By Erasmus Cromwell-Smith

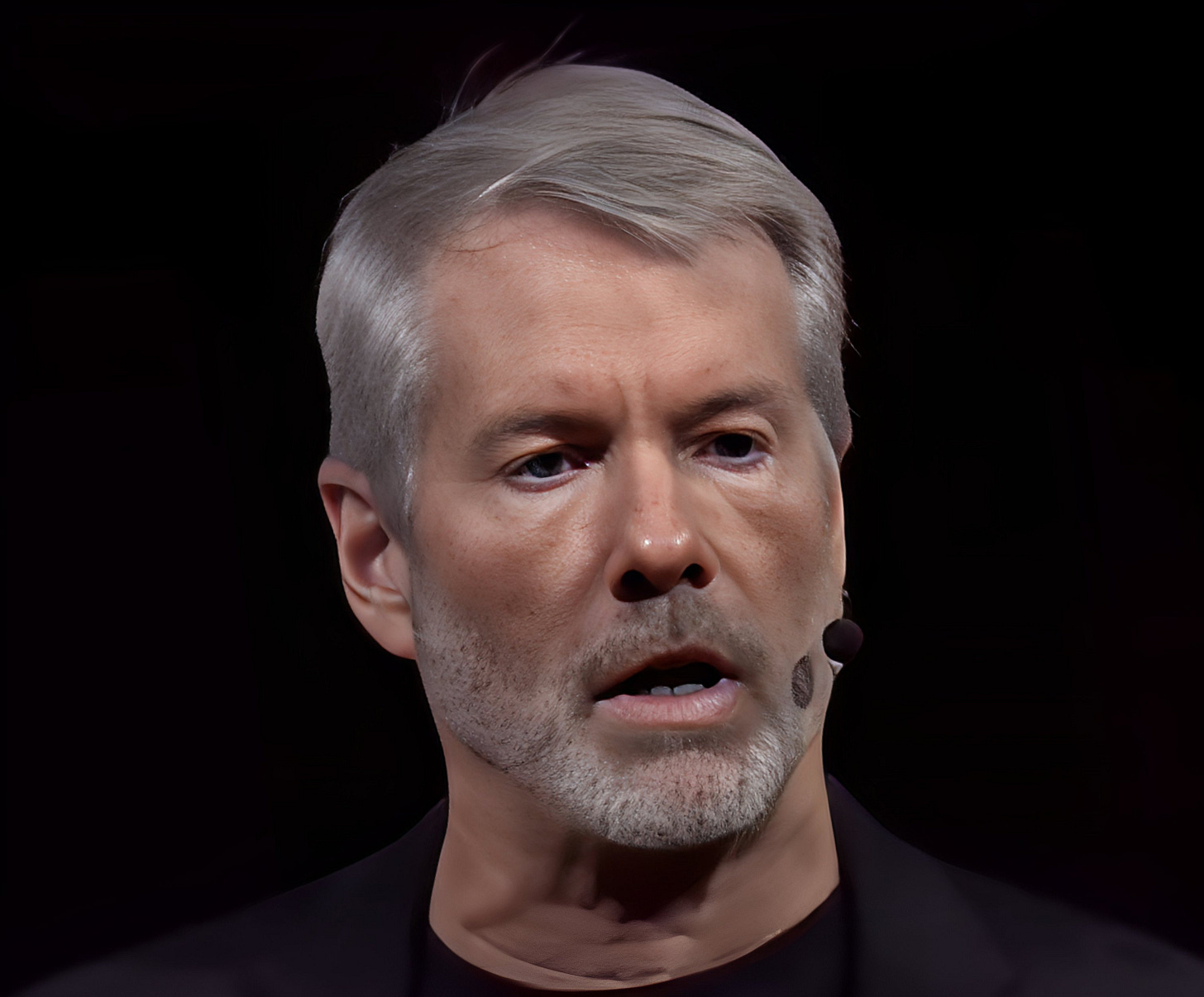

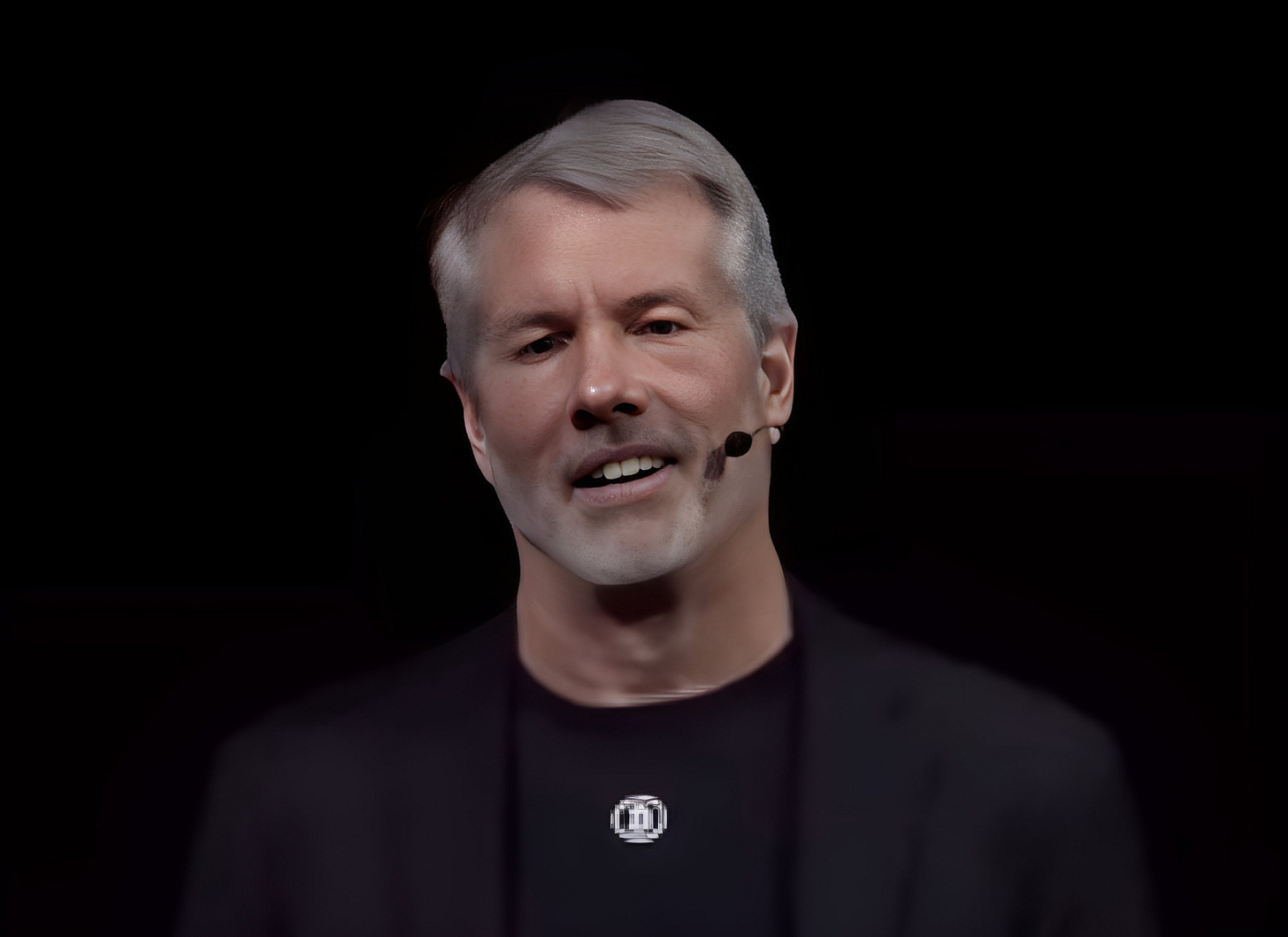

Las Vegas, NV – May 31, 2025: In the final hours of the Bitcoin 2025 conference in Las Vegas, Michael Saylor delivered a keynote titled “The 21 Steps to Wealth.” The venue was packed with Bitcoin enthusiasts, eager to hear from the MicroStrategy (“Strategy”) co-founder turned Bitcoin evangelist who has attained near-legendary status in the community (his company famously converted its treasury into Bitcoin, holding roughly 3% of the total bitcoin supply). But unlike Saylor’s typical addresses aimed at institutional investors or corporate treasuries, this presentation struck a more personal chord. “This speech is for you. I’ve traveled the world and told countries, institutional investors, and even the disembodied spirits of our children’s children why they need Bitcoin. This is for every individual, every family, every small business. It’s for everybody,” Saylor announced, dedicating his message to everyday Bitcoiners in gratitude for their resilience and unwavering belief.

Delivering his keynote address, “21 Steps to Wealth,” at Bitcoin 2025 in Las Vegas, Michael Saylor waxed poetic about Bitcoin’s potential for prosperity. The tone of Saylor’s talk was notably didactic and philosophical, resembling a manifesto more than a corporate strategy brief. “Satoshi started a fire in cyberspace, and while the fearful run from it and fools dance around it, the faithful feed the flame, dreaming of a better world, and bathe in the warm glow of cyberlight,” Saylor proclaimed, setting an almost spiritual stage for his message. This vivid metaphor captured the essence of his narrative: Bitcoin is a transformative force – a blazing “fire” of innovation – and those who truly understand it will feed that fire (by accumulating Bitcoin) rather than fear or trivialize it. To show exactly how to “feed the flame” and achieve prosperity, Saylor laid out 21 guiding principles – a number chosen as a deliberate nod to Bitcoin’s 21 million coin supply cap.

Each principle blends financial advice with philosophical insight, forming a cohesive blueprint for leveraging Bitcoin’s potential to build generational wealth. Below, we unpack each of Saylor’s 21 steps to wealth, interpreting their meaning and the logic behind them in plain language, alongside Saylor’s own words from the speech.

The 21 Steps to Bitcoin Wealth

Clarity: Saylor begins with the importance of vision. “The first way to wealth is clarity,” he explains – a moment of enlightenment when one realizes that Bitcoin is not just an investment, but capital in its purest form. In Saylor’s words, Bitcoin is “perfected capital, programmable capital, incorruptible capital”. In other words, it is money perfected: a form of wealth that cannot be debased or controlled by any government. Achieving clarity means seeing Bitcoin’s true nature as pristine, unstoppable money, which every thoughtful person (and even every AI, Saylor quips) will eventually recognize as the superior place to store value. This first step sets the foundation – it’s about seeing Bitcoin for what it really is and why it matters.

Conviction: The second step is unwavering belief in Bitcoin’s long-term ascent. Saylor asserts that Bitcoin will outperform every other asset class over time because it’s been “engineered for performance”. “It’s going to grow faster than real estate or collectibles. It is the most efficient store of value in human history,” he says. Embracing conviction means trusting the math and code of Bitcoin’s design – its scarcity, security, and network effects – and having the faith to hold on through volatility. This step’s logic is financial: if Bitcoin’s value appreciates faster than everything else by design, then strong conviction (i.e. not second-guessing or wavering) is required to capture that exponential growth. Essentially, Saylor is telling the audience that true wealth favors those who truly believe in Bitcoin’s engineered superiority and stick with it for the long run.

Courage: Buying Bitcoin early – before it’s universally understood – takes guts. Thus, Saylor’s third step is courage, because “if you’re going to get rich on Bitcoin, you need courage” . “Wealth favors those who embrace intelligent monetary risk,” he explains . In practice, this means having the boldness to take action on your conviction: sell off weaker investments and go big on Bitcoin. Saylor vividly urged listeners to “sell your bonds, buy Bitcoin” – even to trade away “inferior equity” and “inferior real estate” in exchange for BTC . Feeding the fire requires brave decisions; “the bold will feed the fire—sell your bonds, buy Bitcoin. An extraordinary explosion of value is coming,” he promises . The philosophy here is that taking calculated risks (not reckless gambles, but intelligent risk) is necessary to achieve extraordinary gains. Those lacking courage will be left behind, while the courageous will position themselves to reap Bitcoin’s potential rewards.

Cooperation: No one builds generational wealth alone. The fourth step, cooperation, emphasizes the power of aligning with your family or close community. “You are more powerful if you have the full support of your family,” Saylor says . He points out that your children represent “time and potential” – they have the future ahead of them – so educating them and including them in your Bitcoin strategy multiplies your long-term impact. “Families that move in unity are unstoppable,” he affirms. The logic here is both philosophical and practical: wealth is more than an individual pursuit; it’s a legacy. By getting your spouse, kids, or relatives on board with the Bitcoin vision, you create a united front that can pool resources, share knowledge, and persevere across generations. Saylor’s overarching narrative for this step is that Bitcoin wealth should be a family mission, not a solitary hobby.

Capability: Step five is a modern twist – Saylor urges everyone to “master AI” and other emerging technologies. In 2025, everything you can imagine is at your fingertips – wisdom, analysis, creativity,” he notes, “Ask AI, argue with it, use it. You can become a super genius” . Here, capability means continuously upgrading your skills and tools so you can navigate the fast-changing landscape.

Saylor’s advice is to put aside ego and “put your interests first”, leveraging artificial intelligence as a force-multiplier for your own intelligence. The underlying logic is that building Bitcoin wealth isn’t just about buying and holding coins – it’s also about investing in yourself. By harnessing AI for research, decision support, and efficiency, individuals can make smarter choices and identify opportunities that others might miss. In short, use every tool at your disposal (especially today’s powerful AI tools) to enhance your financial strategy – your future self and family will thank you.

Composition: The sixth step shifts to how you structure your affairs. Composition refers to constructing robust legal and financial entities around your Bitcoin strategy. Saylor suggests thinking like the rich do: “construct legal entities that scale your strategy and protect your assets,” essentially operate “like the most sophisticated millionaire family office” . In plain terms, this means setting up things like corporations, trusts, or LLCs, as needed, to shield your Bitcoin holdings, optimize for taxes, and enable growth. He even advises to “ask the AI and figure it out” – use technology and expertise to plan your structures smartly . The philosophy behind this is work smart, not just hard. Wealth isn’t only about what you buy; it’s also about how you hold and manage it. By getting the composition right – having the right accounts, entities, insurance, and protections – you scale safely and efficiently. Saylor frames this as a step anyone can do now that information and advice (even from AI) is accessible: you can operate as intelligently as a millionaire investor if you take the time to set things up properly.

Citizenship: Wealth can be amplified or eroded by where you live and which laws you live under. Thus, Saylor’s seventh principle is to choose your economic jurisdiction wisely. “Domicile where sovereignty respects your freedom,” he advises . In other words, pick a country or state that will honor property rights, low taxes, and personal liberty – especially regarding Bitcoin. “This isn’t just about this year – it’s about this century,” Saylor adds , underscoring that the decision of where you plant your flag will have multi-decade consequences for your wealth. The logic here is straightforward: different jurisdictions treat Bitcoin (and wealth generally) very differently. A friendly environment (with clear rules, reasonable taxes, and supportive regulations) can nurture your wealth, whereas a hostile one could confiscate, over-tax, or restrict it. Saylor is urging Bitcoiners to be intentional about citizenship or residency: align yourself with a nation or community that aligns with Bitcoin’s ethos of freedom. In essence, don’t let a bad jurisdiction undo your good decisions – seek a place that lets the Bitcoin fire burn brightly.

Civility: Eighth, Saylor counsels civility – a perhaps surprising ingredient in a wealth blueprint, but a crucial one. “Respect the natural power structures of the world. Respect the force of nature,” he explains. In the quest to promote Bitcoin, he warns “don’t fight unnecessarily. Find common ground”. This speaks to maintaining diplomacy and respect when interacting with governments, institutions, and society at large. The financial logic is that pointless fights (legal battles, antagonistic behavior) can derail your objectives. Instead, work within the system when you can, and pick your battles wisely. Saylor identifies “inflation and distraction” as the true enemies – meaning the devaluation of currency and the noise that pulls one off course, not other people per se. The philosophical angle is almost stoic: focus your energy on combating the real threats to wealth (like inflation), and don’t squander energy making enemies or indulging in drama. By staying civil and constructive, Bitcoin proponents can gradually influence “natural power structures” to be more favorable, all while keeping their own wealth-building on track.

Corporation: The ninth step is about scale. “A well-structured corporation is the most powerful wealth engine on Earth,” Saylor declares . While families and partnerships are great, corporations can “scale globally”. Here he challenges the audience: What is your vehicle? What is your path? In essence, Saylor is suggesting using corporate structures to massively amplify wealth creation. For example, instead of just investing individually, one might start a company that leverages Bitcoin or provides Bitcoin-related services, thereby attracting capital and growing far larger than any singleperson could. The logic is both financial and practical: corporations have access to equity markets, can take on more capital, have legal protections, and can outlive their founders. Saylor himself, through MicroStrategy, illustrated this – using a corporation to hold Bitcoin and even issue stock and bonds to buy more Bitcoin. The overarching narrative is that scale matters if you want to change your financial destiny. By choosing the right corporate vehicle and structure, you can ride the Bitcoin wave on a much bigger surfboard, so to speak, reaching levels of wealth that would be impossible alone.

Focus: The tenth principle is a reminder not to get distracted. “Just because you can do a thing doesn’t mean you should,” Saylor cautions. In the world of endless investment options and shiny new projects, he advocates discipline and concentration. If you believe Bitcoin is the most reliable path to long-term wealth, you shouldn’t dilute that effort with a dozen other speculative bets. “If you invest in Bitcoin, there’s a 90% chance it will succeed over five years,” Saylor says (projecting confidence in Bitcoin’s timeframe). “Don’t confuse ambition with accomplishment. Come up with a strategy — and stick to it”. The logic here is that many people fail to grow wealth because they constantly zig-zag – today chasing crypto tokens, tomorrow real estate, next day a startup idea – and end up master of none. Saylor’s emphasis on focus is about committing to a well-founded plan (in this case, a Bitcoin-centric strategy) and not letting FOMO or overconfidence lead you astray. Ambition is good, but consistent execution of a sound plan is better. In short, find your north star (if Saylor has his way, that north star is Bitcoin) and avoid the siren song of endless opportunities that could cause you tolose sight of your goal.

Equity: Step eleven highlights raising investment from others – sharing the journey. “Share your opportunities with investors who will share your risk,” Saylor advises . He even points to his own company’s story: MicroStrategy (“Strategy”) grew from a $1 Billion valuation to over $100 billion largely by aligning with new equity partners who believed in its Bitcoin strategy . In a personal wealth context, this could mean finding business partners, co-investors, or even supportive shareholders if you run a venture – people who believe in Bitcoin and will back your plays. The idea is to use equity capital to amplify your firepower. Philosophically, this step is about networked wealth: if you have a great Bitcoin-based idea or investment strategy, letting others buy into it not only provides you funds to grow faster, but also creates a coalition of the willing. These partners share in the upside and shoulder some risk with you. Saylor’s message is that you don’t have to do it all with your own money – smart investors will join you if you communicate your vision (a callback to focus and communication) and if they trust your plan. By leveraging equity, you turn your personal crusade into a collective one, vastly increasing the resources available to achieve wealth.

Credit: In addition to equity, Saylor suggests using debt strategically – the twelfth step is about credit. There is a world full of capital looking for safe returns, he notes, and “there are people in the world who are afraid of the future – they want small yield, certainty. Offer that.” In other words, you can borrow money from those who prefer stability, giving them a fixed modest return (certainty) while you deploy their capital into higher-yield ventures like Bitcoin. “Give creditors security in return for capital,” Saylor says, “Convert their fear into fuel and turn risk into yield by investing in Bitcoin.” The logic is classic financial engineering: if you truly believe Bitcoin will outgain the interest rate on a loan, then borrowing at a low rate to buy Bitcoin can dramatically amplify your wealth (this is essentially what Saylor’s company did by issuing bonds to buy BTC). However, he couches it in almost altruistic terms – you are helping risk-averse folks by giving them a safe yield, while you take on the risk (and potential high reward) of Bitcoin. Philosophically, it’s a win-win: the fearful get safety, the bold get capital to chase big gains. Of course, this requires great care – debt can ruin you if misused – but Saylor’s broader point is that judicious use of credit can be rocket fuel for wealth if you are confident in Bitcoin’s trajectory.

Compliance: Step thirteen is a grounded, practical reminder: play by the rules. “Create the best company you can within the rules of your market. Learn the rules of the road,” Saylor says. “If you know them, you can drive faster. You can scale legally and sustainably.” Here, compliance means adhering to laws, regulations, and ethical guidelines in whatever domain you operate. The narrative behind this is that law is not the enemy of wealth – in fact, if you understand the legal framework, you can actually move faster and with confidence. Rather than viewing regulations as mere obstacles, Saylor implies they can be navigational tools: once you know what’s allowed and where the boundaries are,you can innovate and push growth without fear of stepping on a landmine. For Bitcoiners, this could include complying with tax laws, securities laws, or any relevant regulations for your Bitcoin business. The philosophical angle is sustainability: only wealth built on a legitimate, sturdy foundation will last. Trying to skirting laws or operate in gray areas might provide a short-term edge but can backfire spectacularly. Saylor is essentially saying be a model citizen in your domain – it will pay off in the long run by allowing your wealth to compound unimpeded by legal troubles.

Capitalization: The fourteenth step is all about speed of money. By capitalization, Saylor refers to raising and deploying capital quickly and relentlessly. “Velocity compounds wealth,” he points out. “Raise and reinvest capital as fast and as often as you can. The faster your money moves into productive Bitcoin strategies, the more it multiplies.” This principle borrows from the idea of compounding interest but applies it more broadly: money that sits idle or underutilized is wealth lost, whereas money that’s continually put to work (especially in something accelerating like Bitcoin) will grow exponentially. The financial logic is clear – time in the market beats timing the market, and accelerating your deployments means you capture more of Bitcoin’s upward curve. It’s also a call to be proactive: if you can raise more capital (through equity, credit, or reinvesting profits), do it sooner rather than later. Philosophically, this echoes an urgency: Saylor’s sense that Bitcoin is the opportunity of our lifetime, and every day that capital isn’t in BTC is a day of potential compounding missed. Essentially, he’s urging listeners not to dawdle; treat your capital like a high-performance engine – keep it running hot, continuously fueling the Bitcoin wealth machine.

Communication: Even the best ideas need to be understood to garner support. Thus, the fifteenth step is to “speak with candor, act with transparency, and repeat your message often,” as Saylor urges . In building Bitcoin wealth – especially if you’re involving others (family, investors, creditors) – communication is key. Saylor notes, “Creating wealth with Bitcoin is simple – but only if people understand what you’re doing and why you’re doing it.” This underscores that to get buy-in (whether from a spouse about a tight budget while you stack sats, or from investors in a Bitcoin venture), you must clearly articulate your plan and the Bitcoin thesis. The logic is partly persuasive and partly accountability-driven: by being transparent and vocal, you solidify your own understanding and invite constructive input or partnership. Additionally, effective communication builds trust – and trust attracts capital and cooperation. Philosophically, this step highlights that Bitcoin’s story – as revolutionary as it is – still needs storytellers. Saylor himself exemplifies this, constantly broadcasting the merits of Bitcoin. He’s encouraging others to do the same: make sure the people around you grasp your vision, so that you’re rowing in the same direction or at least not facing resistance born of confusion.

Commitment: Hand-in-hand with focus and communication comes sheer persistence. Step sixteen is a call to stay the course. “Don’t allow yourself to be distracted,” Saylor says. “Don’t chase your own ideas. Don’t feed the trolls. Stay committed to Bitcoin. It’s the greatest idea in the world.” Here Saylor is almost pleading with the audience to maintain their dedication even when faced with criticism or the temptation to pivot. “The world probably doesn’t care what you think – but it will care when you win,” he adds wryly . The meaning is that you shouldn’t waste time trying to debate every naysayer or prove yourself to skeptics now; instead, prove it by succeeding. Commitment in this context means a long-term horizon and thick skin. The financial logic is that Bitcoin’s growth and adoption may take time and will have volatility; only those who stay committed through the cycles will reap the full rewards. The philosophical side is about belief in a cause – treating Bitcoin not just as a trade, but as “the greatest idea in the world,” something worthy of unwavering focus. Saylor is essentially saying: tune out the noise, don’t get shaken out or bored, and don’t let short-term diversions (or online trolls) steal your attention. Endurance is a virtue – and those who stick with Bitcoin until it “wins” will, by extension, be winners themselves.

Competence: Saylor’s seventeenth step is a reminder that you must execute well. It’s not enough to believe in Bitcoin; you also need to be good at whatever your role in this ecosystem is. “You’re not competing with noise – you’re competing with someone who is laser-focused, who executes flawlessly,” he says . “You must deliver consistent, precise, and reliable performance. That’s how you win.” In other words, whether you’re a Bitcoin investor, an entrepreneur, a miner, or even an educator, you need to hone your craft. The financial world is competitive, and Bitcoin’s rise, while lifting all boats to some extent, will reward those who are excellent at what they do. The logic is straightforward: outperformance – to really capitalize on the Bitcoin revolution, bring your A-game. If you’reaccumulating, do it steadily and smartly; if you’re running a Bitcoin business, operate it with topnotch professionalism; if you’re coding or creating content, strive for mastery. Philosophically, this step touches on personal integrity and pride in workmanship. Saylor implies that Bitcoiners should embody competence – dispelling the stereotype that crypto is just luck or speculation. Success in building wealth (Bitcoin or otherwise) is rarely an accident; it’s earned by being better, more informed, and more disciplined than the competition. So, refine your skills, learn constantly, and execute your strategy with precision.

Adaptation: The eighteenth principle is about staying agile and open to change. “Circumstances change. Every structure you trust today will eventually fail,” Saylor warns, invoking a long-term perspective . “A wise person is prepared to abandon their baggage and adjust plans when needed. Rigidity is ruin.” This step acknowledges that even as one commits and focuses, one must not become blind to reality. The world can shift – economies, technologies, and even Bitcoin’s ecosystem could evolve in unexpected ways. The wealth builders who survive and thrive are those who canpivot when necessary. The logic here is strategic flexibility: have a plan (yes), but don’t marry the form of the plan if conditions fundamentally change. For example, if a particular exchange, product, or jurisdiction becomes dangerous or obsolete, adapt – don’t stubbornly go down with the ship. Philosophically, Saylor’s line “rigidity is ruin” could apply to many things, from outdated business models to ideological stubbornness. He champions a kind of anti-dogmatism – keep your eyes open and be ready to jettison assumptions or methods that no longer work. In the context of Bitcoin, one might interpret this as being ready to adopt new best practices, security approaches, or even to accept new developments (like layers or forks) if they prove useful. The key is to ensure nothing can knock you out of the game; if the environment shifts, you shift intelligently with it, all while keeping your ultimate goals in sight.

Evolution: Closely related to adaptation is the idea of continuous evolution – Saylor’s nineteenth step. “Build on your core strengths. You don’t need to start over – you need to level up,” he says. “Leverage what you already do best, and expand it through Bitcoin and advanced technologies.” This is both a personal and business insight: rather than reinventing yourself completely for the Bitcoin era, integrate Bitcoin into what you’re already great at. For instance, if you’re a talented software developer, see how Bitcoin or Lightning can factor into your projects; if you’re a savvy investor in real estate, consider how Bitcoin’s principles (or capital from Bitcoin gains) might augment your real estate strategy. The point is to level up your existing strengths with the new superpowers that Bitcoin and tech provide. The logic is that evolution beats revolution when it comes to personal growth – you have experience and skills, so use Bitcoin to amplify them rather than discard them. Philosophically, it’s an encouraging message: you don’t have to be someone else to succeed in the Bitcoin world; you just have to take what you’re good at and evolve it to the next stage. This step ties back into adaptation and capability: keep learning and improving, but do it in a way that builds on your identity. Saylor frames Bitcoin as a tool to supercharge your life’s work, not necessarily to change your entire life’s work.

Advocacy: The twentieth step returns to the community and societal aspect of Bitcoin. Saylor urges Bitcoiners to spread the word. “Inspire others to walk the Bitcoin path,” he says . “Become an evangelist for economic freedom. Show others what this revolution really means. Show them the way.” This is a call to advocacy – not just quietly stacking sats and minding one’s business, but actively helping others understand and join the Bitcoin network. The logic behind this is partly altruistic and partly network-effect-driven. Bitcoin’s value and resilience grow as more people adopt it; by evangelizing, you’re not only doing others a favor (introducing them to a potentially life-changing technology), you’re also strengthening the network that underpins your own wealth. Philosophically, Saylor frames Bitcoin as more than an investment – it’s a movement for economic freedom. To him, spreading Bitcoin is almost a moral duty to help free people from inflation and oppression. He’s encouraging the audience to be proud proponents of this “revolution,” teaching and leading by example. On a practical level, advocacy also normalizes Bitcoin, influencing public opinion and policy in ways that could safeguard its future. So, this step is about looking beyond yourself: once you’ve found the “way,” help others see it too. In doing so, you contribute to a world where Bitcoin (and by extension your wealth) is safer and more widely embraced.

Generosity: Last but certainly not least, Saylor caps his 21 steps with a humanistic flourish: generosity. “When you’re successful – and you will be successful – spread happiness. Share security. Deliver hope,” he urges . The imagery he uses is of an inner light: “That light inside you will shine. And others will be drawn to it.” After achieving wealth, Saylor believes, the true fulfillment comes from giving back – whether that’s helping those less fortunate, reinvesting in the community, or otherwise using one’s success to improve the world. The logic here is that wealth is not an end in itself; its highest purpose is to empower goodness and positive change. By being generous, Bitcoiners can dispel the notion that this is a selfish gold rush and instead prove it’s a movement to lift up humanity. This step also circles back to the gratitude Saylor showed at the start of his speech – it’s a thank-you to those who “found the path first” and a reminder to “spread good karma” once you’ve reaped the rewards . Philosophically, it resonates with the idea that money is energy – and onceyou have plenty, you should direct that energy towards uplifting others. In practical terms, generosity can mean donating to Bitcoin development, funding education initiatives, supporting family and community, or any form of sharing one’s prosperity. Saylor’s final message is that the journey to wealth via Bitcoin doesn’t culminate in hoarding; it culminates in making a difference. By lighting others’ torches, the original flame only burns brighter.

21 Million Reasons: Symbolism and Saylor’s Grand Vision It’s no coincidence that Saylor chose 21 steps – the number mirrors Bitcoin’s capped supply of 21 million coins, symbolizing the scarcity at the heart of Bitcoin’s value proposition . Just as Bitcoin’s hard limit of 21 million endows it with unparalleled digital scarcity, Saylor’s 21 principles underscore the multifaceted approach required to harness that scarce asset. In his worldview, Bitcoin is not just another investment; it is “pure economic energy”, an asset with immutable, indestructible qualities akin to a law of nature. Saylor often equates Bitcoin to energy itself – a digital energy network that stores and transfers value with unprecedented efficiency. This energy metaphor isn’t just poetic flair: it reflects his belief that Bitcoin can absorb and carry economic value across time and space like no asset before. In fact, Saylor’s conviction is so immense that he mused Bitcoin could eventually be worth “half of everything.”

He suggested that Bitcoin might one day represent half of the world’s wealth – an astonishing claim that underscores how completely he envisions Bitcoin transforming finance. The rationale behind such a bold prediction is the idea that much of the world’s wealth is currently trapped in inferior stores of value (debased currencies, negative-yield bonds, overvalued real estate) – all of which Bitcoin could digitize and supplant as the primary treasury asset for both individuals and institutions. In Saylor’s eyes, Bitcoin is the ultimate long-term play, “the foundation of generational wealth, the engine of personal and institutional freedom”. Each of the 21 steps he presented ties back into this grand vision: by adopting Bitcoin and aligning one’s behavior with these principles, one is effectively plugging into this new form of economic energy and helping usher in a future where prosperity is widely shared on a Bitcoin standard.

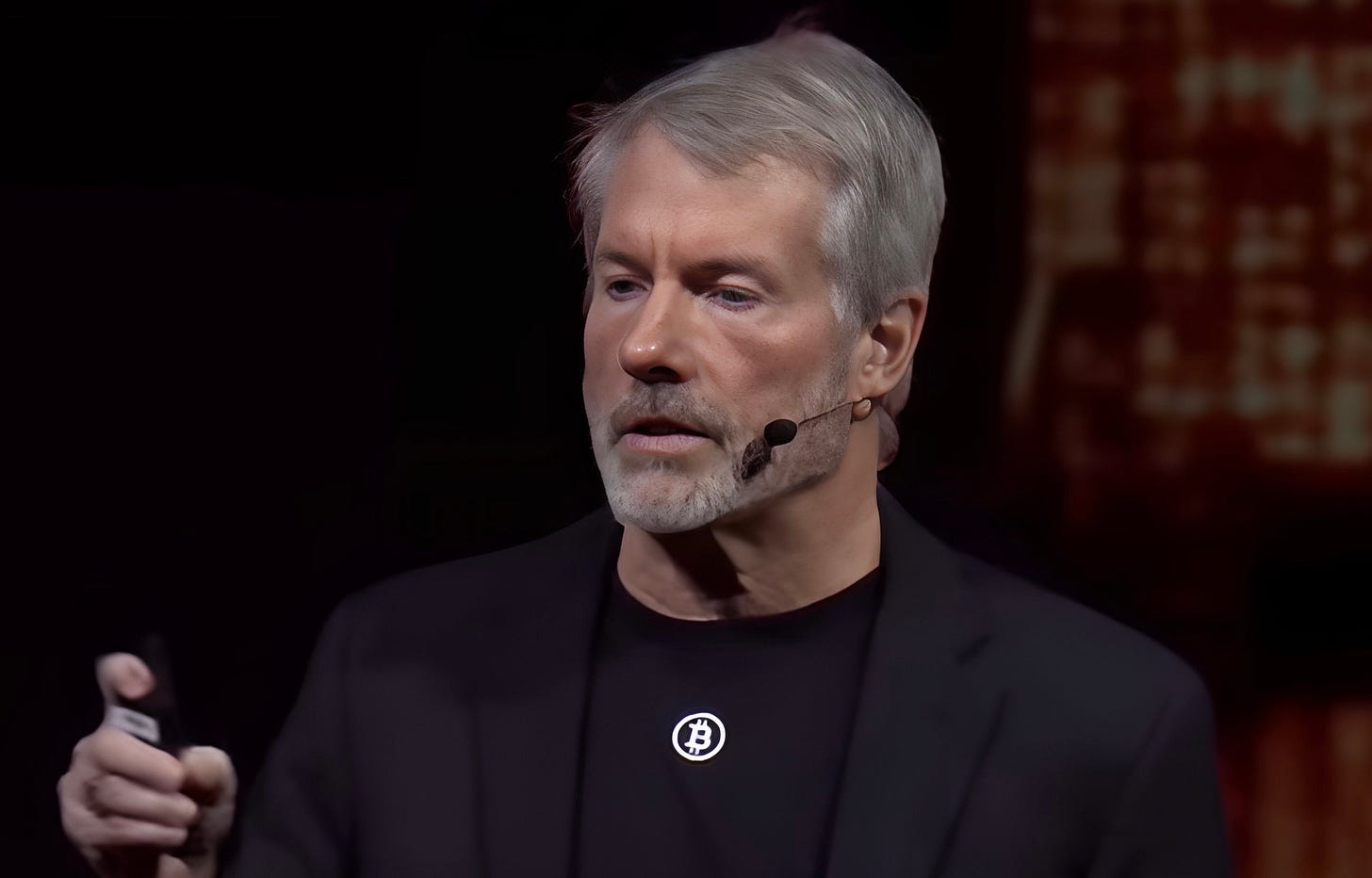

Saylor concluded his Bitcoin 2025 keynote on a note of gratitude and optimism. After guiding the audience through clarity and courage all the way to advocacy and generosity, he smiled and quoted the humble forum post that Bitcoin’s creator, Satoshi Nakamoto, wrote back in 2009:

“It might make sense to get some, in case it catches on.”

In 2025, with Bitcoin having certainly “caught on” for the faithful, Saylor’s entire speech can be seen as an elaborate elaboration of that one early insight. The “21 Steps to Wealth” was his way of saying that Bitcoin has caught on – and for those with the clarity, conviction, and courage to act, it offers a path to unprecedented wealth. More than that, it offers a path to a better world – one where economic energy flows freely, unimpeded by inflation or oppression, and where those who benefit remember to give back. In dedicating the speech to Bitcoiners themselves, Saylor acknowledged the community’s role in getting Bitcoin to this point. Their unwavering belief and resilience through the ups and downs have fed the flame that Satoshi ignited. Saylor’s message in Las Vegas was ultimately one of empowerment and thanks: a recognition that Bitcoin’s strength comes from its believers, and a roadmap for those believers to achieve wealth and spread abundance, 21 million coins and 21 steps at a time.

Erasmus Cromwell-Smith

May 31st. 2025.

Sources:

- Michael Saylor’s Bitcoin 2025 keynote coverage; Bitcoin Magazine and CoinDesk reports on “21 Ways/Steps to Wealth.”

- Saylor’s public remarks on Bitcoin as “digital energy” and global wealth; Satoshi Nakamoto’s quote as referenced by Saylor.

- Strategy Chair Michael Saylor Shares ‘21 Ways to Wealth’ in Vegas Keynote

- Michael Saylor Presents The 21 Ways to Wealth at Bitcoin 2025 | Nasdaq

https://www.nasdaq.com/articles/michael-saylor-presents-21-ways-wealth-bitcoin-2025

- Saylor's '21 Truths': Bitcoin Advocate Reaffirms Digital Thesis

https://coinedition.com/michael-saylors-21-truths-bitcoin-evangelist-doubles-down-on-digital-gold/

- Michael Saylor Presents The 21 Ways To Wealth At Bitcoin 2025

https://bitcoinmagazine.com/news/michael-saylor-presents-the-21-ways-to-wealth-at-bitcoin-2025

- Michael Saylor Predicts Bitcoin Will Represent Half of Global Wealth: Impact on Crypto Trading in 2025 |

- Flash News Detail | Blockchain.News