"THE CASE FOR A STRATEGIC ₿ITCOIN RESERVE"

The Key to Re-Monetization through Perception, Trust, and Credible Stewardship

The Path to Re-Monetization

The bold move by President Trump to establish a ₿TC Strategic Reserve isn't just innovative but necessary in the face of inherent monetary vulnerabilities.

The current U.S. monetary system—entrenched in a quagmire of structural fiscal irresponsibility, ever-expanding debt, and QE-based money printing—is dangerously fragile. A single failed U.S. Treasury auction could trigger an unprecedented global financial crisis, destroying confidence in the U.S. dollar. QE provides only temporary, inflationary relief, exacerbating underlying problems.

Thus, establishing a Strategic ₿itcoin Reserve is not merely innovative or symbolic—it is fundamentally necessary. ₿itcoin’s inherent scarcity, decentralization, and transparency directly counteract fiat weaknesses, providing a stable, credible anchor in the face of structural fiscal irresponsibility and potential currency crises.

The U.S. Government ₿itcoin Strategic Reserve sits atop a number of interconnected strategies launched by the Trump administration geared towards re-monetization. ₿itcoin strategically leverages perception, trust, and credible stewardship to preempt systemic collapse, transforming a dangerously compromised monetary system into one with genuine credibility and resilience.

Moreover, the DOGE initiative, the Sovereign Wealth Fund (SWF), and the newly launched CFTC pilot project on asset tokenization and stable coins further reinforce this credibility restoration by tackling wasteful fiscal practices, investing productively, fostering financial innovation, and diversifying economic resilience

1. Defining Clearly: What is "Re-Monetization"?

Re-Monetization is a strategic effort to re-establish trust, confidence, and genuine value into a currency or monetary system that has suffered significant erosion of credibility due to unsustainable debt, fiscal irresponsibility, excessive currency printing (QE), or inflationary debasement.

In essence, it is about restoring—or fundamentally redefining—the monetary value of currency by linking it back to tangible, credible, scarce, or economically productive assets. This process rebuilds confidence and trust at both the domestic and international levels.

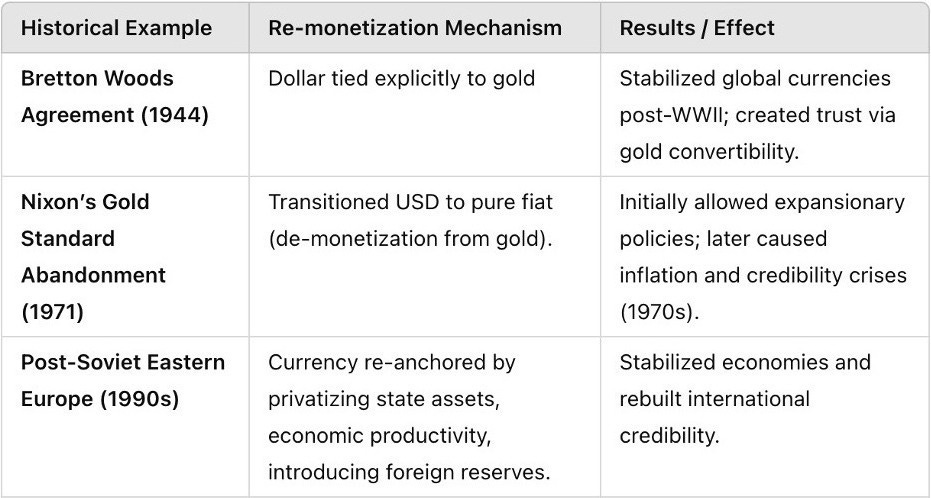

1. Historical Parallels of Re-Monetization:

To understand re-monetization clearly, consider key historical examples:

3. Applying the Concept of Re-Monetization to the Current U.S. Scenario

Currently, the U.S. dollar’s credibility faces increasing scrutiny due to chronic deficits, soaring debt, and unchecked money creation. This presents a real threat of long-term monetary instability.

The recently announced initiatives—particularly:

· U.S. ₿TC Strategic Reserve (₿itcoin)

· U.S. Sovereign Wealth Fund (SWF)

· CFTC Asset Tokenization and Stable Coins Pilot Project (Circle, Tether)

· Department of Government Efficiency (DOGE) under Musk’s leadership,

can be viewed precisely as attempts at Re-Monetization, implicitly or explicitly.

4. Why “Perception” Matters (Central to Re-Monetization)

At the heart of Re-Monetization lies a psychological and confidence-based component—perception:

Fiat money, without tangible backing, fundamentally relies on belief and trust.

Once compromised (by debt, inflation, QE), that trust is extremely challenging to regain.

Re-Monetization initiatives (₿itcoin Reserve, SWF, DOGE) create signals of credible financial management, discipline, and stability, thus reshaping perceptions and restoring trust—essentially acting first as symbolic but crucial psychological shifts.

Indeed, this is critical because:

"Perception precedes reality" in economics and finance.

If initiatives are perceived credibly, they initiate virtuous cycles of renewed trust, attracting investment, stability, and ultimately creating a self-fulfilling reality.

5. Different Monikers for Similar Concepts

There are parallel concepts of Re-Monetization—variously labeled by economists under different monikers—but fundamentally similar:

Currency Anchoring: (Linking currency value explicitly to real, credible, or scarce assets.)

Credibility Reconstitution: (Rebuilding monetary trust via transparency, structural reforms, and disciplined fiscal practices.)

Asset-Backed Monetary Systems: (New or renewed monetary systems explicitly backed by tangible, credible, economically productive assets.)

Monetary Reset or Reform: (Radically restructuring the monetary system itself.)

All these terms essentially describe the same concept: re-anchoring the monetary system and restoring public and international trust in currency value.

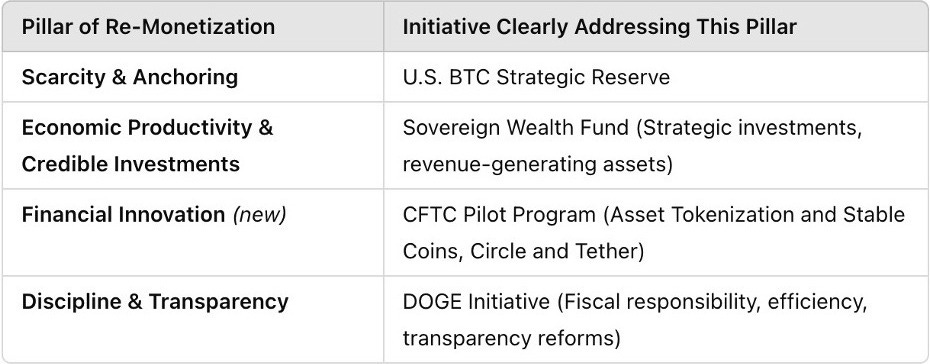

6. How the Four Initiatives (₿itcoin Reserve, SWF, Asset Tokenization/Stablecoins and DOGE) Achieve Re-Monetization in Practice:

Each initiative addresses a separate but interrelated facet of the broader re-monetization process clearly and strategically:

₿itcoin Reserve (Anchor & Scarcity):

Introduces a credible, scarce digital asset (₿TC), creating a clear psychological and financial "anchor" to counter fiat currency debasement.

Sovereign Wealth Fund (Productivity & Credibility):

Explicitly links monetary stability to real economic productivity (investments in technology, infrastructure, businesses), strengthening long-term economic confidence.

CFTC Asset Tokenization and Stable Coins Pilot Program:

Establishes Stable Coins as safe, credible and regulated financial instruments.

Facilitates Financial innovation further strengthening the perception of credible economic leadership.

DOGE (Fiscal Discipline & Transparency):

Establishes a credible commitment to reforming wasteful fiscal practices structurally, signaling genuine governmental responsibility and seriousness about restoring monetary stability.

7. Real Reform Begins with Perception

Initially, these initiatives rely heavily on perception—the belief that something meaningful is changing.

If perceived credibly, these symbolic shifts transform over time into new realities. Credible perception generates confidence; confidence attracts investment and stability; investment and stability become reality, creating a positive feedback loop.

Genuine structural reform often begins precisely this way: a symbolic pivot first, reshaping perceptions, building confidence, and then gradually solidifying into systemic change.

Re-Monetization as a crucial concept—explicitly or implicitly—behind the recent government initiatives (₿itcoin Reserve, SWF, DOGE).

Real monetary reform initially depends largely on reshaping perceptions, then slowly transitioning from symbolic gestures into deeper, sustainable fiscal realities.

8. ₿itcoin as a Strategic "Re-Monetization" Instrument

Enter ₿itcoin—a fundamentally different monetary asset that directly addresses core vulnerabilities:

₿itcoin provides a credible, tangible monetary alternative, significantly reducing dependency on structurally vulnerable fiat currency, thus creating a monetary "firewall" against systemic collapse.

9. Connecting This Clearly to the U.S. ₿itcoin Strategic Reserve

Establishing a U.S. Strategic ₿itcoin Reserve (SBTC) isn't simply innovative—it’s strategically essential given the precarious vulnerabilities of the public finances:

10. Practical and Political Challenges Ahead

While these strategic initiatives offer a visionary path toward monetary stability and re-monetization, practical and political challenges inevitably remain. Entrenched financial and political interests benefiting from the status quo will likely resist profound changes, especially the shift towards transparency and accountability that these strategies entail. Moreover, regulatory complexity, potential pushback from traditional financial institutions, and international skepticism around adopting Bitcoin as a reserve asset could pose further obstacles. Nevertheless, these challenges underline rather than diminish the importance and urgency of implementing these initiatives, highlighting the essential need for bold leadership and clear, credible communication to effectively reshape perception and build long-term trust. Overcoming these hurdles is critical to achieving genuine transparency, accountability, and financial credibility.

13. Conclusion

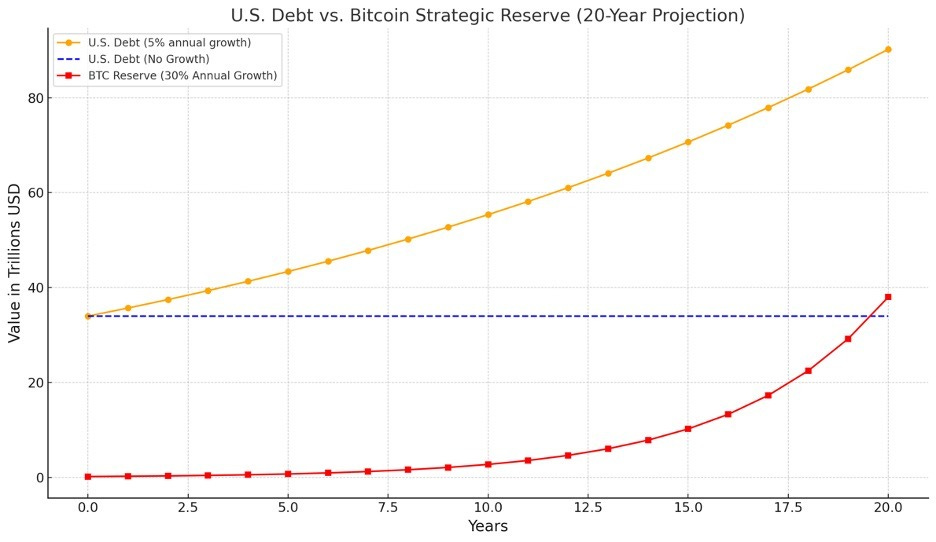

Adopting fiscal responsibility (following the Austrian economic model) and avoiding deficit budgets to stabilize public debt at current levels presents an extraordinary opportunity. Consider this: 1 million BTC purchased at an average cost of $200,000 each, appreciating at Bitcoin’s historical annual growth rate of 30%, would result in a strategic reserve valued at approximately $38.01 trillion within two decades—enough to pay off the entire U.S. government debt.

Bitcoin’s inherent scarcity, decentralization, and transparency directly counteract fiat weaknesses, providing a stable, credible anchor in the face of structural fiscal irresponsibility and potential currency crises.

Re-monetization through Bitcoin strategically leverages perception, trust, and credible stewardship to preempt systemic collapse, transforming a dangerously compromised monetary system into one with genuine credibility and resilience.

A ₿itcoin reserve is fundamentally prudent, strategically essential, and explicitly addresses the vulnerabilities underpinning a debt-ridden, QE-dependent monetary system.

Erasmus Cromwell-Smith

Mar 10th 2025

https://e-cromwellsmith.medium.com/

Note:

1. Projected U.S. Debt ($152.30 Trillion in 20 years)

Assumption: Calculated based on the average annual growth rate of U.S. national debt observed over the past 24 years (from Clinton’s presidency in 2001 to Biden’s in 2025). The average annual debt growth rate is derived by compounding from $5.77 trillion (2001) to $34.40 trillion (2025), resulting in approximately 7.8% per year. This rate was projected forward for 20 years.

2. Projected GDP ($48.22 Trillion in 20 years)

Assumption: The current GDP of $26.7 trillion is assumed to grow consistently at an annual growth rate of 3% over the next 20 years, reflecting moderate economic expansion.

3. Debt as % of Projected GDP (315.83%)

Assumption: Calculated by dividing the projected U.S. debt ($152.30 trillion) by the projected GDP ($48.22 trillion). This highlights the sustainability challenge posed by rapid debt accumulation compared to moderate economic growth.

4. Interest Cost as % of Budget (34.02%)

Assumptions:

The U.S. government budget ($6.75 trillion in 2025) is projected to grow at a consistent annual rate of 5%.

An average interest rate on government debt of 4% is assumed.

Interest expense is calculated as annual debt service costs (4% of the projected $152.30 trillion debt) divided by the total projected budget after 20 years.

5. Debt per American ($400,214.88)

Assumptions:

Current U.S. population is approximately 331 million people.

Population growth is projected at 0.7% annually over the next 20 years (historical average).

The projected national debt ($152.30 trillion) is divided by the projected U.S. population after 20 years to clearly illustrate the individual debt burden per American citizen.