SVB gives masterclass in Why Bitcoin Matters

Actions speak Louder than words. The “builders” who laughed at Bitcoin and called it boring because there’s “no yield” and it’s “too hard to custody” are now learning a lesson in modern banking. The question remains, will the lesson be learned, or will the builders just take a page out of the Wall St playbook?

Just over 4 years ago, I wrote the essay that landed me on the BTC Map. At that time, it was my most read essay, and was entitled “Why Bitcoin Matters”. Worth a read if you have time.

I wrote it at the bottom of an ugly, multi-year bear market. It was late 2018 / early 2019. Bitcoin was $3000 and outside of the strong cohort of existing and newly minted Bitcoin maximalists, nobody really cared about Bitcoin any more.

That all changed in the proceeding years of course. Bitcoin came into vogue once more. Saylor entered the scene. $69k highs. $250k next stop. But of course…Here we are in March of 2023, doing the same old dance. Bear market. Despair. All while the underlying value proposition of Bitcoin remains the same.

Luckily for me, this time - I don’t have to write another article about Why Bitcoin Matters. Instead, our friends at the prestigious Silicon Valley Bank just did a better job than I could ever have done in explaining and showing first hand, why it does. In a manner of 48hrs.

They say that actions speak louder than words. This is true.

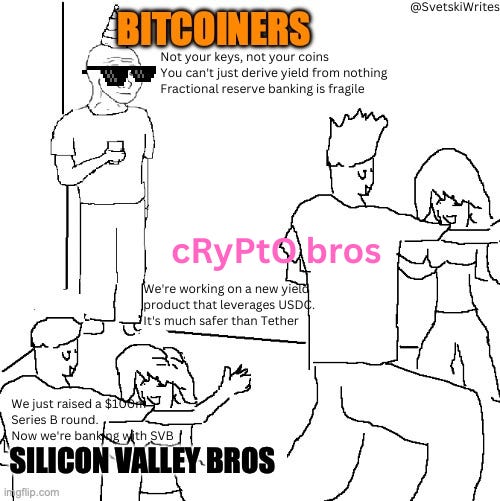

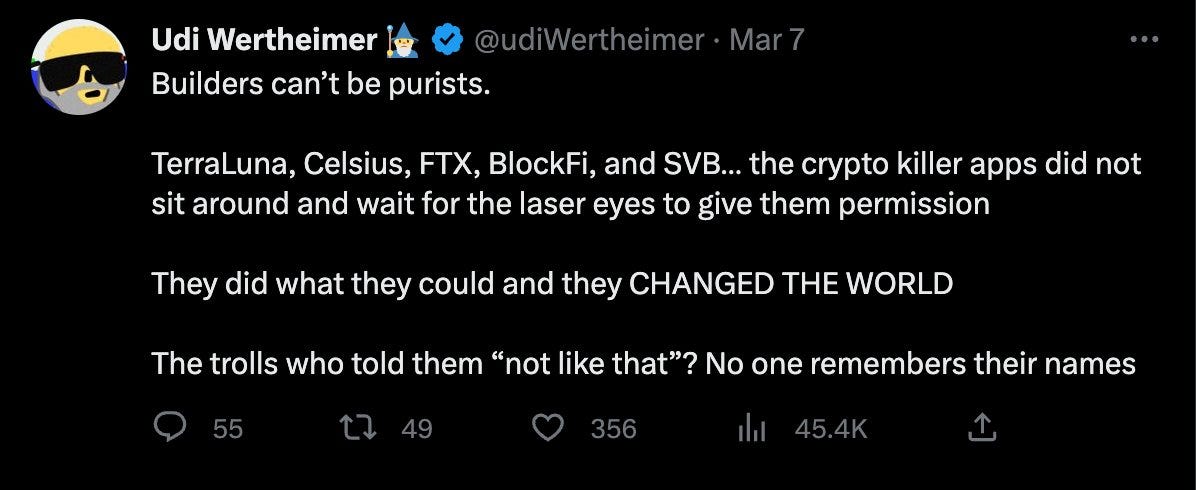

I told you so doesn’t quite cut it these days. For Bitcoiners, 2022 was a year of being proven right, again and again and again. In fact, those who raged against the Bitcoiner-machine, like Udi, proved to be one of the most powerful contra-indicators on the planet. Five for Five:

In some senses, I do get it. The conditioning is strong. We live in a world where we:

Saving’s a loss-making activity

Consider risk-free-yield something normal,

Assume the money we hold in banks is actually ours (lol)

Believe that the bigger the institution, the less likely and “too important” they are to fail (hence bailouts).

Everything that you *can* do, you *should* do

Inside that sort of a paradigm, it’s no wonder that “just” acquiring and holding sound money is too boring. I can almost hear some people yelling right now.

“But but…what do you mean you just hold money? Isn’t that hoarding? How will we get growth? What will happen to the world? Won’t everything just stop? Muh choice and freedom!?!?”

If it’s not clear to you yet, Saving money is not a new thing. It’s actually the cornerstone of civilization.

You cannot invest what you have not first saved, and in a world that values saving in sound money, people will likely be more discerning with what they invest in. This is good because it creates a naturally higher barrier for ideas and businesses, leading to less malinvestment and capital destruction.

I see only positives. More Savings = More certainty in people’s lives. Higher quality, or more discerning investments = better entrepreneurs, better products and better services. Less mindless consumption = less cheap plastic crap flooding the world, and a higher quality end user to sell to.

That sounds a hell of a lot better than the status quo.

It’s just unfortunate that we live in a world of easy money, where savings is the very thing being made unattractive. When the purchasing power of the money is falling, you’re not going to save. You’re going to consume and speculate.

You might call the latter investing, but I’m sorry - it’s actually just gambling. Stop pretending you’re Warren Buffet while using RobinHood, or thinking you’re the next Peter Thiel because you just “exited a company”.

Saving is boring, but it’s sound.

Taking custody of your own money may at first be scary, but it’s actually very easy.

Playing games with fire might be fun…until you burn yourself. In fact, it’s often also fine, if you learned something.

It’s not fine when you run to daddy government to bail you out when you got burnt.

That’s when things go sour, and that’s really my concern now. If SVB gets bailed out, it will be the last drop of whatever (moral?) dignity Silicon Valley had. They will have finally and completely dropped all pretense of being builders and turned into East Coast bankers.

Instead of owning it. Instead of coming together as some sort of Silicon Valley consortium to buy out the bank, fire management, restructure, salvage what’s left and offer better services, they want “government” - which is just a proxy for using other people’s money, via inflation or taxation - to step in and bail them out.

Of course I know it’s more complex than that. It’s a huge bank, there’s nuance, etc.

But that just further proves my point. If this institution is too big to save, then it’s just plainly too big.

If it cannot be commercially restructured, and all it took was some twitter rumors to bring it down in 48hrs, then it had no business doing business in the first place.

If this is on anyone, it’s on the often-arrogant Venture Capital community in the Bay Area, who funneled all of their startups into this one bank, and never cared to look deeper or enquire into how things were being run.

But then again, that’s just the nature of fiat banking. It’s opaque for a reason.

When Bitcoiners talk about transparency and audibility, this is why.

Saifedean wrote a short thread on this which you can find here:

(4) Saifedean Ammous (@saifedean) / Twitter

“David thinks the purpose of the fiat banking cartel is to serve customers, when it's there to rob customers to the benefit of the cartel. That's why the Fed won't license a 100% reserve bank & will try to stop you in every way from trying to save your money away from them”

Let’s review a few lessons from this fiasco:

Custody

Counterparty risk is a real thing. Crypto bros, bankers and as is now clear, Silicon Valley, never believed it mattered. This is not to say that people focused on building products should necessarily understand how backwards the banking system is, and rage against the machine. One cannot know or do everything.

But it’s clear there were many in those camps who derided Bitcoiners for promoting self-custody and acted arrogantly, thinking they were untouchable, and that Bitcoin was for idiots.

Jason Calacanis is a prime example. He’s never quite got it, and while I respect him for his competence as an investor in his own field, he’s in general an example of someone who was often hostile to what Bitcoin stood for.

I assume that he will be one of the strongest voices calling for “Government intervention” to bail him and his friends out. He doesn’t care about the startups so much as he cares about the money he invested in them, and second the potential gains he could’ve made.

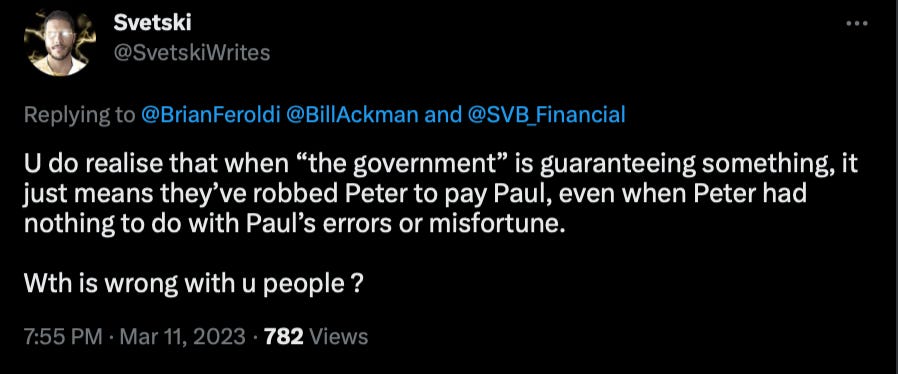

The problem, as I outlined earlier, is that it’s not the government bailing you guys out. It’s the taxpayers who had none of the upside you did, but our now going to hold the bag for your errors in judgment.

Sorry Sacks, but please be consistent. The answer here is not “let’s do capitalism when things are good, and then communism when things go bad”.

Own it.

Move fast, break things, be risky, yes.

Just Don’t run to daddy government to bail you out when you mess up.

Because it’s not government saving you, it’s the common man and woman, who had NONE of the upside opportunity but now have to pay for the downside consequences

If this is an “extinction level event” then none of these startups are being built by founders who really care about the problems, nor is this any longer an industry of the best builders, but merely of those who can raise the most successive rounds of venture capital possible.

That’s not business. That’s not problem solving. That’s just Ponzi schemes masquerading as such.

Yield

The same goes for yield. This one is maddening and its extension into the crypto world is just another example of why Crypto is more like Fiat than like Bitcoin.

You can’t just generate yield on stuff, without there being risk, and of course, some form of underlying productivity and income generation.

In crypto, there is nothing of the sort. It’s just one big Ponzi. We know that and anyone who tells you otherwise is scamming or delusional.

BUT!!!

In fiat-land, you have this broadly-believed fantasy of “Risk Free Assets” in the form of US treasuries.

Well…in the words of every twitter-bot-scammer: “How’s your trade going”?

The second “Pillar of Irony” in this episode of the banks are collapsing is that SVB and others blew themselves up by investing in risk free assets. The bond market did what it was not “supposed” to do, at least according to them and the “experts”, and caught them with their pants down.

Of course, in reality, the Bond market did exactly what it needed to do because of all the shenanigans being pulled by central bankers and government bureaucrats.

Once again, Bitcoiners have been telling you so, for how long - but we’re just crazy and stupid.

Well…f*ck around and find out part 2.

Bonus Section: The FDIC insurance Lie

I’ve seen people talking about FDIC insurance and the first $250k being “yours”.

I’m sorry, but none of this money is yours, and neither is FDIC insurance a good thing by any stretch of the imagination.

Such State “insurance” products (which are not really insurance) give banks permission to be reckless with depositor’s money because of a tax-payer backstop. It creates a false sense of security for depositors, and just ties everyone together. Once again, upside for me, downside for thee.

Edward Griffin, explains this in great detail in his book “The Creature from Jekyll Island”,

So before you screech about FDIC, please think a little deeper about where the money comes from and who is paying for it. Then put yourself in the other party’s shoes. Imagine you do everything right, and then someone else makes a mistake that you need to pay for. News flash. That’s socialism.

A Call to the real Builders in Silicon Valley

Will SV experience this moment as one which encourages them to be better?

Or will they do what the Wall St boys did, and get bailed out by the government?

This is a telling moment.

For Silicon Valley and for Bitcoin.

A bail out here will set a bad precedent because we’ll find out whether Silicon Valley are builders or political grifters and complainers.

Many of them will say, “Builders - but this wasn’t our fault.”

But the reality is - shit happens in business sometimes.

Sometime a supplier fails

Sometimes a client doesn’t deliver

You have to deal with it and find a way through it. That’s what builders and entrepreneurs do.

I understand that it’s not the fault of the start ups, but it is the fault of the VC industry funneling everyone into one bank run by their buddies, that was playing roulette.

If the Bill Ackman’s of the world really cared about those startups, then HE and all the VCs who pushed them in that direction, would be buying out the bank, and making things right.

Sure - you might not make everyone whole, but I’m sure there’s a solution.

And if you can’t and if there is no solution, then NEWS FLASH: It just means a bank that size should not have existed in the first place! Which then means this was going to happen at some point anyway because of how interconnected this fragile banking system is.

This needs to be washed out and the pain needs to be taken now. You can’t just call for government to bail you out when things went wrong.

Never forget. “Government” is just proxy for other peoples money!

And these “other people” had no skin in the game on the upside. They should not be the ones bailing you or any start up out for this screw up

In Closing

The 2020’s continue to astonish. Last year, the major Crypto Ponzi’s blew up.

This year, the fiat Ponzi begins to blow up.

The irony is next level also.

2023 Irony Part 1 is the Silicon Valley Screeching.

They’re all yelling for help, and instead of building and fixing, they’re begging to be saved.

2023 Irony Part 2 is that the stuff that blew up was the “Risk-free assets”

And of course Irony Part 3 is “We told u so.” And that’s the Bitcoiner piece specifically.

But of course, holding sound money is just too boring.

Sometimes you just need to F*ck around and find out. The question is whether we have a fair or functional game on the back end. Do you actually find out or not?

Functional game:

If {F*ck around and find out}, then {Own it} —> Learn and improve

Rigged game

If {F*ck around and find out}, then {someone else pays for it} —> Never learn, repeat same mistake.

On a Bitcoin standard, we have the former. In the current paradigm, we’re at risk of doubling down on the former. Remember, with Bitcoin, we have:

No counter party risk

No robbing Peter to pay Paul

Full reserve

No bank runs

All equity. No debt

Yield unnecessary bc purchasing power increases commensurate to increasing economic and commercial efficiencies.

Absolute perfection. And boring. Yes.

March 13 Update

Well..so much for writing this.

I guess I should update the title to be:

How SVB gave a masterclass in Bitcoin, but then concluded with: “Nah forget about it.”

So much for builders. So much for Silicon valley.

Now we just have techno-wall-st lads on the West Coast…

Amen