BUY BITCOIN

In 2017 during a hearing on US monetary policy, US congressmen Bill Posey was questioning Janet Yellen, the then chairmen of the US central bank, the Federal Reserve. Bill asked a couple of simple questions; why is the US government not allowed to audit the Federal reserve, why is the Federal Reserve not transparent about their financial condition?

Seems like a reasonable line of questioning.

Janet sidestepped the questions, answering that the Federal Reserve is one of the most transparent central banks in the world. Mr. Posey then asked, what it was that the Federal Reserve feared from having an audit conducted, and it was at this exact moment that a freedom fighter for truth, transparency and honesty, told the world exactly what it was that the most powerful bank feared.

The answer, in case you don’t watch this 45 second long clip, as to what they fear, is the end of their fractional banking scam, their fears are the apex predator coming to end them. The answer, as always, is BITCOIN dear friends.

We’ll come back to central banking in a minute, but first let’s take a brief dive into the rest of the banking system, all the banks below the central banks.

BANK RUNS

Recently Lyn Alden wrote in her monthly newsletter, an explanation on the latest round of bank bailouts in the United States. As usual her explanation was simple, clear, and on point. To summarize in a few sentences — banks had more liabilities due to their customers than they had assets to cover. Bank liabilities are the money they owe depositors, people like you and me with checking and savings accounts at the bank. In other words, there was more cash trying to leave the bank, than what was available inside the bank.

It was a classic bank run. The bank took their depositors money and bought other assets, thinking they could make money, and earn a profit with this approach. By the way, this is not unusual. Every bank does this.

The problem was what these particular banks bought with their depositors money, US government bonds and US treasuries, or said simply, government debt. Normally a “safe” asset to own.

However, with the federal reserve raising interest rates over the past year or so, these interest rate rises made that government debt, the banks assets, worth less, effectively leaving these banks with fewer dollars than what was needed for their depositors. Basically the banks made bets on the direction of interest rates, with their customers deposits, and they lost.

Here is Lyn explaining it from her recent March 2023 Newsletter: A Look at Bank Solvency;

In the United States, the banking system as a whole has $22.9 trillion in assets and $20.7 trillion in liabilities. The problem, of course, is that their assets are riskier and less liquid than their liabilities, and so they face both liquidity risks and solvency risks if things aren’t managed well, or if they face external shocks that are larger than they can deal with.

We can quantify this another way. The majority of bank liabilities are deposits for individuals and businesses, and these deposits currently total $17.6 trillion. That’s what you and I consider to be our “money”. They offer very low interest rates, especially for checking and savings accounts.

Deposits are fractionally-reserve bank IOUs; when you see $10,000 in your account balance for example, that figure is not actually backed up by dollars. Instead, that figure is backed up by a broad mix of less-liquid assets including Treasuries, mortgage loans, credit card loans, business loans, a bunch of other assets, and then a small percentage of actual dollars.

Banks currently have just $3 trillion in cash to back up their $17.6 trillion in deposits. The majority of this cash is just a ledger entry with the U.S. Federal Reserve, and so it is not tangible. Somewhere around $100 billion of it ($0.1 trillion) is held by banks in the form of actual physical banknotes in vaults and ATMs. So, the $17.6 trillion in deposits are backed up by just $3 trillion in cash, of which perhaps $0.1 trillion is physical cash. The rest is backed up by less liquid securities and loans.

Another way of thinking about all of this is that your bank is actually nothing more than a low interest rate borrower, and you are the low interest rate lender.

Not only are you getting a low interest rate return on your lending, basically zero percent, but also you are making an unsecured loan to the bank. There is no agreement in place with you and the bank that you get your money back if and when they make a mistake, or make a bad bet.

Contrast this with your home mortgage. If you stop paying back the lender, they take your house. But if the bank stops paying you from your checking or savings account, are you entitled to the bankers home? Of course not. It’s a one way street, purposefully designed to screw you, the poor ignorant peasant.

Pretty neat, right?

So why are you lending your money to the bank at a zero interest rate, with nothing to protect you from the banks careless investments, with no collateral from the bank if they make a mistake, if they make a bad bet, and keep your money?

INTEREST FREE LOANS FROM YOU STUPID PEASANTS

Lyn provides an answer as to why you might be stupid enough to lend your money to the bank at a zero percent interest rate, without any collateral from the bank;

To help normalize [depositors lending money to banks for free] and make it seem less weird, the FDIC provides insurance against deposit losses up to $250,000 which mitigates some of the risk. However, at any given time, FDIC only has about 1% of bank deposits’ worth of insurance in their fund. They can protect depositors against individual bank failures, but they don’t have enough to prevent against system-wide banking failures, unless they draw in aid from elsewhere or are backstopped by Congress with a fiscal bailout.

In other words, the banks tell you that you need not worry because if the bank does make a bad bet and loses, and decides to keep your money, don’t worry, the US government will step in and make you whole, so long as you don’t have more than $250,000 in the bank. And since most of us are living paycheck to paycheck, we’re not even close to the $250,000 mark, so everything is fine, right?

Right???

Wrong!!!

First of all, as Lyn just explained, the FDIC insurance program, is not a good solution if there is a major bank run, they don’t have enough money to cover you, not even the $100 in your account. That’s precisely why you hear Janet Yellen and the President going on TV telling everyone there is plenty of money in the system. There isn’t, its insolvent. They print new money to pay people back, which simply further inflates your food and gas expenses.

But never mind that, assuming the collateral problem is resolved with inflationary printed money, are you ok with lending your money to the banks at a zero percent interest rate?

You didn’t even realize that is what you are doing, did you!

When you deposit money in the bank, you are actually entering into an agreement with the bank to lend them your money at ZERO PERCENT INTEREST. Don’t worry, nobody knew that was the game. They’ve kept it a quiet little bankers secret, until now.

Turn the tables around.

If you had to borrow $1,000 what interest rate would you need to pay? My credit card interest rate is around 20%. So why the hell do I need to pay 20% to the bank to borrow $1,000 but the bank doesn’t need to pay me anything when I am lending them $1,000 with my checking or savings deposit account. Pretty messed up game.

Never mind the FDIC insurance. The point is the banks get to collect HUGE interest rates on us when we borrow, but when we lend, by depositing money with them, they don’t pay us shit. It’s not fair. It’s a rigged system. And not only is it rigged, but the bankers know it’s rigged, and they want to keep it that way.

More from Lyn’s March newsletter;

Some banks, such as TNB Inc. and others, have attempted to make bank models that just store all of their assets as cash at the Federal Reserve and therefore operate full-reserve banks, but they have not been allowed by the Federal Reserve to exist. This would basically be the safest possible bank, but if it were allowed to exist it could suck deposits out from other banks, threaten the whole fractional-reserve banking model, and reduce the Federal Reserve’s ability to control monetary policy.

So ironically, regulators want banks to be reasonably safe, but not “too safe”. They want all banks to be leveraged bond funds to a certain degree, and won’t allow safer ones to exist.

Are you ready to see the whole picture? Want to understand what the hell is actually going on? Ok, hope you are sitting down for this one.

IT GETS WORSE, MUCH WORSE

The banks that you and I are forced to use, are nothing more than administrators of debt. Here’s how it works:

Step 1: All of us peasants are forced to hold our few hundreds or thousands of dollars in the banks. But since we make up about 90% of the population, us peasants hold most of the cash (digital and paper cash) in the system at our local bank branches. The other 10% of the population doesn’t hold their wealth in cash, they own the equity and the real estate of the banks and businesses and governments that us peasants are forced into using.

Step 2: So the banks give all of our money to the global governments and corporations to finance the destruction of all competition and to finance and impose their insane ideas upon all of us peasants, to keep this insane system going.

Step 3: The banks earn a fee, an interest rate on the debt they buy, with our money, from global governments and corporations, for overseeing the administration of giving our money to the governments and corporations to spend as they want.

Pretty cool, eh?!

It’s so insane, let me try and explain it another way so it sinks in how insane the current financial system is that we are forced to use.

The government and corporations want to borrow money to finance their operations. Ok fine. But they know that you and I are not interested in financing their insane operations. So they put a bank in between us and them. And they tell us it is much more “convenient” for us to keep our money at the bank. They give us a cool and convenient ATM card and a debit card and a credit card to spend our money from the bank whenever we would like.

Super convenient…FOR THEM!

Because now the bank takes our money and lends it to those governments and corporations we would not have lent to in the first place. You don’t know this is happening of course. The banks are never going to tell you that this is what is happening, but that is precisely what is happening. The recent bank failures were the result of this process!

Oh but wait, there’s more!

BANKING THE BANKS

Since her position as chairman of the Federal Reserve, Janet Yellen has now shifted into a position with the US Government as the Treasury Secretary. And in this role she was recently questioned during her testimony for the recently forecasted ten year budget of the government.

The total forecasted budget is approx. 20 trillion dollars of DEFICIT spending over the next ten years, driving the total national debt from the current $30 trillion dollars, up to $50 trillion in the next ten years!

So where in the hell is the government going to find $2 trillion dollars every year for the next ten years to buy their debt?

Welcome to Step 4 in the systems design...

Step 4: The banks sell the debt, that they purchased with our money, to the central bank. And since the central bank has an unlimited amount of fake digital cash, they can just buy all the debt from the banks, forever!

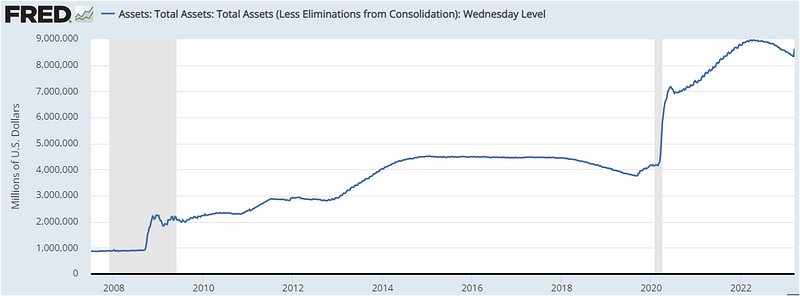

Here is the federal reserves balance sheet, their assets, which is things like government debt, purchased with fake digital money, that they conjure up for free on a computer spreadsheet.

In 2008 they held 1 trillion in assets.

In 2010 they held 2 trillion in assets.

In 2020 they held 4 trillion in assets.

In 2022 they held 8 trillion in assets.

Do you see a pattern here?

OPT OUT OF THE PAST, OPT INTO THE FUTURE

Large corporations, governments and banks, do not want full reserve banking. They need fractional reserve banking in order to continue to finance their growth and domination. Our checking and deposit accounts are the first step in a systemic global multi generational pyramid scheme, a massive banking scam.

The only way to stop this game, is to not play the fractional reserve banking game, which means opting into either a full reserve banking system, or an alternative banking system. Since it is clear that the powers that be will not allow for a full reserve banking system, because they know it will kill their game, the only remaining option is to play an alternative game that is not part of their fractional reserve banking game, that they have no power over.

The only alternative game, then, is Bitcoin.

Every unit of cash you keep within the current banking system creates multiple more units of debt which then shows up in the world as price inflation that harms the poorest people of the world the most.

The most charitable act everyone of us can do is to remove every single dollar, euro, yuan, ruble, or whatever fiat currency you have at the bank, remove every single last penny from your bank accounts, and push that value into Bitcoin. In this way we stop inflation at the source, and we strengthen the alternative fair and equitable game of Bitcoin. Only we have the power to end their game.

This is the way.

Opt out of the past.

Opt into the future —> Bitcoin, Full Reserve, OR GFY.

Excellent post!

what's the worst weapon that bank/government can use against bitcoin? a total ban? illegalziation? a complete cutoff on fiat onramp/offramp? will that bring down the bitcoin price significantly? let's assume what's the worst that can happen?