“Money is a technology—a tool we use to transmit value, store savings, and

coordinate global commerce. As technology evolves, so does money. A new world economic order—what some call ‘Bretton Woods III’—could be driven by Bitcoin and decentralized digital assets, challenging the fiat-centric systems of the past 50 years.”

1. Introduction

For decades, the global financial architecture has revolved around Bretton Woods II—a loose term describing the post-1971 dollar-centric era that emerged after the collapse of the original gold-backed Bretton Woods system. Although the dollar remains globally dominant, technological, geopolitical, and macroeconomic shifts signal the potential rise of a Bretton Woods III: a multi-layered system where non-sovereign assets like Bitcoin (BTC) could meaningfully compete with or complement fiat currencies and central bank digital currencies (CBDCs).

In this article, we examine the Bitcoin-centric version of the Bretton Woods III thesis. We explore Bitcoin’s role as digital gold, the critique of stablecoins and CBDCs through a decentralization lens, and the broader geopolitical and policy implications of a monetary order that may be partly anchored by a stateless asset. Along the way, we address the following key points:

The evolution from Bretton Woods I to II

Why Bitcoin matters for a potential Bretton Woods III

How stablecoins and CBDCs differ fundamentally from Bitcoin (and why that matters)

Geopolitical responses to a Bitcoin-based world

Risks, challenges, and counterarguments

Policy recommendations and future outlook

Our analysis aims to be accessible yet comprehensive, offering both journalistic narrative and policy-focused insights. By examining the data, historical context, and geopolitical jockeying, this article underscores how Bitcoin is no longer a fringe asset but rather a serious contender in shaping the monetary future.

2. From Bretton Woods I & II to the Bitcoin Era

2.1 Bretton Woods I: The Gold-Dollar Standard

Historical Context: In 1944, Allied nations established an international monetary system centered on fixed exchange rates, with most currencies pegged to the U.S. dollar, and the dollar pegged to gold at $35/oz.

Outcome: This era fostered post-war recovery and monetary stability but began to unravel in the 1960s, as the U.S. ran persistent balance-of-payments deficits and gold reserves became insufficient.

End of an Era: In 1971, President Nixon suspended dollar-gold convertibility, effectively ending the Bretton Woods I arrangement.

2.2 Bretton Woods II: Dollar Dominance Without Gold

Fiat Dollar Hegemony: After the collapse of the gold peg, currencies floated, and the U.S. dollar retained its reserve status—albeit as a pure fiat currency. This entrenched the U.S. Treasury bond as the “risk-free asset” for global reserves, leading to what is sometimes called the “exorbitant privilege” of the U.S.

Structural Imbalances: Over time, emerging markets amassed large dollar reserves. Periodic financial crises (e.g., Latin American crisis, Asian financial crisis, Global Financial Crisis of 2008) highlighted the fragility of unmoored fiat systems.

Skepticism and Search for Alternatives: Countries like China and Russia have questioned the unipolar dollar order, especially after the post-2014 sanctions regimes. Meanwhile, Bitcoin’s launch in 2009 introduced a radically new, decentralized form of digital money.

2.3 Bretton Woods III: A Potential Pivot to Outside Money

Outside vs. Inside Money: Zoltan Pozsar, among others, advanced the idea that a new system might revolve around outside money—assets not reliant on any one sovereign’s promise (like gold, commodities, or Bitcoin) as a reaction to perceived risks in the Western financial system.

Bitcoin’s Rise: While some emphasize commodities (e.g., gold, oil), Bitcoin has surged as an alternative store of value with a transparent, fixed supply. Amid concerns over monetary debasement, BTC has attracted institutional interest.

Looking Ahead: A Bretton Woods III that is truly decentralized could see Bitcoin (and perhaps other decentralized assets) emerge as a new anchor, challenging both the dollar and prospective central bank digital currencies.

3. Why Bitcoin Matters: The Core Value Proposition

Bitcoin stands apart from fiat currencies, stablecoins, and even commodity-backed assets in several critical ways:

Monetary Policy by Algorithm: Bitcoin’s supply is capped at 21 million coins. No central authority can unilaterally change issuance, offering a stark contrast to inflation-prone fiat systems.

Decentralized Validation: The Bitcoin blockchain is secured by thousands of nodes worldwide, making it censorship-resistant.

Borderless and Permissionless: Anyone with internet access can send BTC without relying on a central intermediary, a potent tool for financial freedom in high-inflation or capital-control regimes.

Digital Gold Thesis: Bitcoin’s scarcity and decentralized nature have led many to liken it to digital gold—a potential safe haven during economic turmoil, and a new form of store-of-value asset.

3.1 Global Adoption and Use Cases

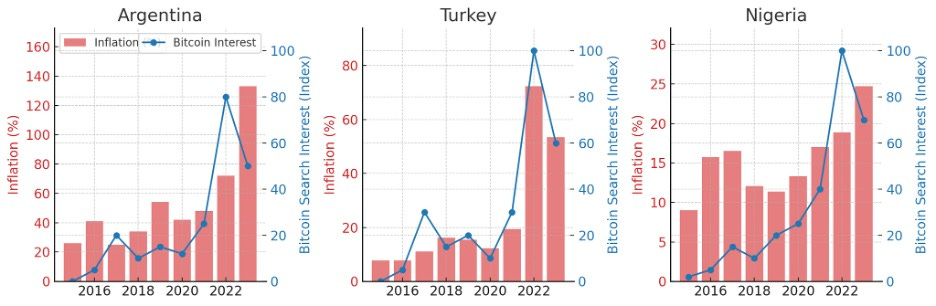

Inflation Hedges in Emerging Markets: In countries like Argentina, Turkey, Nigeria, and Venezuela, double- or triple-digit inflation has driven many to Bitcoin. Surveys indicate 10–30% of citizens in some high-inflation economies own or have used Bitcoin, underscoring real-world demand as a monetary refuge.

Institutional Interest: From hedge funds to pension plans, major financial institutions now allocate a percentage of portfolios to BTC. BlackRock, Fidelity, and others have filed for Bitcoin ETFs, signaling mainstream acceptance.

Remittances and Financial Inclusion: El Salvador famously adopted Bitcoin as legal tender to reduce remittance costs and improve financial access. Although adoption rates are debated, the broader narrative of using BTC for cheaper cross-border transfers remains strong in regions with expensive remittance corridors.

Table 1. Bitcoin Adoption vs Inflation Rates:

(Hypothetical chart plotting 2022–2023 inflation rates for Turkey, Argentina, Nigeria, etc. against local Google Trends or user adoption for Bitcoin. Correlation typically shows higher BTC interest/use in high-inflation environments.)

Fig.1 – Inflation vs. Bitcoin Interest: In high-inflation economies like Argentina, Turkey, and Nigeria, periods of rising inflation often align with spikes in Bitcoin search interest or P2P trading volumes. Each country’s chart shows annual inflation (bars, %) against a Bitcoin interest index (line, as proxied by search or volume data).Inflation and Bitcoin Interest in Argentina, Turkey, Nigeria (2015–2023). Higher inflation (red bars) often coincides with increased Bitcoin interest or usage (blue line).

4. A Critical Look at Stablecoins and CBDCs

While Bitcoin soared as a decentralized asset, two other digital currency models emerged:

4.1 Stablecoins: Fiat in Crypto Clothing?

Definition: Stablecoins are digital tokens pegged 1:1 to fiat currencies, typically the U.S. dollar. Examples include USDT (Tether) and USDC (Circle).

Centralization Risk: Most stablecoins are issued by private companies that hold fiat reserves. This central issuer can be pressured by regulators or face insolvency, introducing counterparty risk.

Regulatory Arbitrage: Stablecoins are used globally for quick, cheap transfers. Yet, they remain tied to fiat monetary policy—they are effectively an extension of the dollar system.

Critique from a Bitcoin Lens: While stablecoins do help onboard new crypto users (especially in high-inflation economies looking for USD exposure), they may undermine Bitcoin’s broader mission of a truly sovereign monetary network. They also pose systemic risks if reserves are opaque.

4.2 CBDCs: Digitizing the Status Quo

Definition: A central bank digital currency (CBDC) is a state-issued digital version of national currency. China’s e-CNY is the largest pilot; others (Sweden’s e-krona, the ECB’s digital euro, etc.) are in various stages.

Centralized Design: Unlike Bitcoin, CBDCs are typically permissioned systems controlled by the issuing central bank. Governments can monitor and potentially censor transactions.

Monetary Policy Extensions: CBDCs could enable deeper negative interest rates, expiration dates on money, or direct helicopter drops—giving central banks unprecedented control.

Policy-Driven Rollouts: Nations see CBDCs as a hedge against private stablecoins and a mechanism to enhance the reach of monetary policy. For authoritarian regimes, it could also increase financial surveillance.

Bitcoin Critique: From a decentralization and privacy standpoint, CBDCs represent the antithesis of Bitcoin. They keep monetary issuance firmly in state hands and often sacrifice user anonymity. If a key driver of Bretton Woods III is escaping politicized control over reserves, CBDCs remain firmly within government purview.

Table 2. Bitcoin vs Stablecoins vs CBDCs

5. Bitcoin’s Geopolitical Impact

5.1 U.S. Approach: Embrace Innovation but Preserve Dollar Hegemony

Dollar Diplomacy Meets Crypto: The U.S. government is balancing crypto innovation with regulatory crackdowns. Historically, the U.S. has expressed concern over illicit finance, but also sees dollar-pegged stablecoins as extending the greenback’s global dominance.

Bitcoin’s Role: For the U.S., Bitcoin might be viewed as both an investment asset (institutional funds) and a strategic hedge against other powers. Some policymakers, however, fear it undermines the traditional banking system.

Regulatory Responses: Enforcement actions (e.g., SEC vs. unregistered tokens) suggest a push for compliance. Meanwhile, a U.S. CBDC has stalled, with some officials favoring private stablecoins over a Fed-issued retail CBDC. Bitcoin continues to operate, largely unimpeded by the U.S. government, which implicitly legitimizes it.

5.2 China: Pioneering CBDC, Opposing Bitcoin

Digital Yuan (e-CNY): China leads in CBDC experimentation. Trials show millions of e-CNY wallets, but actual usage remains a fraction of total payments.

Bitcoin Ban: In 2021, China banned Bitcoin mining and retail trading to preserve capital controls and champion the e-CNY.

Geostrategic Vision: A state-run digital currency could facilitate cross-border transactions with partner nations, bypassing U.S.-centric systems. Yet, Bitcoin’s censorship-resistant design conflicts with Beijing’s preference for tight monetary governance.

5.3 Russia and Sanction Evasion Concerns

Flight from Dollar Assets: Faced with Western sanctions, Russia reduced its dollar reserves and explored crypto for cross-border settlements.

Bitcoin and Commodity Backing: Speculative discussions around “gold- or oil-backed tokens” emerged, yet adoption is minimal so far. Russia’s official stance on Bitcoin remains mixed, endorsing it only in limited contexts (e.g., foreign trade).

Bifurcated Landscape: While Russia’s central bank works on a digital ruble, others see Bitcoin or stablecoins as pathways to dodge sanctions. This intensifies debates over anti-money-laundering (AML) policies in decentralized networks.

5.4 Emerging Markets: Bitcoin as a Lifeline

Financial Inclusion: Countries like Nigeria, Argentina, Venezuela, and Lebanon turned to Bitcoin during hyperinflation or bank collapses.

El Salvador’s Experiment: Adopted Bitcoin as legal tender. Although usage data is mixed (low everyday adoption), the move signaled a sovereign break from dollar reliance.

Growing Grassroots Adoption: Peer-to-peer trading volume in Africa and Latin America has outpaced many developed regions. This bottom-up support may be the strongest force propelling Bitcoin into a Bretton Woods III narrative—ordinary people seeking stable value outside failing fiat.

Figure 2: P2P Bitcoin Trading Volume by Region (2021):

This figure illustrates peer-to-peer (P2P) Bitcoin trading volume globally, highlighting substantial trading volumes in Africa and Latin America relative to Europe and North America, underscoring Bitcoin’s role as a crucial financial lifeline in emerging markets.

Figure 2 vividly captures Bitcoin’s grassroots momentum, especially in regions plagued by economic instability, hyperinflation, or limited access to traditional financial infrastructure. The significantly higher P2P volume in Africa and Latin America signals strong organic demand, affirming Bitcoin’s value proposition beyond mere speculation—as a genuine tool for economic empowerment and financial autonomy. Such adoption demonstrates practical, everyday trust in Bitcoin’s capabilities, positioning it uniquely to anchor a decentralized Bretton Woods III monetary order from the ground up.

6. Risks, Challenges, and Counterarguments

6.1 Volatility and Liquidity

Volatility: Bitcoin’s price has historically swung ±50% within months. Critics argue such instability hinders its viability as a global unit of account.

Liquidity Constraints: Despite rising institutional presence, liquidity can dry up during market panics. A large capital flight might trigger chain reactions in crypto lending or DeFi, with no central bank backstop.

6.2 Governance and Regulatory Risk

Potential Bans or Restrictions: Already, China has banned BTC for domestic trading/mining. Other governments could follow. Even partial restrictions (e.g., banning on/off ramps) hamper adoption.

Fragmented Global Regulation: Some jurisdictions are crypto-friendly; others are stringent. The lack of uniformity complicates large-scale adoption.

AML/KYC Enforcement: Bitcoin’s pseudonymity can be exploited by illicit actors. If forced to comply with KYC/AML at all wallet levels, Bitcoin’s censorship resistance could be eroded.

6.3 Scalability and Energy Concerns

Transaction Throughput: Bitcoin can handle ~7 transactions per second (on-chain). Solutions like Lightning Network help scale payments, but widespread adoption is still unfolding.

Energy Usage: Proof-of-work mining is energy-intensive. Although the share of renewables is growing, critics highlight potential environmental harm. Proponents counter that BTC mining can incentivize clean energy development.

6.4 No Lender of Last Resort

Systemic Crises: In a major financial meltdown, who backstops the Bitcoin system? Traditionally, central banks inject liquidity. In a decentralized realm, there’s no equivalent, raising fears of catastrophic collapses.

Decentralized Safety Nets? Some argue that multi-signature custody, insurance protocols, and stable layering (like LN) can mitigate risk. But these remain nascent compared to established central bank and IMF structures.

7. Empirical Outlook: Bitcoin’s Data in Focus

Below, we highlight key metrics reflecting Bitcoin’s role in the evolving monetary landscape.

Figure 3. Bitcoin Market Capitalization (2016–2025 YTD):

(Line chart showing BTC market cap rising from under $10 billion in 2016 to over $2 trillion at peak in 2024, then stabilizing in the $1.75–$2 Trillion range during 2024–2025.)

Market Capitalization: Peaked at over $1 trillion in 2021. Despite bear markets, BTC remains one of the top assets by market cap, often surpassing large public companies (e.g., Meta, Tesla).

Hash Rate and Network Security: Bitcoin’s mining hash rate reached all-time highs in 2023, indicating growing computational security even after China’s mining ban forced relocation.

Figure 3. Evolution of Bitcoin network hash rate from 2018-2025 (simplified units). Rising hash rate reflects increasing miner participation and growing computational power securing the Bitcoin network, even amid regulatory and geopolitical pressures.

Institutional Holdings: Publicly listed companies (e.g., MicroStrategy) hold over 150,000 BTC collectively. Major asset managers are seeking Bitcoin ETFs, signaling deeper mainstream finance ties.

Lightning Network Growth: Lightning channel capacity surpassed 5,000 BTC in 2023, increasing Bitcoin’s ability to handle micropayments and everyday purchases at near-zero fees.

Figure 4. Lightning Network Capacity Over Time:

(Bar chart illustrating LN capacity from 2019 to 2025, showing steady growth from ~500 BTC to over 5,000 BTC.)

Adoption in High-Inflation Countries: Survey data (Chainalysis, 2023) shows 20%+ adoption in Nigeria, 15%+ in Argentina, confirming grassroots demand for BTC as an inflation hedge.

8. Policy Considerations for a Bitcoin-Centric Bretton Woods III

8.1 Regulatory Frameworks vs. Bitcoin’s Core Principles

Preserving Decentralization: Excessive regulation risks “turning Bitcoin banks into traditional banks.” Policymakers need a light-touch approach that respects self-custody, open-source development, and permissionless protocols.

AML/KYC Boundaries: Reasonable compliance at fiat on/off-ramps is necessary, but requiring KYC for every wallet transaction would undermine Bitcoin’s privacy features.

International Coordination: Just as Bretton Woods I required multinational agreement, Bretton Woods III might need transnational norms on crypto taxation, stablecoin reserves, and cross-border enforcement.

8.2 Potential Role of IMF and World Bank

From Restrictive to Supportive? Traditional institutions have voiced concerns about cryptoization in emerging markets. Yet, they also recognize Bitcoin’s real use cases in remittances and financial inclusion.

Advisory and Integration: The IMF could develop frameworks for countries that adopt Bitcoin in parallel with fiat, addressing macro-stability. The World Bank might fund digital infrastructure to ensure the unbanked can safely access BTC wallets.

8.3 Hedging National Reserves with Bitcoin?

Gradual Reserve Diversification: While controversial, some economists suggest central banks could allocate 1-5% of reserves to Bitcoin—similar to a gold allocation.

Volatility vs. Uncorrelated Asset: Critics point to BTC’s fluctuations; proponents argue its long-term upward trajectory and independence from fiat devaluation make it a strategic hedge.

Geopolitical Ramifications: If major states or blocs accumulate BTC, it legitimizes Bitcoin as a global reserve asset, akin to gold.

8.4 Monetary Policy Implications

Competitive Currency Environment: With Bitcoin as an alternative, central banks must maintain tighter discipline or risk losing credibility. This could curb rampant money-printing.

End of Monetary Sovereignty? Countries with weak currencies may see faster “dollarization” or “Bitcoinization.” Policymakers must either improve fiat stability or accept partial displacement by BTC.

9. Possible Futures for Bretton Woods III

**Bitcoin as a “Digital Gold” Standard: Bitcoin becomes a reserve asset underpinning monetary confidence, while day-to-day transactions remain in CBDCs or stablecoins. This is akin to Bretton Woods I, but with BTC replacing gold.

Fully Decentralized Monetary Ecosystem: Bitcoin (on Lightning) handles the bulk of retail payments. States issue CBDCs, but large populations bypass them in favor of censorship resistance. This is more revolutionary yet seems less likely in the near term.

Fragmented Landscape: The U.S. dollar remains dominant, with partial incursion by Bitcoin in places with fiat instability. Meanwhile, China champions e-CNY in its sphere, and stablecoins flourish in global trade. Bretton Woods III is less a coherent system than a multipolar patchwork.

Bitcoin as a Geopolitical Neutral Asset: Rival states might adopt Bitcoin reserves to avoid reliance on each other’s currencies (e.g., Russia or China not wanting to hold dollars). Bitcoin’s neutrality becomes a selling point, supporting global acceptance.

Which scenario emerges depends on how states, markets, and individuals weigh the trade-offs of sovereignty, stability, and decentralization. Regardless, Bitcoin is firmly on the radar in discussions of the global monetary future.

10. Conclusion: The Case for a Bitcoin-Centric Bretton Woods III

A new international monetary order—call it Bretton Woods III—is coalescing in response to shifting geopolitics, waning trust in pure fiat, and the advent of blockchain technology. While stablecoins and CBDCs often dominate headlines, Bitcoin remains the foundational innovation:

A Non-Sovereign Store of Value: Its scarcity and decentralization make it a prime candidate for nations and individuals seeking a monetary asset that no single government can debase or sanction.

Financial Inclusion Catalyst: Grassroots adoption in emerging markets demonstrates Bitcoin’s power to bypass broken banking systems.

Disruptor and Stabilizer: Ironically, while it threatens the status quo, Bitcoin may also enforce discipline on central banks by providing an exit from poorly managed fiat.

Resilience Against Control: Unlike stablecoins (subject to issuer risk) and CBDCs (fully state-controlled), Bitcoin’s network is inherently censorship-resistant and globally permissionless.

Counterarguments highlight real challenges—volatility, regulatory pushback, scalability, and the need for institutional guardrails. Yet, the momentum behind BTC adoption, particularly in inflationary settings and institutional portfolios, points to a permanent role in the global financial tapestry. Should states incorporate Bitcoin as a partial reserve asset, or should individuals in troubled economies keep using it as a hedge, Bitcoin’s place in Bretton Woods III will only solidify.

In the grand historical arc, money has evolved from metallic coins to paper notes, and now to digital ledgers. Bitcoin’s invention in 2009 was a watershed moment, offering a self-sovereign alternative at a time of deep mistrust in banks and governments. As the world navigates uncertain terrain—rising geopolitical fractures, record-high debt, inflationary fears—Bitcoin stands as a unique anchor, unlinked to any central issuer.

If Bretton Woods III is about recalibrating the global monetary order around trust, diversification, and technological progress, then Bitcoin’s transparent, decentralized architecture might serve as the cornerstone of a more resilient, inclusive system. The journey is fraught with obstacles, but the ambition of Bretton Woods III demands nothing less than reimagining how value is created, transferred, and preserved across borders.

In a world seeking alternatives to politicized fiat and heavily surveilled digital cash, Bitcoin offers a path to monetary autonomy. Whether it remains a niche reserve or becomes the linchpin of a new global order, its influence will shape the contours of finance in the 21st century.

Closing Argument

A new international monetary order—Bretton Woods III—is emerging at the intersection of technological innovation, shifting geopolitical realities, and growing skepticism toward traditional fiat-based financial systems. Although stablecoins and CBDCs often dominate public discourse, Bitcoin's uniquely decentralized structure, resistance to centralized oversight, and inherent digital scarcity distinguish it fundamentally as the ideal anchor for this evolving monetary framework.

Bitcoin embodies a crucial turning point in monetary history. As nations grapple with escalating sovereign debt, persistent inflation, geopolitical tensions, and increasing financial surveillance, Bitcoin presents a timely and essential alternative—politically neutral and insulated from governmental manipulation. Its growing adoption in distressed economies and expanding institutional acceptance signal a permanent shift toward a financial landscape where monetary trust is rooted in code rather than political decree.

Figure 5. Growth in Bitcoin holdings by institutional entities, 2018–2025: Data reflects estimated BTC accumulation by public companies, ETFs, and large funds holdings, as of Abril of 2025, exceed 2.5 million Bitcoins, signaling growing mainstream acceptance of Bitcoin as a reserve and treasury asset.

Real-world data reinforces this transformation: As of 2025, over 10% of Fortune 500 companies hold Bitcoin either through ETFs or directly on their balance sheets. In high-inflation nations like Nigeria and Argentina, adoption rates are estimated between 20–30%, driven by economic instability and limited access to traditional banking. Meanwhile, Bitcoin’s network resilience continues to grow—its hash rate reached all-time highs in 2023 despite global mining crackdowns, and its market capitalization peaked above $2 trillion in 2024, securing its position among the world’s most valuable financial assets.

These empirical signals point to a lasting shift toward a financial landscape where trust is rooted in open-source code rather than sovereign decree.

We find ourselves at a pivotal juncture. Nations, financial institutions, and individual actors must now decide between continued reliance on vulnerable centralized monetary systems or a decisive embrace of Bitcoin's transparent, resilient decentralization. Bretton Woods III thus emerges not merely as an intellectual proposition, but as an immediate necessity—a historic opportunity to cultivate a fairer, freer, and more secure global economic order for future generations.

Erasmus Cromwell-Smith

April 14th 2025

References and Suggested Reading

Pozsar, Z. (2022). “Bretton Woods III” Theory and Implications. (Credit Suisse Insights)

Chainalysis. (2023). Global Crypto Adoption Index.

IMF. (2023). “Global Financial Stability Report” – includes discussions on cryptoasset risks.

BIS. (2022–2023). Working Papers on CBDC experiments and digital payments.

El Salvador. (2021–2023). Official Policy Documents on Bitcoin Legal Tender Implementation.

CoinMarketCap. (2022). “Bretton Woods III and Crypto: A Closer Look.”

Lightning Labs. (2023). Lightning Network Capacity and Adoption Statistics.

World Bank. (2021). Global Findex Database – for unbanked populations leveraging mobile/crypto solutions.

Acknowledgments

Some empirical data derived from Chainalysis, IMF databases, and BIS studies.

Special thanks to crypto analytics platforms that provided insight on Bitcoin adoption in emerging markets.

Author’s Note

This manuscript merges policy analysis with a Bitcoin-centric perspective on Bretton Woods III. Readers from academic, financial, crypto-industry, and general backgrounds are invited to interpret and critique these findings within their own research or policy contexts. The aim is to illuminate how Bitcoin’s unique attributes might catalyze (or at least shape) a shift in the international monetary order, and what that implies for governments, institutions, and everyday users worldwide