The Case for Bitcoin’s March to $1 Million: Why the Trend Looks Inevitable

By Erasmus Cromwell-Smith, May 19, 2025.

Introduction

Bitcoin has spent the first months of 2025 shattering expectations and brushing up against six-figure prices. After briefly touching a record ∼$109,000∼$109,000 in January, it weathered a spring pullback to the mid-$70Ks and rebounded near $95,000 by early May. The cryptocurrency’s market dominance has surged to around 65%—a four-year high—as investors flock to its relative safety amid uncertainty. This remarkable momentum has reignited an old debate with a new twist: Is Bitcoin destined to reach $1 million per coin? Increasingly, a confluence of macroeconomic forces, geopolitical shifts, and technological breakthroughs are convincing many that the path to $1 million is not a question of “if,” but “when.”

To be sure, “inevitable” is a bold word. In finance, nothing is guaranteed. The core thesis presented here does hinge on several bullish assumptions—such as sustained institutional adoption, persistent fiat debasement, and ongoing corporate interest. At the same time, short-term volatility could be far more severe than some expect (Bitcoin has historically seen 50%+ drawdowns). However, as of May 2025, trends set in motion since the start of the year—including ongoing adoption by both institutions and corporate treasuries—have built a compelling case that Bitcoin’s long-term trajectory is up, potentially way up.

Some prominent investors and analysts have openly speculated that seven-figure valuations are only a matter of time. Among them, Cathie Wood of ARK Invest and Michael Saylor of MicroStrategy have repeatedly doubled down on highly optimistic price forecasts, further fueling market speculation. Even as we critically examine the bullish arguments (while acknowledging that geopolitical risks or potential coordinated crackdowns might disrupt Bitcoin’s trajectory), the narrative of a coming $1 million Bitcoin is gaining traction in both Wall Street boardrooms and online crypto forums. This document also explores near-term risks in greater detail, highlighting that steep corrections—like the dip to $70,000—can significantly undermine investor confidence, especially if unexpected global events or security breaches arise. Additionally, we consider potential hurdles to mass adoption—user education, wallet security, and energy usage.

Figure 1: Bitcoin Price & Halving Cycles

Solid Gold Line: Monthly BTC/USD closing price, showing historical bull and bear phases.

Dashed Vertical Lines: Dates of Bitcoin halving events (Nov 2012, Jul 2016, May 2020, Apr 2024), marking each 50% cut in new supply.

Figure 2: Global Debt vs. Bitcoin Supply Growth

Dark Gray Bars (Left Axis): U.S. federal debt outstanding (trillions USD) from 2015 through 2025.

Black Dashed Line (Right Axis): Bitcoin’s annual issuance rate (%), illustrating the drop from ~3.6% pre-halving to ~0.8% post-2024 halving.

2. Geopolitical Game-Changers: De-Dollarization and Digital Refuge

Beyond inflation, geopolitical undercurrents are shifting in ways that strengthen Bitcoin’s hand—but might also present substantial risks if global powers coordinate against it. The gradual move by nations and institutions to reduce reliance on the U.S. dollar (“de-dollarization”) has accelerated in 2025. Fresh IMF data places the dollar’s share of global foreign exchange reserves at 30-year lows, while central banks diversify into gold and alternative currencies. Such shifts, fueled by trade disputes, sanctions, and strategic hedging, create an opening for neutral, non-sovereign assets like Bitcoin.

Indeed, VanEck research notes that as trust in major fiat currencies erodes, “neutral” reserve assets like gold and Bitcoin may gain ground. Even a White House advisor remarked that if the U.S. dollar’s reserve role is slipping, Bitcoin might be preferable to a yuan-centric global system. Yet this opening could reverse if a crisis sparks coordinated anti-crypto measures among large economies. Although El Salvador openly embraced BTC, other governments remain wary. A major political or economic showdown might prompt G7 nations to jointly clamp down on crypto-related banking and capital flows. If that happens, Bitcoin’s global usage could be severely hampered.

On the other side, sanctioned nations like Russia and Iran have reportedly turned to cryptocurrencies, including Bitcoin, to settle trade outside the dollar-centric SWIFT network. While volumes are currently modest, each month shows incremental growth in crypto-based settlements. This highlights how Bitcoin can function as a parallel settlement rail that is difficult to censor. Likewise, emerging markets dealing with extreme inflation—Argentina, Turkey—showcase Bitcoin’s appeal as a store of value when local currencies collapse and people face capital controls. Still, if governments in these countries intensify bans or restrictions, adoption might be curtailed. Overall, the world’s fractious state is inadvertently showcasing Bitcoin’s advantages. Yet geopolitical alliances may shift without warning, posing a real threat to widespread acceptance.

Figure 3: Bitcoin Dominance & Institutional Holdings

Top Panel – Orange Line: BTC market-cap dominance (% of total crypto market) from 2019 to 2025.

Bottom Panel – Gold Bars: Total BTC held by major spot-Bitcoin ETFs (e.g., BlackRock, Fidelity).

Bottom Panel – Orange-Red Bars: BTC held in corporate treasuries, showing rising corporate adoption.

3. Technological and Market Catalysts: ETF Floodgates, Halving Cycle, and the Lightning Surge

If macro and geopolitical factors form the wind in Bitcoin’s sails, technological and market developments are the engine propelling it forward. Recent innovations and institutional breakthroughs make the long-term investment thesis more robust—but one must remember that a critical security breach or mishandled user experience could derail adoption more severely than many forecasts assume.

Halving Cycle and Scarcity

The 2024 Bitcoin Halving reduced the block reward from 6.25 to 3.125 BTC, pushing annual supply growth down to roughly 0.8%. This makes Bitcoin’s inflation rate lower than gold’s (~1.5%). Historically, the 12–18 months following each halving (2013, 2017, 2021) saw powerful bull runs—but that pattern isn’t guaranteed. If a global recession or a “risk-off” environment emerges, Bitcoin can suffer large drawdowns, temporarily postponing its upward trajectory.

Institutional Adoption: ETFs and Corporate Treasuries

Bitcoin exchange-traded funds—long resisted by regulators—finally launched in the U.S. in early 2025, channeling substantial capital into BTC. BlackRock’s fund reportedly holds hundreds of thousands of BTC, signaling a strong vote of confidence. Meanwhile, corporate treasuries—from tech startups to multinationals—have accelerated their Bitcoin acquisitions. Some data suggests that these corporate purchases now rival ETF inflows, although critics question whether companies might reverse course if macro conditions turn ugly. Still, the simple fact that major brands hold BTC as a “digital reserve” normalizes it for both institutional and retail participants.

Lightning Network Growth

A frequent criticism is that Bitcoin is slow and expensive for everyday payments. Layer-2 solutions like the Lightning Network address this by handling transactions off-chain and settling them on the blockchain later—think of Lightning as “email for Bitcoin transactions.” In Q1 2025 alone, Lightning reportedly processed over 100 million transactions, while nodes and channel capacity continued expanding. Major retailers such as Walmart and Starbucks have begun pilot programs accepting Lightning-based payments, though user education and wallet security remain ongoing challenges. If mainstream consumers find these tools too complex—or if there’s a high-profile security incident—adoption could stall. Nonetheless, the maturation of Lightning is steadily eroding the argument that Bitcoin is unusable as a currency.

Figure 4: Bitcoin Adoption by Country (% of Population)

Gold Bars: Percentage of national population holding or transacting in Bitcoin, highlighting top adopters (Turkey, Argentina, Nigeria, USA, Germany).

Figure 5: Quarterly BTC Inflows: ETFs vs. Corporate Purchases

Gold Bars: Quarterly BTC inflows into U.S. spot-Bitcoin ETFs (Q1 2024–Q1 2025).

Orange-Red Bars: BTC acquired by corporate treasuries over the same periods, showing how corporate demand has grown alongside ETFs.

Figure 6: Lightning Network Growth

Gold Line: Number of active Lightning Network nodes per quarter (Q1 2023–Q1 2025).

Orange-Red Line: Total Lightning channel capacity (in BTC), demonstrating scaling progress for instant, low-fee payments.

4. The Other Side: Risks and Rebuttals

Declaring Bitcoin’s march to $1 million “inevitable” would be careless without evaluating counterarguments:

Short-Term Volatility: Bitcoin often trades like a high-beta tech stock, meaning it can plummet in a market downturn. Correlations to equities rise during crises, as seen in past global selloffs. If a recession or a severe liquidity crunch hits, Bitcoin might drop sharply, regardless of its long-term fundamentals.

Regulatory and Political Uncertainty: Large governments could target Bitcoin to protect monetary sovereignty, tax revenue, or financial stability. A unified crackdown—ranging from severe restrictions on mining to banning fiat on-ramps—could stall adoption, especially if several G7 nations act together.

Economic Critiques of Fixed Supply: Many economists argue that a completely inflexible supply is dangerous, limiting the ability to respond to recessions. While Bitcoin proponents say it need only serve as a store of value (not the world’s primary currency), some see this rigidity as a fatal flaw in broader adoption.

Security and Technological Risks: No software is invincible. Potential quantum computing threats or serious protocol bugs could undermine trust. Wallet hacks and poor security practices are also real issues. If mainstream consumers decide Bitcoin is too risky or too complicated, adoption may plateau.

Competition and Market Saturation: Other digital assets or stablecoins might siphon away market share, keeping Bitcoin below extreme valuations. Though BTC dominance is high (65%), the fast-evolving crypto ecosystem remains unpredictable.

Acknowledging these vulnerabilities provides a more balanced perspective. Macro, geopolitical, and technological tailwinds are powerful but not foolproof. Even dedicated advocates concede Bitcoin could suffer multiple gut-wrenching crashes on its way to higher plateaus—if it reaches them at all.

Figure 7: Bitcoin Price Scenarios (2025–2030)

Bear Case (gold line): A conservative path assuming periodic pullbacks, with prices peaking near $200k before retreating.

Base Case (orange line): A moderate growth curve reaching about $600k by 2030 under steady adoption.

Bull Case (red line): An accelerated scenario where widespread institutional and retail demand drives BTC toward $2.5 million by 2030.

Shaded fill between Bear and Bull to illustrate the full range of outcomes.

5. Cathie Wood & Michael Saylor Projections

Two of Bitcoin’s most vocal champions are Cathie Wood, CEO of ARK Invest, and Michael Saylor, CEO of MicroStrategy:

Cathie Wood (ARK Invest):

Known for modeling scenarios where Bitcoin’s market cap rivals gold’s and beyond.

ARK’s “bull case” has projected prices reaching or exceeding $1 million (and potentially up to $2.4 million by 2030) if institutional adoption accelerates and de-dollarization trends deepen.

Michael Saylor (MicroStrategy):

One of the first Fortune 500 CEOs to move corporate treasury reserves into Bitcoin.

Has publicly stated he views Bitcoin as “digital property” and believes it could eventually surpass $5 million per coin in the far future, based on massive global adoption and a prevailing store-of-value narrative.

While these figures are ambitious, they illustrate the depth of conviction among certain prominent investors. Critics argue these predictions rely heavily on continued risk-on capital flows and a friendly regulatory climate—both of which can shift quickly.

Figure 8: ARK & Saylor Price Projections

ARK Case (orange line): Base/bull models surpassing $1 million by 2030, possibly hitting $2.4 million.

Saylor View (red line): A far-reaching trajectory positing multi-million-dollar valuations.

Shaded background: Illustrates how these forecasts compare to more conservative projections (e.g., Bear and Base Cases from Figure 7).

6. Conclusion: The Convergence Making $1 Million Seem Possible

Stepping back, it’s the convergence of macro, geopolitical, and tech factors since early 2025 that gives the $1 million Bitcoin narrative surprising weight. Any single factor might not be enough, but in combination they form a cycle: fiat debasement concerns channel capital into Bitcoin; geopolitical tensions reinforce its neutrality; and solutions like Lightning expand functionality, which draws in more users.

With each passing cycle, Bitcoin appears less like a fringe curiosity and more like a permanent fixture in global finance. Institutional players—previously wary—now integrate Bitcoin into ETFs and corporate treasuries. Retailers pilot BTC acceptance. Meanwhile, users in inflation-wracked countries treat Bitcoin as a lifeline, not just a speculative punt. That base layer of inelastic demand, coupled with ongoing supply halvings, could propel prices to previously unthinkable levels over time.

Still, the road ahead could be rocky. A global recession, major crackdown, or security crisis might stall progress. Bulls expecting a straight shot to $1 million risk disappointment; historical precedent shows massive drawdowns can materialize with little warning. Yet each bear market has eventually given way to new highs, with adoption ratcheting upward.

Below is a simplified table illustrating scenarios modeled by ARK Invest, as well as a cautionary view:

Could Bitcoin genuinely rise to seven figures by 2030? Possibly. Might it take longer, given setbacks? Certainly. However, the notion of a million-dollar Bitcoin has moved from fringe fantasy to a scenario large segments of Wall Street, Silicon Valley, and emerging-market users now consider plausible. In a world of spiraling debt, fracturing geopolitical blocs, and advanced payment technology, Bitcoin’s upside potential seems too significant to ignore—particularly if evangelists like Wood and Saylor continue attracting followers.

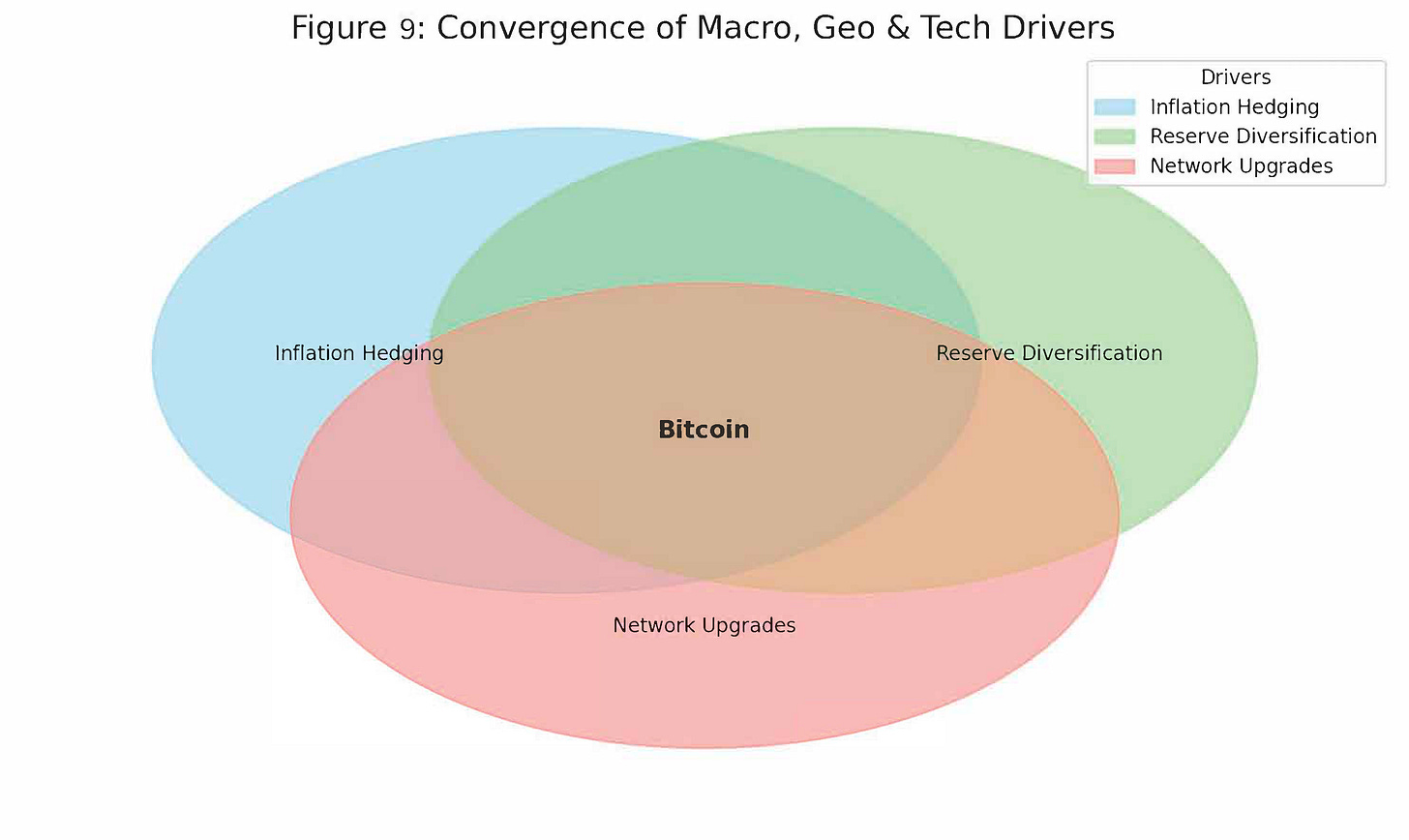

Figure 9: Convergence of Macro, Geo & Tech Drivers

Legend (Drivers):

Inflation Hedging (sky blue): Bitcoin’s appeal as a scarce, non-inflatable asset.

Reserve Diversification (light green): Movement toward non-sovereign assets amid de-dollarization.

Network Upgrades (salmon red): Technological advances (Lightning, Taproot, layer-2 scaling) boosting usability.

Central Intersection (“Bitcoin”): Represents how the overlap of all three forces underpins sustained demand and long-term value.

In closing, Bitcoin’s journey toward $1 million remains an intricate interplay of powerful macroeconomic forces, shifting geopolitical landscapes, and rapidly evolving technological capabilities. While high-profile investors like Cathie Wood and Michael Saylor underscore optimistic scenarios, prudent analysis demands careful consideration of volatility, regulatory landscapes, and adoption barriers. Regardless, the undeniable momentum Bitcoin has built thus far in 2025 signals not only its growing acceptance as a vital financial asset but also the compelling possibility that future valuations might indeed surpass even today’s boldest predictions.

References

Amberdata Q1 2025 Bitcoin Market Report

https://blog.amberdata.io/bitcoin-q1-2025-historic-highs-volatility-and-institutional-movesFinance Magnates – Bitcoin Price Prediction (May 2025)

https://www.financemagnates.com/trending/bitcoin-price-prediction-2025-2026-2030-experts-btc-forecast-and-outlook-may-2025Binance Research / Altcoin Buzz – US Debt & Crypto Hedge

https://www.altcoinbuzz.io/cryptocurrency-news/binance-research-how-31t-u-s-debt-could-shake-crypto/Brave New Coin – Bitcoin vs Gold: 2024 Halving

https://bravenewcoin.com/insights/bitcoin-vs-gold-how-the-2024-halving-shifts-the-inflation-dynamicsCoinDesk – Fed Signals Rate Cuts

https://www.coindesk.com/markets/2025/03/19/fed-holds-rates-steady-cuts-growth-outlook-raises-inflation-forecastCointelegraph – Arthur Hayes on Fed QE

https://cointelegraph.com/news/bitcoin-price-250k-fed-qe-arthur-hayesVanEck – Mid-April 2025 Bitcoin Chaincheck

https://www.vaneck.com/us/en/blogs/digital-assets/matthew-sigel-vaneck-mid-april-2025-bitcoin-chaincheck/Reuters – Russia Using Crypto in Oil Trade

https://www.reuters.com/technology/2025/03/14/russia-using-crypto-in-chinese-and-indian-oil-tradeReuters – Crypto Adoption in Turkey & Argentina

https://www.reuters.com/technology/cryptoverse-digital-coins-lure-inflation-weary-argentines-turks-2023-05-02/Medium (The Bitcoin Beacon) – Lightning Network Growth

https://medium.com/the-bitcoin-beacon/bitcoins-lightning-network-hits-100-million-transactions-boosting-global-use-75be5c1e3853Advisor Perspectives – Bitcoin vs Dollar

https://www.advisorperspectives.com/articles/2025/02/24/bitcoin-will-not-replace-dollarCME Group – BTC Correlation to Equities

https://www.cmegroup.com/insights/economic-research/2025/why-is-bitcoin-moving-in-tandem-with-equities.html