Every week a three-letter agency, the “human rights foundation,” or a globalist dung heap like the WEF rains FUD upon El Salvador. Why so much attention and focus discrediting the nation of 6.5 million inhabitants? It’s because they were the first to adopt Bitcoin as legal tender freeing themselves from the fiat oppression of the dollar and IMF.

Despite the drop in Bitcoin’s price, El Salvador is winning on nearly all fronts displaying to the world the Bitcoin Standard and its effects.

Mr. Hanke states Bitcoin Experiment in El Salvador Failed

Steve Hanke has been a nemesis against Bitcoin and El Salvador’s Bitcoin Law. In a reasonably new piece in the National Review, Hanke pushes more anti-Bitcoin propaganda. Still, most of the claims are baseless as El Salvador continues its trek to the free-market future.

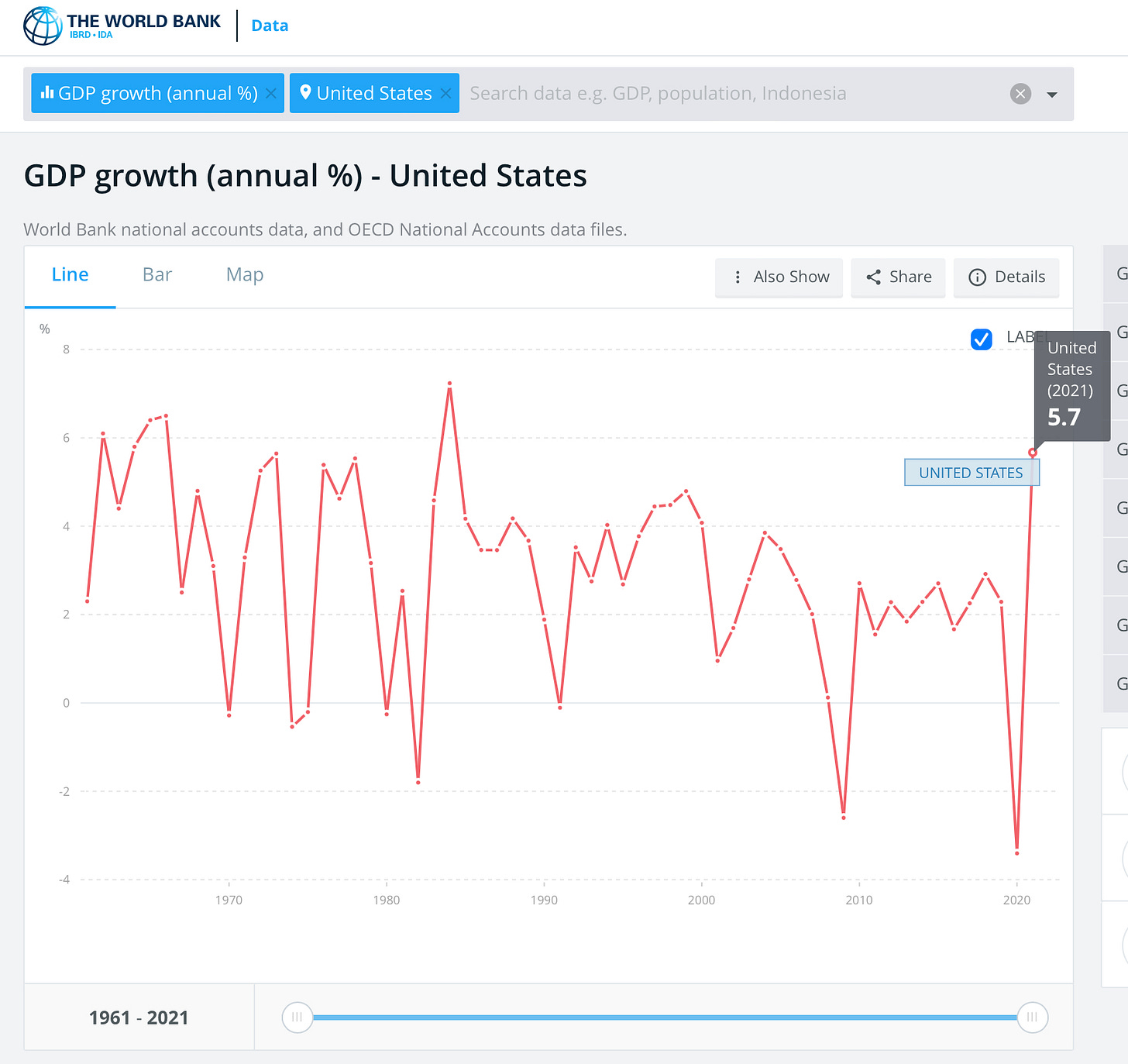

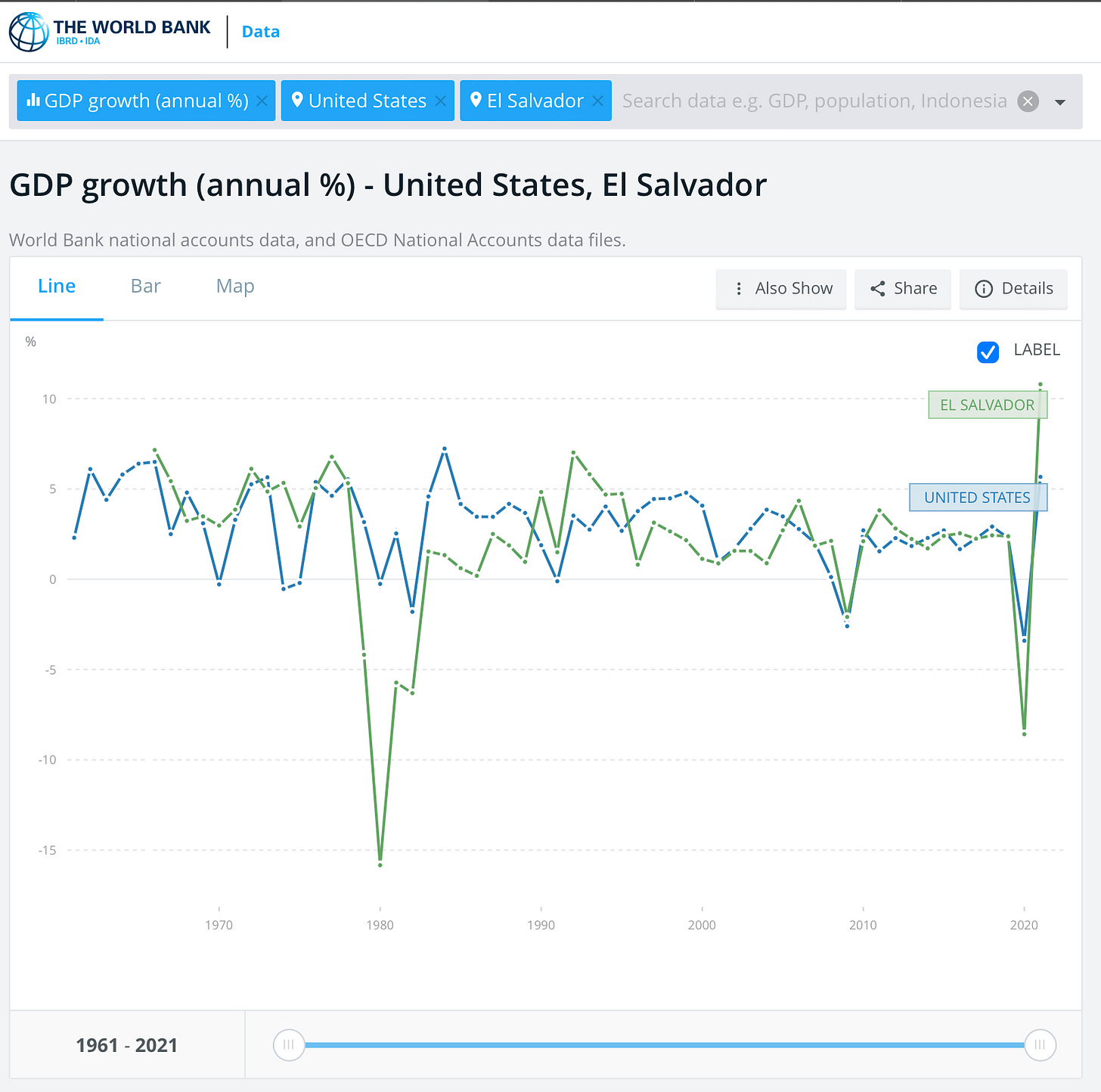

Is it a coincidence that the GDP of El Salvador rose just 1-2 years after implementing Bitcoin as a Legal Tender law? GDP in El Salvador didn’t just grow. It took off.

Now let’s compare to the United States; in the same timeframe, El Salvador nearly doubled US GDP growth, with the US in the standardized definition of a recession.

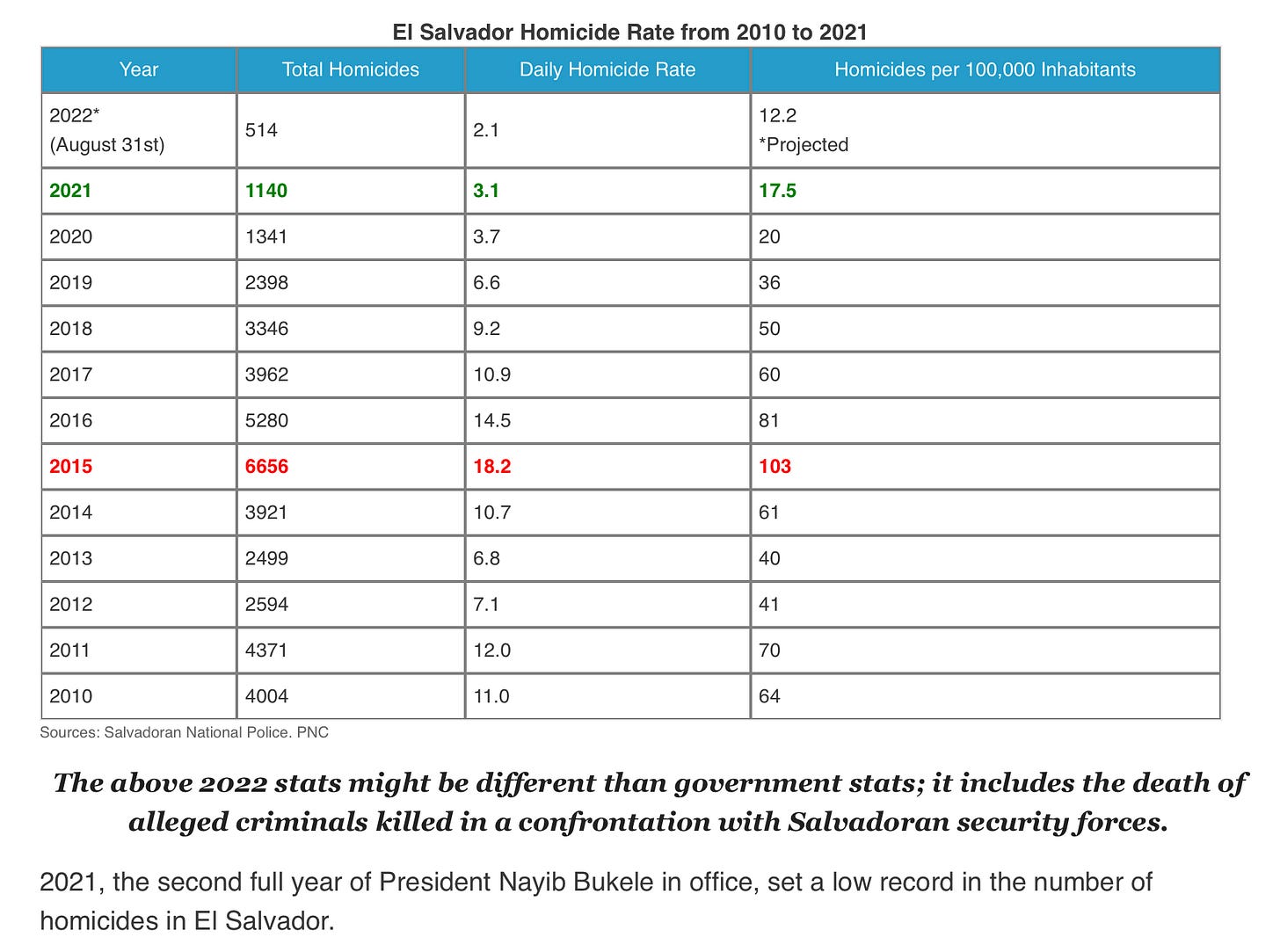

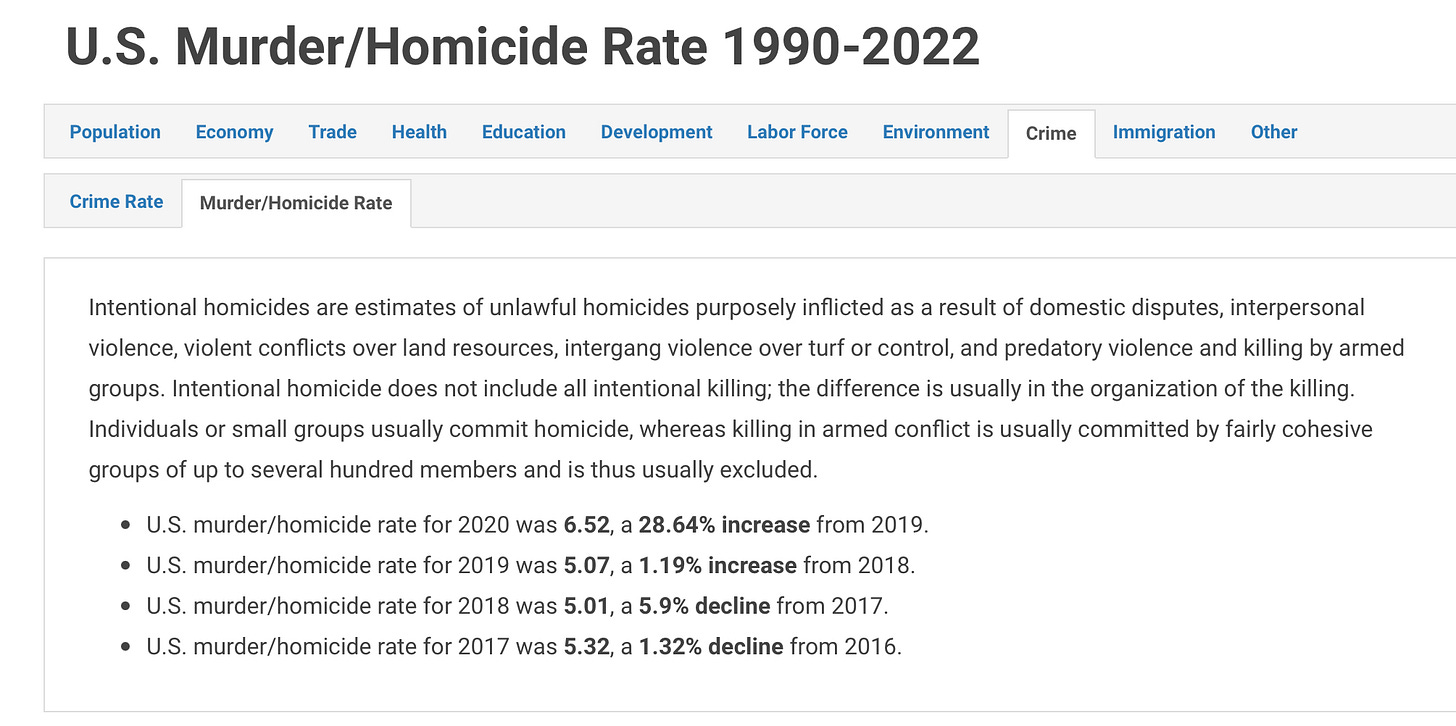

El Salvador’s not just outpacing US in GDP but Murder Rate is Dropping while rising in US

Since Bukele stepped in and the Bitcoin Law was implemented, the murder rate in El Salvador has dropped sharply as their GDP has boomed.

Given the waves of crime in cities across the country, it's not surprising that the United States homicide rate is rising along with crime while the people of El Salvador are growing safer under President Nayib Bukele as America devolves. Bukele also didn't label half of his inhabitants as fascist domestic terrorists.

Tourism Booming in El Salvador

Since the Bitcoin Law's implementation, tourism has increased by 30% in El Salvador, according to Minister of Tourism Morena Valdez.

It was projected that 1.1 million new visitors would come to El Salvador, but they outpaced that number with 1.4 million tourists, 60% of whom were from the United States. This increase in tourism blossomed into over $1.4 million in foreign exchange earnings.

The Authoritarians won’t go Without a Fight

Argentina wouldn't be on their sixth IMF bailout if the IMF and Dollar were an actual benefit. But instead, these cabals seek to cancel national sovereignty and keep citizens within these nations hostage to the central bankers and their controlled and corrupt money apparatus.

The central banks and their crony-Cantillon-comrades' days are numbered. Their power is diminishing, and the weaponization of the dollar has led to Bitcoin Blowback and Currency Wars, with El Salvador as the first mover in one of the grandest games humanity has ever seen.

Bitcoin Beach led an incredible movement culminating in prosperity, hope, tourism, and the opportunity for El Salvador to champion the Separation of Money and State Revolution.

Bukele’s Star rises, Brandon’s Falls off a Bike

While Hanke, the IMF, and United States condemn the actions of El Salvador in their implementation of sound money, the truth is in the pudding. Bukele may have the highest approval rating among any leader on the planet.

In the United States, as the economy continues to teeter, crime and Homicide rise, and GDP drops, it’s not surprising that Biden’s approval ratings have fallen faster than the famous bike incident.

El Salvador is Winning ‘Bigly’

Criticism from the IMF and other institutions continues to be thrown at the orange-pilled nation of El Salvador. Yet, while the FUD and attacks have risen, so has the economy of El Salvador. The country experienced double-digit GDP growth in 2021 for the first time in the country's history. Exports also rose 13% YoY.

The International Monetary Fund has been quite loud about its disapproval of El Salvador's decision to recognize Bitcoin as a form of legal money. But, on the contrary, how would El Salvador's neighbors react if it was revealed that the country had made a significant discovery of lithium or natural gas and intended to begin extracting these resources?

Something like this wouldn't even elicit a blink of an eye. Meanwhile, El Salvador would even be able to earn royalties, borrow money secured by the mines' proven reserves, and sell ownership stakes in the mines. But, most significantly, they could utilize money received to support whatever services they thought were necessary without taking out loans or charging the people who lived there.

Because of its extreme price fluctuation, the International Monetary Fund considers Bitcoin an excessively hazardous investment. However, over the past few years, the price of lithium has fluctuated from US$160,000 to US$40,000, then back up to nearly US$500,000. This price swing is even more unpredictable than the bitcoin price, which moved between $19,000 and $65,000 over the previous year.

Given the difficulties associated with dollarization, it should be no surprise that the El Salvador government has attempted to innovate with Bitcoin to tighten its grip on their country's economy.

Suppose they could regain some amount of their monetary sovereignty. In that case, it may allow them the capacity to invest more heavily in their nation by utilizing social initiatives and public infrastructure without having to rely on borrowing or levels of remittances that are unsustainable.

At the very least, it places people in a situation where the success or failure of their policies will determine whether they will drown or swim, which is the only true promise of self-sovereignty. Moreover, the success or failure of El Salvador's Bitcoin experiment will be a key in enticing the leaders of other nations, such as Honduras, Guatemala, Mexico, and other places worldwide, who are seriously contemplating conducting Bitcoin trials.

Everyone is watching El Salvador, and despite the pressure and animosity, El Salvador stays winning.

Written by @SatsforLife