In a recent report, Fidelity Digital Assets made a striking assertion: "Bitcoin is better than gold" and stands apart from any other “digital asset”.

Fidelity just said, “There is no second best.”

In an era where traditional financial pillars waver, Bitcoin emerges as a beacon of stability. The recent report from Fidelity Digital Assets advocate for the primacy of Bitcoin over traditional assets like gold.

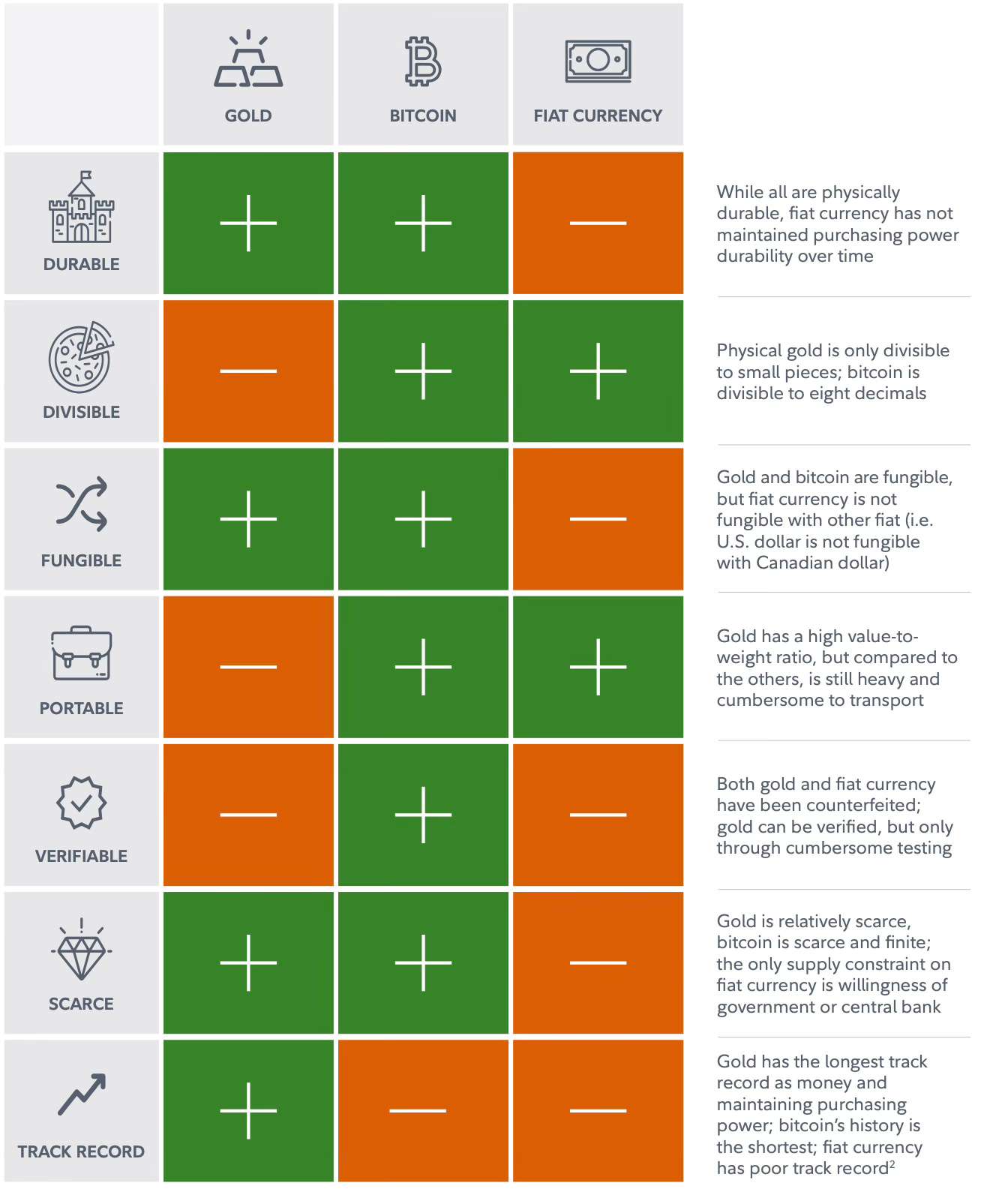

This isn't just about scarcity; while gold has long been a traditional store of value, Bitcoin, with its cryptographic security, decentralized nature, and transactional integrity, offers technological advantages that are hard to ignore. Plus, its resistance to "innovative destruction" gives it a unique position among all assets.

Yet, Fidelity's report isn't just about praising Bitcoin. It emphasizes the critical role of a well-defined regulatory framework. Proper regulations can drive away bad actors, they claim, elevating the space's reputation and potentially attracting more investors.

However, the road isn't without bumps. Fidelity acknowledges Bitcoin's volatility and the potential risks tied to technological obsolescence, but the underlying message is clear: Bitcoin's merits as a diversification tool and store of value are undeniable.

Unlike other commodities, Bitcoin's decentralized nature and limited supply make it resistant to inflationary pressures. As Fidelity's research indicates, Bitcoin's scarcity parallels gold, but with the added benefits of transportability and divisibility, which gold inherently lacks

Bitcoin Not “Crypto”

Bitcoin stands out in the vast world of cryptocurrencies (shitcoins). As Fidelity Digital Assets states, its fundamentals set it apart. With its decentralized nature, Bitcoin is less susceptible to geopolitical events and economic policies, offering a global, immutable store of value.

Why the Financial World is Paying Attention

The financial landscape is evolving. With geopolitical tensions and economic uncertainties, institutions are seeking resilient assets. Bitcoin, often termed 'digital gold', is gaining traction amongst these institutions. Fidelity's in-depth dive showcases Bitcoin's potential to act as a hedge against inflation and economic downturns.

The Road Ahead

With institutions like Deutsche Bank highlighting potential economic downturns, the call for diversifying portfolios is louder than ever. Bitcoin, with its unique properties, is poised to be a game-changer in this realm.

Conclusion

While the world grapples with economic uncertainties, Bitcoin shines as a promising asset, backed by research from giants like Fidelity. As we transition into a more digital age, Bitcoin's role as 'digital gold' becomes increasingly pivotal.

In a world where gold was once the uncontested and corrupted champion, a digital contender rises. Fidelity's report might just be the cornerman Bitcoin needed for some massive orange pilling.

For More: Check Out this Simply Bitcoin Original from Rustin 丰(@SatsforLife)