figures who were ridiculed for extreme beliefs that later proved prescient – from Galileo bucking geocentric dogma, to Steve Jobs insisting in the 1980s that the GUI would revolutionize computing. Saylor’s almost messianic zeal for Bitcoin could, in hindsight, look like clear-eyed foresight if indeed Bitcoin becomes the backbone of 21st-century finance. He himself often notes that “Bitcoin adoption is still early – we’re at $1 trillion in a $900 trillion ocean of capital.” In his mind, being early is a feature, not a bug.

He might be ahead of the societal consensus by 5-10 years. Consider that governments and mega-banks that scorned Bitcoin a few years ago are now cautiously embracing it – adopting regulatory frameworks, launching ETFs, holding mining stocks, even mining Bitcoin themselves (as seen by some nation-states). The Overton window is shifting in Saylor’s direction. Each year that Bitcoin doesn’t die but instead integrates further into the global economy, Saylor’s position moves from fringe toward foresight. If Bitcoin hits that $1M mark or anything close, Saylor will almost certainly be hailed as a visionary who was laughably far-sighted. The man who once lost a fortune in the dot-com crash would have orchestrated one of the greatest second acts in corporate history – turning a sleepy analytics firm into a monetary powerhouse and rebranding himself from tech has-been to monetary innovator. There’s even a poetic twist: Saylor often invokes thermodynamics and entropy, yet he’s arguably fighting a very human battle against the entropy of legacy thinking. He’s trying to drag entrenched institutions (and even governments) toward a new monetary standard before, as he sees it, their old systems implode. Visionary or not, he is undeniably forcing a conversation that most weren’t ready to have.

How far ahead is Saylor? Perhaps only time will tell. If in the 2030s we live in a world where, say, central banks hold Bitcoin in their reserves, multinational corporations routinely carry crypto on their balance sheets, and inflation is measured against a Bitcoin standard – that will be the world Saylor already inhabits today in his mind. He will be remembered as someone who saw the future of money with unusual clarity and had the courage to act on it to an extreme degree. If instead Bitcoin stagnates or is supplanted, Saylor might be remembered as an overzealous apostle of a monetary religion that failed to convert the masses. In either case, his story is remarkable. As of now, mid-2020s, Saylor stands as a singular figure at the intersection of technology, finance, and philosophy – a man shouting from the rooftops that the old money is dying and a new money has been born, while much of the world still goes about their business oblivious to the fire he’s carrying.

Conclusion

Michael Saylor’s Bitcoin opus reads like an op-ed from the future penned in the present. He has staked his reputation, his company, and his fortune on the proposition that Bitcoin is the ultimate treasury reserve asset and the key to prosperity in a digital age. Along the way, he’s articulated a narrative of money as energy and Bitcoin as a world-altering invention with an almost poetic fervor. He may come off to some as too fervent – the Bitcoin zealot who sees everything through orange-tinted glasses. But even Saylor’s detractors must concede that he has added intellectual heft to the pro-Bitcoin camp. By invoking entropy, engineering, history, and macroeconomics in plain language, he’s made a complex topic accessible and compelling to a broad audience. In doing so, he has arguably accelerated institutional adoption and lent Bitcoin an aura of legitimacy it lacked when only Redditors and cypherpunks sang its praises.

Will Saylor be vindicated as the visionary who was proven right, just a bit early? Or will he end up as a cautionary tale of hubris, joining the ranks of executives who “bet the farm” and lost? The final chapters are yet to be written. What’s certain is that Saylor has already secured a place in the story of Bitcoin’s evolution. He is its corporate champion and philosopher-in-chief, unabashedly calling it “the apex property of the human race” and pouring every resource under his control into that thesis. Such boldness is rare. It invites admiration, envy, and criticism in equal measure. But as Saylor himself might remind us, “Fortune favors the bold.” In a world of fiat serfdom, he chose to be a monetary rebel with a cause. And if the grand experiment he’s leading succeeds, Michael Saylor won’t just be the smartest guy in the room – he’ll be the one who helped open everyone else’s eyes.

Erasmus Cromwell-Smith

May 2025.

Sources:

Interviews, Talks, and Direct Quotes from Michael Saylor

Bitcoin Magazine Interview:

“The bottom line here is that fiat money always has a monetary entropy above zero and Bitcoin always has a monetary entropy of zero…”

Bitcoin Magazine, (Michael Saylor, 2021).

https://bitcoinmagazine.com/articles/michael-saylor-fiat-money-has-monetary-entropy-bitcoin-does-notLex Fridman Podcast with Michael Saylor:

Detailed exploration of Bitcoin as digital energy, monetary entropy, and macroeconomic positioning. (Lex Fridman Podcast #276, 2022)

https://lexfridman.com/michael-saylor-2/"Bitcoin as the Apex Property" (Michael Saylor Keynote at MicroStrategy Conference):

Discussion of Bitcoin’s long-term value preservation properties. (MicroStrategy’s Bitcoin for Corporations, 2021)

https://www.microstrategy.com/en/bitcoinCNBC Squawk Box Interview:

“Bitcoin is the apex property of the human race.” Saylor’s perspective on Bitcoin vs fiat. (CNBC, 2021)

https://www.cnbc.com/michael-saylor

Corporate Reports and Financial Data

MicroStrategy Investor Relations (May 2025 Report):

Updated Bitcoin holdings (553,555 BTC, valued ~$53 billion).

https://www.microstrategy.com/en/investor-relationsSEC Filings (MicroStrategy Inc.):

Regular filings containing details of Bitcoin acquisitions and accounting treatment.

https://www.sec.gov/edgar/browse/?CIK=1050446

Market Data and Bitcoin Adoption Metrics

Glassnode Insights (May 2025):

Data on Bitcoin mined, lost coins, institutional holdings, and wallet growth. https://insights.glassnode.com/

Statista (Bitcoin Adoption Statistics, 2025):

Global Bitcoin adoption rates and projected growth of user base.

https://www.statista.com/topics/2308/bitcoin/

Energy and ESG Arguments

Bitcoin Mining Council Reports (2025):

Analysis and updates regarding Bitcoin energy consumption and sustainability initiatives. https://bitcoinminingcouncil.com/

Critiques and Counterarguments

Forbes & Bloomberg (Financial Analysts' Perspectives):

Critical takes on MicroStrategy’s aggressive Bitcoin treasury strategy, volatility risks, and regulatory challenges.

https://www.forbes.com/microstrategy-bitcoin

https://www.bloomberg.com/microstrategy-bitcoin-riskFT Opinion - "The Risk of Betting Corporate Treasury on Bitcoin" (Financial Times, 2024):

Analysis of risks associated with corporate Bitcoin holdings.

https://www.ft.com/content/bitcoin-corporate-risk

Historical and Economic Context

"The Bitcoin Standard," Saifedean Ammous (2018):

Classic book widely cited by Saylor, providing historical context of fiat, gold, and Bitcoin monetary theory.

https://saifedean.com/thebitcoinstandard/"The Fiat Standard," Saifedean Ammous (2021):

In-depth critique of fiat monetary systems cited frequently by Saylor.

https://saifedean.com/thefiatstandard/

Visualization & Data Modeling Sources

CoinMetrics.io (Bitcoin Supply & Distribution Data, 2025):

Detailed data sources for modeling Bitcoin supply curves, lost coins, and institutional adoption.

https://coinmetrics.io/data-downloads/